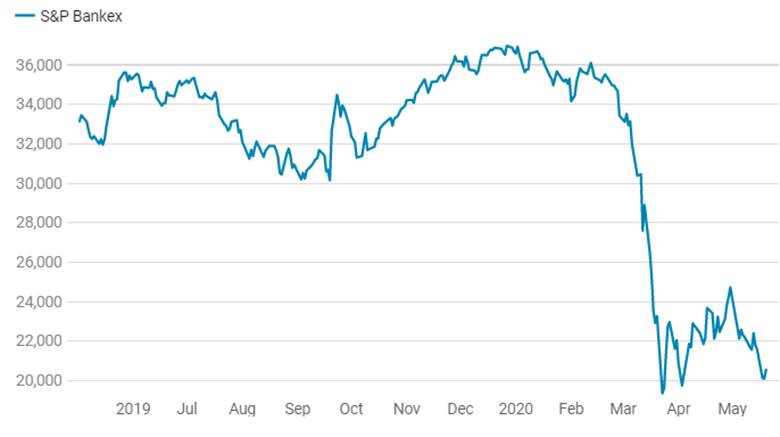

AT1 bond yields have exhibited a correlation with equity valuations with spreads at lower levels on higher bank valuations in the market and spreads rising on fall in valuations (in terms of price to book). Table 1 shows the correlations.

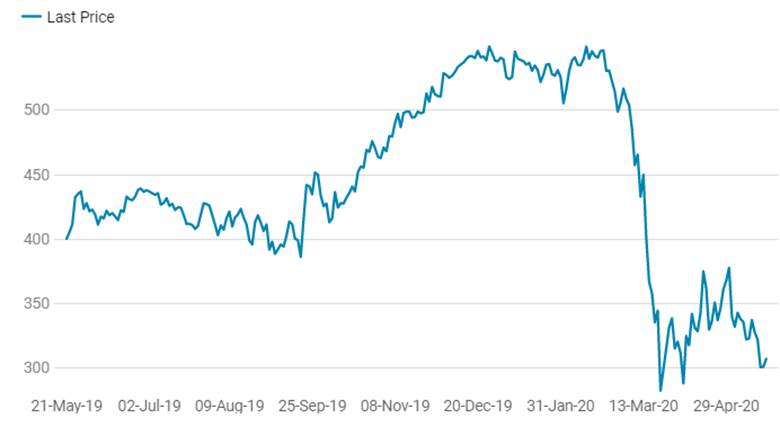

S&P BSE Bankex

The probability factor for exercising call options on AT1 bonds is mathematically derived based on various parameters such as future share of yield curves, forward rates and spreads, equity risk premium, etc. At this juncture we do not have a model to capture the probability factor. However, this factor plays a sentimental role in pricing of AT1 bonds and when issuers come under perceived or real stress and equity valuations fall, the probability factor for calling the bonds does tend to decrease in the minds of the market participants, leading to rise in yields on AT1 bonds. On the other hand, when factors improve, the probability factor increases for calling the bonds and yields tend to fall.

This brings into focus the AT1 Bonds (Perpetual Bonds), that have call options. These bonds trade at Yield to Call, and when banks find that equity capital is expensive and they are not able to raise more capital through AT1 bonds, they may just refrain from calling the bonds on the call option date. However, conditions may change going forward and the probability of callingthe banks can increase but at present, probability will come off in the eyes of the market and this will be priced in the bond yields.

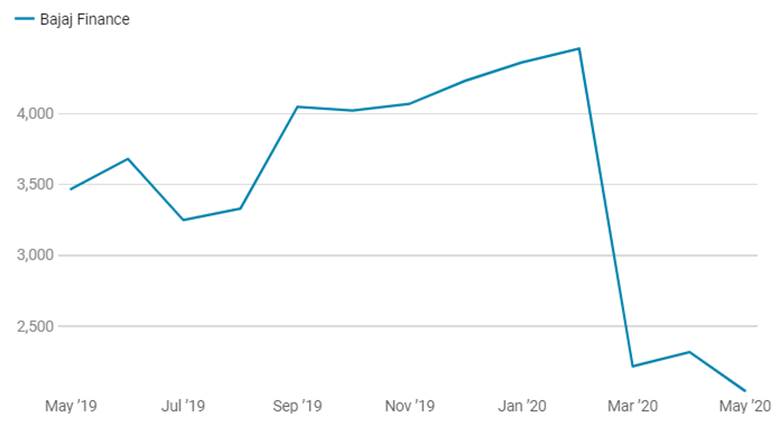

Bajaj Finance Caution and its Impact on Financial Sector.

The country’s biggest NBFC, Bajaj Finance is preparing itself for tough times ahead given the Covid 19 lockdown. The stock price has fallen be over 50% from highs as markets worried about the impact of the lockdown on Bajaj Finance borrowers and their ability and willingness to pay back loans.

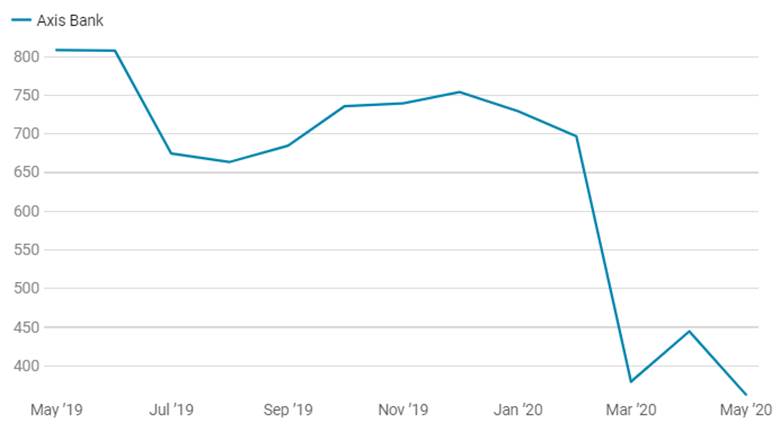

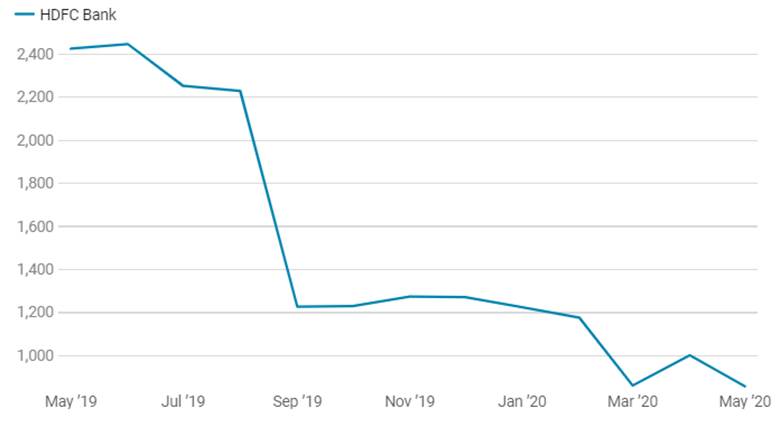

Banks too have seen sharp falls in their equity valuations and if loan loss provisions increase, their capital adequacy ratios will come under pressure. Banks may not be able to raise capital to growth loan books or even to shore up their CAR.

Lenders, including banks, NBFCs and HFCs can see volatility in their credit spreads if assests under moratorium turn NPAs going forward.

The company’s Assets under Management (AUM) as of Q4FY20 rose 27% to Rs 1471.53 billion from Rs 1158.88 billion as of Q4FY19. Consumer Auto and Sales (B2B),SME, Commercial and Rural lending(B2B) segments showed growth of 9%, 13%, 5% and 7% in AUM respectively.

Net interest income grew 38.88% in Q4FY20 to Rs 46.84 billion and Net profit declined by 19.39% to Rs 9.48 billion year on year.

The company’s gross non-performing loans was higher by 7 basis points to 1.61% from 1.54%, while net NPA rose 2 basis points to 0.65%.

Company has started to prepare itself for potential Covid-19 impact. It took one-time provision amounting to Rs 14.19 billion in Q4FY20.Company has built multiple scenarios on potential Covid-19 credit cost impact. These scenarios take into account various factors including, phasing of lockdown, behavior of moratorium customers, collection capacity management, changes in regulatory forbearances and response of the economy post lockdown.Company has a rigorous and granular collections capacity planning model. Company has committed significant investments and is currently executing significant ramp up of its collections capacity to manage Covid-19 bounce portfolio.27% of AUM is under moratorium.

Consolidated borrowing mix for Money Markets: Banks: Deposits: ECB stood at 42%: 38%: 17%: 3%. Cost of funds at consolidated borrowing long term monies.

Amidst Covid-19, the Company has taken a cautious stance and has tightened underwriting and LTV norms across all businesses till July 2020. It is open for business in 1,926 urban and rural locations as on May 2020.

Bajaj Finance Share Price Movements

Axis Bank Share Price Movements

HDFC Bank Share Price Movements

ICICI Bank Price Chart

SBI Price

Bajaj Finance Signals Credit Stress for Lenders on Moratorium

Bajaj Finance bonds have enjoyed a premium position in the bond market with the lowest spreads amongst NBFCs. However, continued weakness in consumer lending due to lockdowns and stress on loan books post moratorium could impact its credit spreads negatively.

Bajaj Finance Ltd(BFL) is core to the Bajaj Group and it has financed over 40% of Bajaj Auto Limited’(BAL) two-wheeler domestic sales volumes and 36% of three-wheelers in FY19. BFL’s auto finance segment is closely integrated with the parent group for the planning and execution of its business strategies. BAL has a robust business profile with zero leverage and is the primary source of dividend income for Bajaj Holdings and Investment Ltd (BHIL).

Strong Positioning in Consumer Financing: BFL has a strong market position in consumer durable financing (13% of assets under management (AUM),) and holds 70%-80% share in financed sales in over 38,000 consumer retail stores in which it operates. The company’s retail store penetration has increased over the years and the total customer base has grown at a CAGR of 28% from FY16 to 9MFY20.

Diversified Funding: BFL’s funding is well diversified with good access to banks and capital markets. Amongst banks, it has funding relationships with almost all the banks. The bank funding (around 32% share in funding) is largely at the marginal cost of funds-based lending rate benchmark levels. Capital market instruments are subscribed by big corporates, insurance companies, and mutual funds. The company also has a deposit-taking license and the share of deposits has increased in the funding mix from 6% at FYE16 to 21% at 9MFEY20 lending granularity to the funding mix. BFL has also raised funds through the external commercial borrowing route in October and November 2019 to further diversify its funding mix. BFL has equally good access to equity markets and that is exhibited by a successful qualified institutional placement of INR85,000 million in November 2019.

Stress in Loans Against Property Portfolio: BFL has been maintaining good control over asset quality with gross non-performing assets at 1.96% at end-9MFY20 (FY19: 1.8%, FY18: 1.5%). Delinquencies have gone up in the loan against property segment with 90 days past due, increasing from 1.5% at FYE17 to 4.7% at end- 9MFY20, specifically due to its exposure to IL&FS (barring IL&FS exposure, the 90+days past due in loans against property would have been at 2.2%).

Current Scenario of Covid-19 crisis and its impact

The sheer speed and ferocity of Covid-19 has disrupted many global and domestic business operations. On the domestic front, management of Bajaj Finance Ltd (BJL) expects USD 250 billion of GDP fall and demand uptick by July & normalization by September 2020. In a conference call with investors, management of Bajaj Finance Ltd sounded cautiously optimistic and stated 3-moratorium of RBI as a moral hazard and potential behavior issues by borrowers. On the financial front BJL management reported Q4Fy20 key metrics:

· New loan book witnessed 3.5% (Y-o-Y) growth compared to 54% (Y-o-Y) growth witnessed last year during the same quarter.

· Asset under management rose by 27% (Y-o-Y) to Rs. 1.47 trillion and missed management expectation of 1.52 trillion.

· Company has liquidity of Rs. 158 billion in cash.

BJL Management Q1 Business Outlook:

Two-wheeler and B2B business which is 19% of AUM has lost portion of sales due to lockdown and expects more slump till Q1Fy21. However, the company is confident on recovery of portion of lost sales during the rest of fiscal year. B2C business front which is 20% of AUM is expected to witness faster growth from small markets than larger markets. MSME business segment has been under severe strain since introduction of GST which further aggravated last year due to a slow economy. The company expects growth recovery in next 12-15 months in the absence of credit guarantee support from the government because lenders are not likely to be forthcoming.

Management of BJL expects. demand recovery in rural markets is likely to be fastest as rural was already doing very well given strong monsoon and stimulus by the government. Rural B2B is likely to come back to normalcy fastest while B2C will revert to normalcy in line with urban B2C.

Private lenders with already on-going issues like recognition of NPAs, low loan book growth, the higher amount of withdrawals by depositors and weak corporate governance practices will see steep fall in valuations. However, NPA levels are likely to remain stable till the moratorium is lifted. According to RBI data at the end of January 2020, banks have an outstanding exposure of Rs 11 trillion to the micro, small and medium enterprises (MSME) sector and Rs 7.37 trillion to the NBFC sector. Banks have also lent Rs 3.73 trillion to the manufacturing sector, Rs 2.27 trillion to the commercial real estate sector, Rs 1.41 trillion to the transport sector and over Rs 450 billion to the tourism and hotels segment.