China is placing structural reform on hold and shifting to policies intended to support growth, as it prepares to shield its economy from the effects of a potential trade war with the U.S, and the government’s efforts to deleverage the economy.

China cut its reserve requirement ratio (RRR) by 50 basis points this week, which will come in to effect on 5th July, releasing CNY 700 billion (or USD 108 billion) of cash. The RRR cut, which is the third cut by the central bank this year, had been widely anticipated by investors amid concerns over market liquidity and a potential economic drag from a trade dispute with the United States.

Expectations of a cut had risen after the State Council said that monetary policy tools including targeted cuts in banks’ reserve requirement ratios will be deployed to strengthen credit flows to small firms and keep economic growth in a reasonable range amid trade disputes.

Market participants are also expecting further reserve requirement reductions for the rest of the year as borrowing costs have risen due to Beijing’s clamp-down on leverage in the financial system. Currently, the reserve requirement ratio is 16% for large banks and 14% for smaller banks.

The cash released by RRR cut will be restricted to two purposes. State-owned and large banks will use CNY 500 billion (USD 77 billion) for “debt-to-equity swaps” while other banks, including foreign lenders, will use the remaining CNY 200 billion (USD 31 billion) to lend to SMEs.

This dual purpose of RRR cut will reduce the two biggest risks facing the economy by:

1. Relieving corporate default pressure from financial deleveraging reforms.

2. Providing a cushion for SMEs that could be affected by trade wars.

China’s policymakers have been pushing for debt-for-equity swaps since late 2016 to ease pressure on firms struggling with their debts.

Market Movements

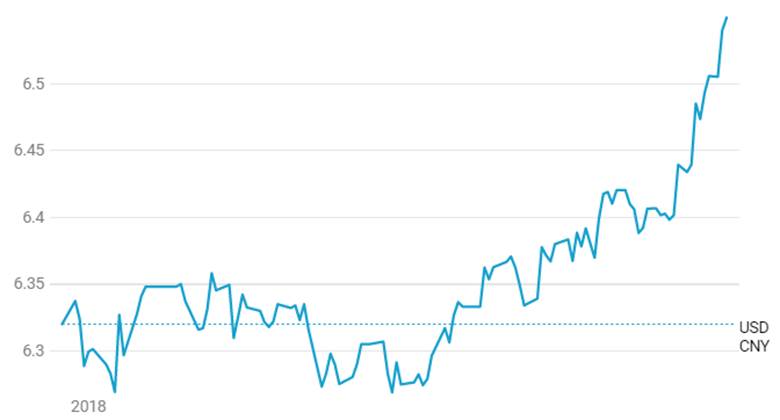

Fears of a full-scale trade war with U.S., have magnified concerns on the outlook for the world’s second-largest economy, following weaker-than-expected Chinese growth data for May and Beijing’s financial regulatory crackdown starting to weigh on business activity. The Shanghai Composite Index, in the last one month, has declined by 9%, Chinese Yuan (CNY) has depreciated by 2.5% against the USD and is currently trading at 6.5572.

Weak Data

· Fixed asset investment (FAI) growth dropped again in May to an all-time low of 3.9% from 6.1% in April.

· Infrastructure investment slowed from 11.3% to 2.3%.

· Retail-sales growth registered the slowest pace in over 15 years, with car sales being the main drag as volume growth fell to 7.9% from 11.2%.

· Export growth in CNY terms moderated to 3.2% in May from 3.7% in April.

USD CNY

Shanghai Composite (SSEC)