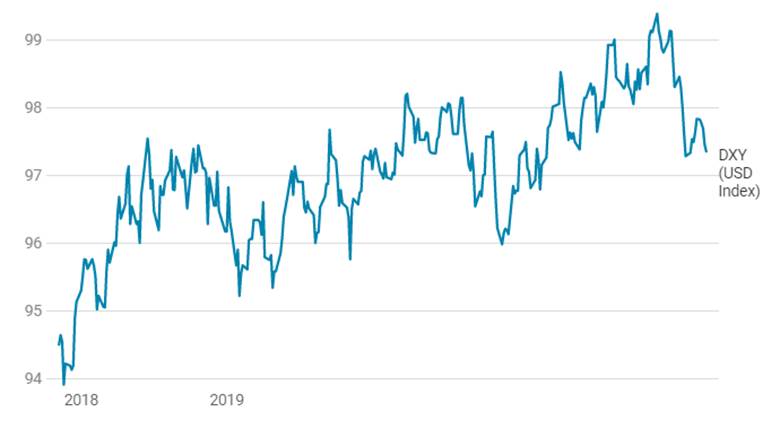

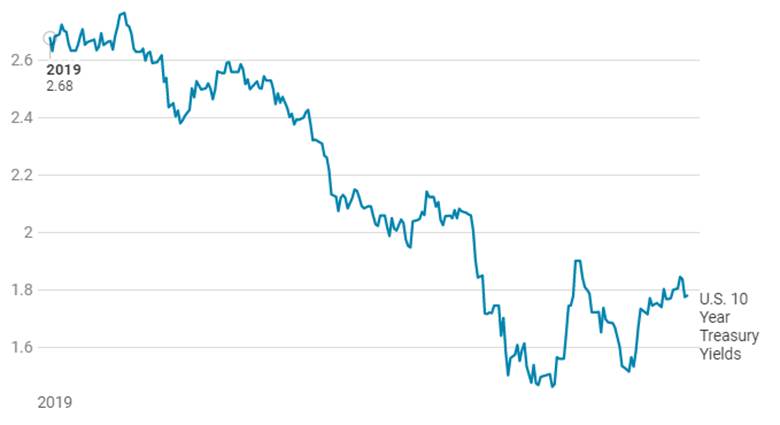

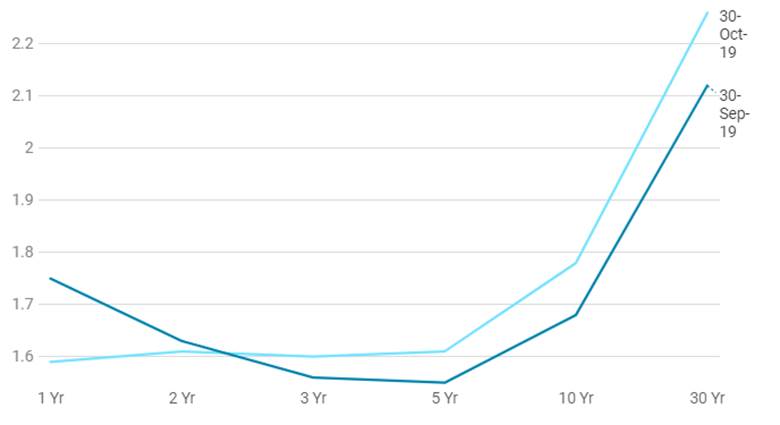

The Fed is looking to add USD 400 billion into money markets to ease a banking system liquidity crunch. The US yield curve stayed marginally steep on the Fed rate cut, as short end rates moved towards fed fund rates. US yields will react to risk appetite that has increased on prospects of a US-China trade deal and a better than expected earnings season. USD too will move on risk appetite, tending to weaken on higher risk appetite and strengthen on lower risk appetite.

The Fed lowered the overnight lending rate for the third time this year to a target range of 1.5% to 1.75%, driving a broad equity market rallyr and the USD lower against other major currencies on Wednesday, Fed also signaled that the central bank will pause from here.

The FOMC removed a key clause that had appeared in post-meeting statements since June saying it was committed to “act as appropriate to sustain the expansion.”. However, the Committee said in a statement that it will continue to monitor the implications of incoming information for the economic outlook as it assesses the appropriate path of the target range for the federal funds rate.

In his news conference, Fed Chair Jerome Powell listed the reasons why he feels the economy is doing well, and likely to continue to do so under the current stance of monetary policy – from robust consumer spending, strengthening home sales, and asset prices he considered healthy but not to a level of excess. As well, Powell said, Fed took this step to help keep the economy strong in the face of global developments and to provide some insurance against ongoing risks.

The U.S.-China trade war was “a step closer” to resolution, Powell said, and it looked less likely that Britain would crash out of the European Union.

The outlook for the U.S. economy continues to be for “moderate” growth, a strong labor market and inflation rising back to the Fed’s 2% annual goal, he said, and only “a material reassessment” of that outlook could drive the central bank to cut rates further from here.

DXY (USD Index)

U.S. 10 Year Treasury Yield Movements

US Yield Curve