Now this is the most chilling factor, a USD 7 trillion of money pumping will only help stabilise a plunging economy, but what about future growth? Will consumer behaviour get back to normal and will investments take place? Can governments afford more stimulus for growth with huge debt overhang. Can Fed normalise policy ever to prepare for future shocks? Can deflation rule like it has in Japan for 30 years? Too many questions for the future but now, cash will continue to rule investor and public preference as the best asset class given the fears they have now on their own future.

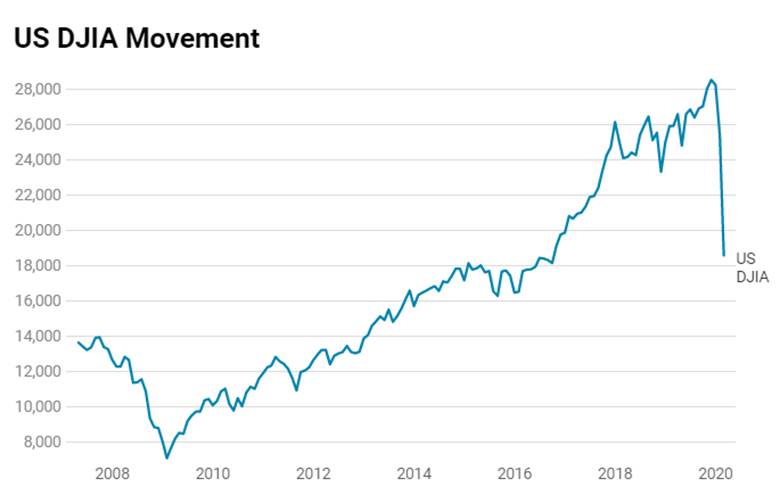

The US Federal Reserve removed all stops on the 23rd of March by announcing unlimited QE and buying at least USD 4 trillion of corporate and muni bonds. Fed’s now throwing USD 5 trillion or over into the market in order to counter the economic disaster of the corona virus on America and the world.

The Fed followed up its Sunday, March 15th rate cuts and QE announcements with a move to directly purchase CPs and provide liquidity to mutual funds, and the latest bazooka is after both measures failed to stem a plunge in asset prices. Investors and the virus affected public in the US rushed into the safety of cash, with public even making a run on banks.

The US government too is expected to announce a USD 2 trillion fiscal package and with the Fed throwing money, both measures can help to stabilise a hard hit economy.

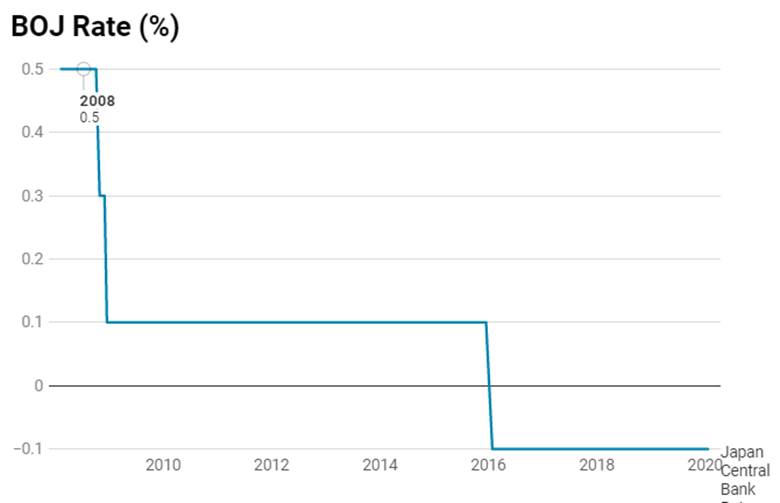

Now this is the most chilling factor, a USD 7 trillion of money pumping will only help stabilise a plunging economy, but what about future growth? Will consumer behaviour get back to normal and will investments take place? Can governments afford more stimulus for growth with huge debt overhang. Can Fed normalise policy ever to prepare for future shocks? Can deflation rule like it has in Japan for 30 years? Too many questions for the future but now, cash will continue to rule investor and public preference as the best asset class given the fears they have now on their own future.

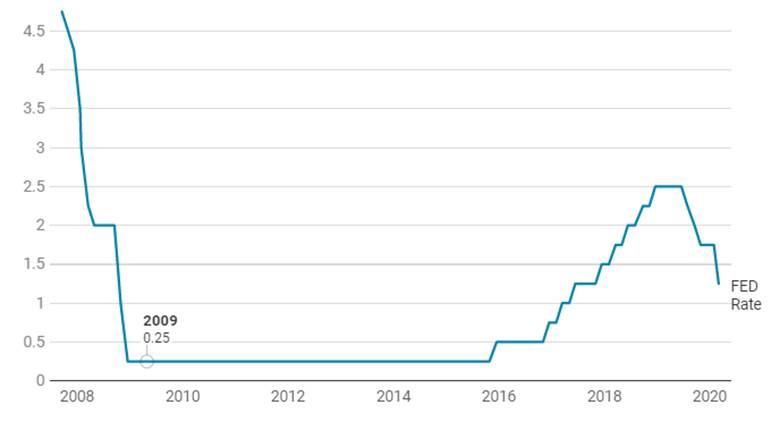

Fed Rate Cut on Sunday 15th March – Asset Prices to Plunge on Prolonged Recession Fears

The Fed in a dramatic move on Sunday the 15th of March cut its target rate by 50bps to a 0-25bps range, announced asset purchases of USD 400 billion in the coming weeks with a promise of more to come and pledged USD to foreign central banks to tide over a USD shortage. The Fed cited the economic impact of the Corona Virus will be deep and recovery uncertain.

What will the Fed move do to markets and economy? The move is actually negative for markets as fears of prolonged recession globally will drive down asset prices and the economy will will take a long while to recover as both consumption and investments stop on investors preference for cash.

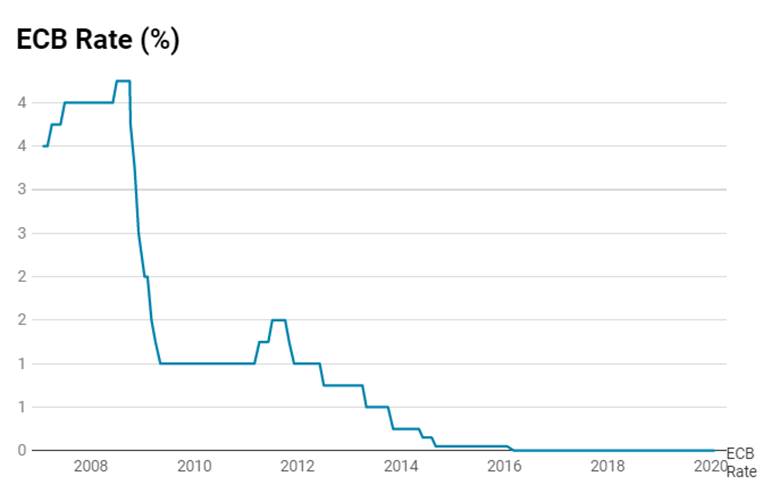

The fact that the Fed was yet to fully normalise policy after the 2008 rate cuts and asset purchases sends out signals that pure low rates and liquidity does not ensure prospects of a long term economic recovery. Globally too central banks have not yet been able to normalise policy since 2008 on lack of inflation and weak economic growth.

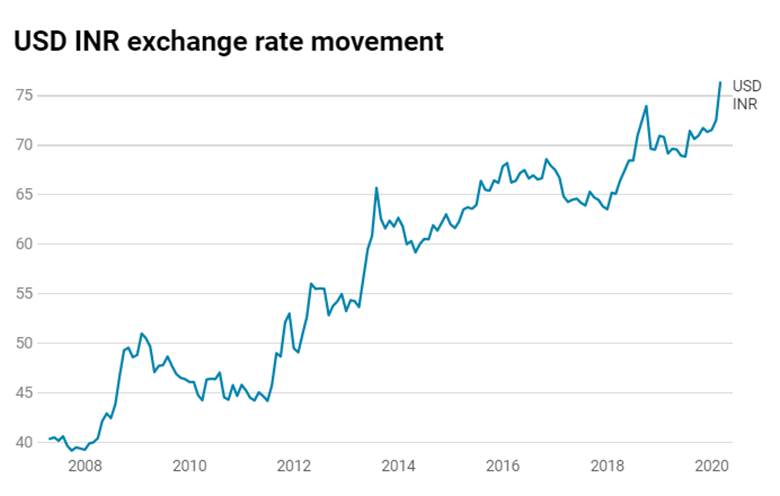

Indian markets will feel the heat of worries of global recession and this together with a already weak economy, credit market freeze and a banking crisis on Yes Bank failure, INR, Sensex and Nifty are likely to see sharp downward pressure and extreme volatility.

(Fiscal + Monetary Policy)^n = Long Term Growth Slowdow

Too much use of antibiotics makes the body resistant to fight viruses and also weakens the body considerably leading to more and more infections. Similarly, any sign of trouble in the economy is being dealt with the antibiotic of fiscal and monetary stimulus, first started by the Fed and now embraced by governments and central banks across the globe.

The coronavirus has hit global economies at a time when they were most vulnerable, with China the world’s second-largest economy, seeing growth slow down sharply to 6% levels from high double-digit growth. Eurozone economy was weakening on the back of weak global trade while India’s growth had plummeted to below 5%, from 7% levels seen a couple of years ago. India is facing a slowdown in domestic demand and weak export growth. Japan was limping with low inflation and weak growth.

The US was the only economy that was seeing strength with unemployment at record lows, consistent job creation, and strong corporate earnings. However, the US too felt the effect of China slowdown and the trade war, prompting the Fed to change its stance from normalizing rates to cutting rates.

Economic weakness in all the economies was despite unprecedented fiscal and monetary easing post the 2008 financial crisis, which saw governments cutting loose fiscal ammunition and central banks pumping in huge amounts of liquidity at record low rates. At that time, economies were able to come out of the crisis slowly but the defenses against further shocks weakened.

Government debt ballooned, inflation refused to pick and rates stayed at record lows. Fed took 10 years for the first-rate hike since 2008 while ECB has not raised rates since. Japan has been on stimulus for 30 years with no results.

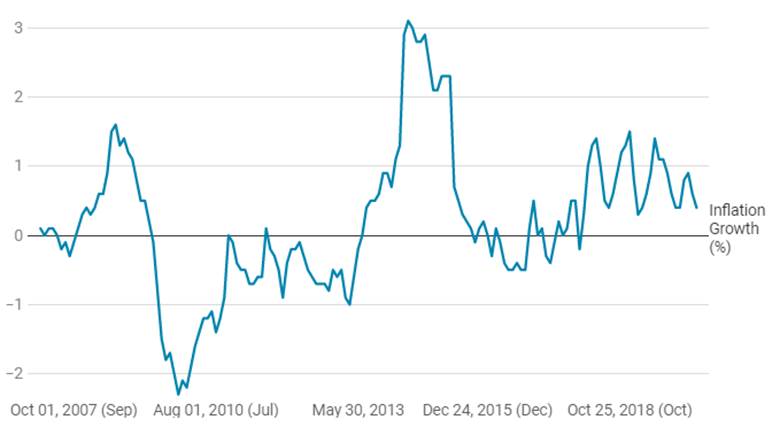

Japan Inflation Growth (%)

Eurozone Inflation Growth

US Inflation growth (%)

In the fight against the coronavirus, governments are increasing debt for fiscal stimulus while central banks are lowering rates and pumping in liquidity. When the virus issue goes away, economies can see an uptick in growth largely because of the low base effect but the economies will be weaker with high government debt and low rates that hurt an aging population that cannot afford rising costs despite headline inflation at record lows.

When the next shock happens, which will happen given the way the world is affected by climate change, economies will be left almost defenseless and no amount of fiscal and monetary stimulus will work.

It is high time that economies build up defenses to shocks through prudent policies, leaving enough space for stimulus to work when it’s required.

Quantitative Easing is essentially a monetary policy tool used by central banks globally to inject liquidity directly into the system. The US Federal Reserve System had undertaken quantitative easing (QE) following the global financial crisis of 2007–08 and mitigated some of the economic problems since the financial crisis. To some extent, QE helped global economies to recover from the recession which was witnessed during the 2007-08 financial crisis. But however, the growth rates reported by the developed nations have not achieved what they had reported prior to the financial crisis. Excessive liquidity will lead to depreciation of the currency and in turn, hurts countries that highly depended on imports. QE is not the solution every time when the economies slow down, otherwise, the global economy currency will slowly shy away from the intrinsic value. Economies internally should have the capacity to absorb the liquidity provided by the central bank in order to spurt demand levels, given the lower demand levels and high liquidity could affect macro indicators of the country in long run.

As per Reuters report, mature markets total debt now tops USD 180 trillion or 383% of these countries combined GDP, while in emerging markets it is double what it was in 2010 at USD 72 trillion, driven mainly by a USD 20 trillion surge in corporate debt. Global government debt alone is set to break above USD 70 trillion. Emerging markets are also loading up with excessive levels of Debt to GDP, China’s total debt to GDP is above 300%. Government debt to GDP of China stood at 55% and India stood at 70%. Another potentially risky trend is that the amount of emerging market hard currency debt (debt sold in a major currency like the dollar) that can become hard to pay back if a crisis hits a local currency’s value.

The Covid-19 virus spread is now global and this can have a long-lasting effect on markets even if the virus is contained in a few months. The reason is that global economies including India are already weak and central banks have maintained an easy stance since 2008, proving that their resources are limited. Given this scenario, there is no visibility on growth going forward even with government stimulus.

The Fed cut rates as an emergency measure to combat the Corona Virus effects on the Economy. The rate cut yesterday, the 3rd of March 2020, drove down US Treasury yields to record lows of below 1% and also took down the USD against the Yen and pulled down US equities.

The Reserve Bank of Australia cut interest rates on Tuesday in response to the growing threat from the coronavirus epidemic to the global economy.

The markets took the Fed rate cut as an affirmation that the virus will have a major impact on economies and corporate earnings. Global economies were already weak and with this virus and fall in oil prices, major economies and oil economies will see a huge impact on growth. Recession is not far away as seen by bond yields that are negative in Eurozone and Japan and at record lows in the US.

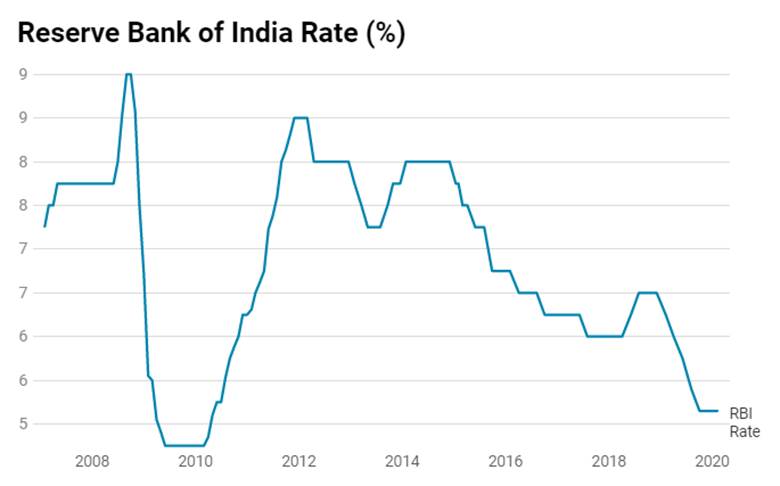

FED Rate Since 2007