Market Linked Debentures- Is Pay-Offs Commensurate With Risk?

MLDs are seeing strong traction as an investment product but the risk they carry may not be commensurate with the pay-off. MLD’s carry credit risk where the issuer could default, interest rate and liquidity and also market risk of the underlying, which is Nifty index or 10 year G-sec. It may be better off to invest in bonds and Nifty ETFs separately and pay offs could be much higher with high liquidity.

Market Linked Debentures (MLDs) are structured debt products where the pay-off is not as regular coupon-bearing debenture but linked to the movement in an underlying asset, which is typically Nifty index or 10-year G-sec yield. MLDs have two types of products – 1) Principle protected and 2) Non-Principle protected. MLDs range between tenure of 12 months to 60 months (depends on issuer). Unlike a regular bond, MLD issuers do not pay periodic coupon payments, the pay-off for the investor would be at the maturity or through exiting the position on stock exchanges.

According to CARE Rating report, the average tenure of MLDs has been 2.89 years in FY-19, as compared to 2.92 years in the earlier year. The average fundraising using MLDs is expected to go up to Rs 13 billion per month in FY-20. The same stood at Rs 10 billion in the previous year. In the first quarter of FY-20, the issuances of MLDs with government securities as the underlying increased to 37% of the total value from 26% during Fy19. The nifty index remains the most used underlying to design MLD. Around 63% of the issuances used Nifty as the underlying index. In FY-17, only 5% of MLD issuances were linked to government securities. Over a period, the share of government securities related to MLDs has gone up steadily.

MLDs are rated by credit rating agencies just like traditional bonds, even though they are linked to the performance of the underlying asset. During the first quarter of the current financial year, issuers with AA and lower rating raised money using MLDs, which was 11% of the total MLD issuances. As per the SEBI guidelines, MLDs are valued by a third-party valuation agency, which has to be primarily a credit rating agency company. The minimum ticket size criteria set by the regulator is Rs. 1 million, and the issuer sets the face value for the security. Click here to read other regulatory requirements.

On taxation front, If MLD’s are listed :

- Held till maturity – Proceeds are taxed as interest at the income tax slab rates

- Held for more than 12 months – Proceeds taxed as long-term capital gains at 10%

- Held for 12 months or less – Proceeds taxed as short-term capital gains at slab rates

For Unlisted MLD:

- Held till maturity – Proceeds taxed as interest as per slab rates

- Held for 36 months or less – Proceeds taxed as short-term capital gain

- Held for more than 36 months – Proceeds taxed as long-term capital gain at 20% after

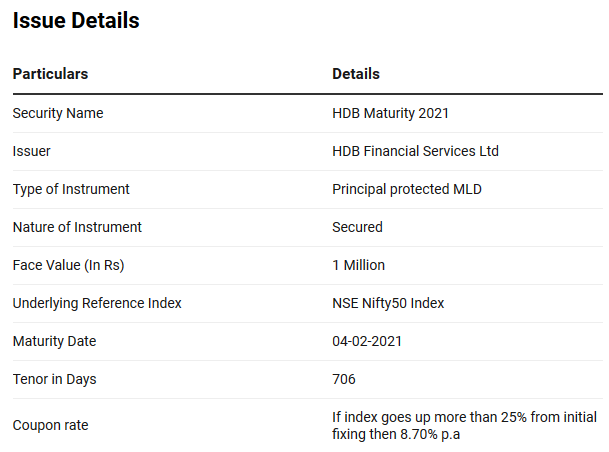

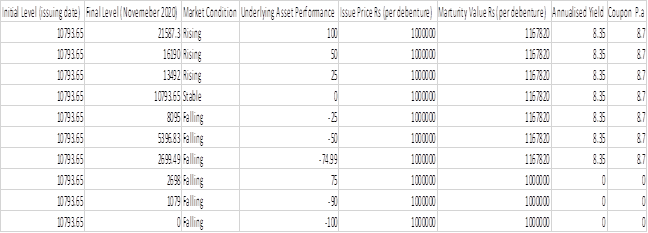

Pay-off for the HDB Finance Issue Maturity 2021:

Redemption Amount:

Rs.1 million per Debenture plus accrued Coupon, per Debenture at the Coupon rate which is as follows.

Initial level (Nifty 50) index – 10793.65 and 25% of Initial level (NIFTY 50) lndex-2698.1425

Scenario 1:

If Final Fixing Level <= 25% of Initial Fixing Redemption Amount redemption amount: Rs 1 Million – per Debenture

Scenario 2:

If Final Fixing Level > 25% of Initial Fixing Level: Redemption Amount: Rs. 1.167 million per Debenture

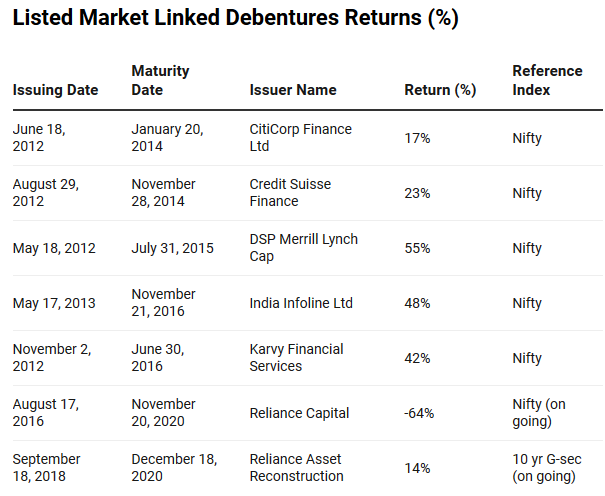

Investing in MLDs is tricky as compared to any traditional asset because of the complexity of the structured product and pay-off is linked to the performance of the underlying asset. In some cases, if the issuer goes bankrupt even after the performance of the underlying asset is in favor, an investor might not get paid. Listed MLDs might even get unsold at steeply discounted prices due to a lack of liquidity. An investor needs to quantify several risk factors before investing in an MLD as the pay-off might be impacted due to credit risk of the issuer, market risk, interest rate risk, liquidity risk, underlying asset performance, etc. Investors need to be prepared to hold an MLD till the maturity before investing amid low liquidity for MLDs on exchanges. The following table shows the returns of MLDs and Reliance Capital MLD has been trading at a steep discount price due to default in coupon payments.