SEARCH FOR YIELDS Issue 2, October 17th

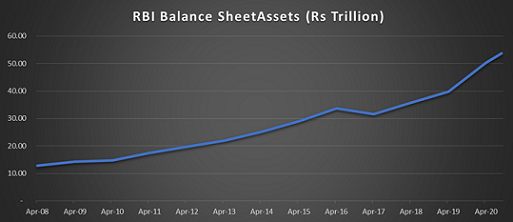

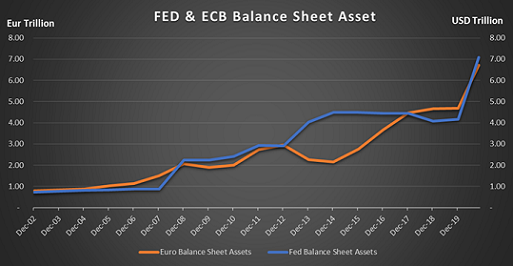

License to Print and Borrow MoneyThe COVID pandemic has given central banks license to print unlimited amounts of money and governments to borrow unlimited amounts of debt. The license has its foundations in the fact that as GDP contracts, the fall in absolute terms has to be replaced by artificial money and debt to bring back demand in the economy. Simply put, if GDP was USD 100 and falls to USD 80 due to fall in output on pandemic, central banks and governments have to bring it back to USD 100 and then allow GDP to grow from wide economic benefits.

The huge addition of money into markets has led to sustained rise in equities, bond prices and gold. Equity markets are at record highs, bond yields at record lows and gold at record highs as investors inflate asset prices on cheap money. Low interest rates lower risk premium on equities, keep bond yields low and gold benefits from the falling value of money due to unlimited supply. The maya can sustain but as the asset price bubble grows bigger and bigger, true reality will hit the markets and there will be prolonged asset price deflation.Actual Reality

The maya of wealth created by markets is what it is, a maya. In reality, people have lost jobs, businesses are suffering and a recessionary economic cycle is playing out. Value of money continually goes down as inflation stays above interest rates. SFY issue 1 talks about the inflation, interest rates issue. Governments can make up for lack of consumer demand by spending, but at some level of debt, this will stop as markets will stop funding the debt if the economy itself does not generate demand.

The End Result

Markets wait for the economy to catch up, as future profits are reflected in current prices. If profits do not rise, markets tend to fall and fall sharply as the maya effect wears off and reality hits. Investor wealth falls sharply, which in turn hurts investments into the economy and this time around no amount of money printing or government debt can save the market.

Central banks and governments should focus on reality not create a maya.