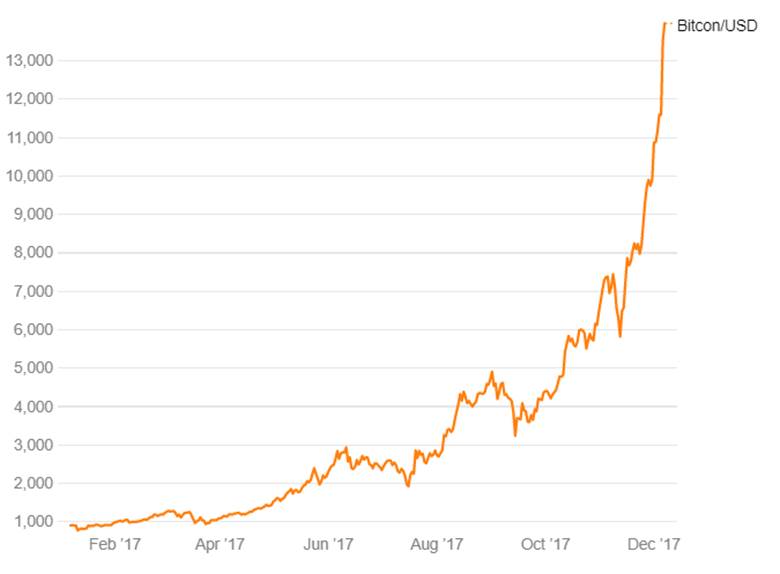

Bitcoin touched USD 15,000 today and price is sky rocketing. Its on everyone’s lips. Investors wonder whether to buy, regulators are issuing “at your own risk” warnings, bankers are hugely worried of its disruptive effects.

Bitcoin is a common currency of the world. Individuals in remotest part of the world and in metros can buy or sell bitcoin. All it requires is an internet connection. The benefits of this currency are huge. You can travel all over the world without needing to exchange currencies, trade can take place with no exchange rate risk, its inflation proof, political proof and central bank proof.

Risks are also there. Risk of banning the currency by regulators and governments, risk of server breakdowns, hacking, violent swings in value etc.

To buy its difficult to recommend, to sell its difficult to recommend. However, its going to be in the limelight for a long while.

Bitcoin

All of us get what money is at its most basic level. It is a common medium of exchange, facilitating trade of goods and services between individuals. Before the advent of standardised money as is today people bartered for goods and services. You got fish? I got bananas, wanna trade?

You can imagine how hard it would be then to find someone who needed what you wanted to sell and sold exactly what you wanted to buy.

Thus evolved the standardised form of money with some common acceptable store of value like gold. Eventually gold & silver coins gave way to paper money.

Paper money has value because it just is. There is no commodity backing it.

Economies are now run on fiat money which has value because a government backing it decrees that it does. The piece of paper with which you happily buy shiny new objects has no intrinsic value but for the fact that enough people have faith in the value. Based on the belief that the government is stable and the economy of the country is strong. It is used on the basis of both parties’ common agreement to use it; shared acceptance of the value assigned and shared agreement to accept it as currency.

Bitcoin traded at all time high USD 15,000 for the first time on 07th December 2017. Optimism around bitcoin drove its market capitalisation to USD 218 billion (Source – MarketWatch) which is more than Goldman Sachs market capitalisation( USD 93 billion). Changing economic and regulatory conditions have led to sudden shifts in trading volume of bitcoin in recent times. During last month (September 2017), the price of bitcoin fell around 13% following news that one of China’s largest bitcoin exchanges said it would be stopping operations.

What Is Cryptocurrency and Bitcoin?

The new age avatar of currency is Cryptocurrency. It is a digital currency that is created and managed through advanced encryption techniques called cryptography. Although there are many crypto currencies, the one which is most commonly used is the bitcoin.

Bitcoin was created in 2009 and has now gained worldwide acceptance. It was created by a Satoshi Nakamoto. Satoshi left the project in late 2010 without revealing much about himself. Bitcoins are created or mined by people using computers that solve complex mathematical problems or algorithms. It can also be bought and sold via bitcoin exchanges.

The thing about bitcoin is that the supply of the coins is finite. The total number has been fixed at 21 million. Currently about close to 15 million is said to have been mined or bought into circulation. It is completely decentralised and uncontrolled by any entity. There is acceptance of bitcoins as a currency is because people accept it as money and are willing to use it as currency.

How does Bitcoin Work?

First get a bitcoin wallet,buy some bitcoins from exchange or from any individuals..voila start spending or trading on them.

To understand how it works without getting too technical here is the simplified version of how it works. Once you install a bitcoin wallet in your system or mobile phone, it will generate your first bitcoin address or the public key; you can create more whenever you need one. You can disclose your addresses to your friends so that they can pay you or vice versa. In fact, this is pretty similar to how email works, except that bitcoin addresses should only be used once.

A transaction happens when there is a transfer of value between bitcoin wallets, they keep a secret piece of data called a private key, which is used to sign transactions, providing a mathematical proof that they have come from the owner of the wallet.

The signature also prevents the transaction from being altered by anybody once it has been issued. All transactions are broadcast between users and are confirmed by its internal network through a process called mining.

What is Blockchain Technology?

The technology behind cryptocurrency is called blockchain. It is an online ledger that uses data structure to simplify the way we transact. Blockchain allows users to manipulate the ledger in a secure way without the help of a third party. It is anonymous, protecting the identities of the users which make it more secure to carry transactions.

The technology works almost like a shared Google Sheets spreadsheet, allowing multiple parties to view, edit and validate a transaction, eliminating the need for a middleman.

Blockchain enforces a chronological order in the block chain to make it completely neutral. To confirm a transaction, it must be packed in a block that fits very strict cryptographic rules that will be verified by the network. These rules prevent previous blocks from being modified because doing so would invalidate all following blocks.

The way it is designed blockchain prevents any individual from easily adding new blocks consecutively, no individuals can control what is included in the block chain or replace parts of the block chain to roll back their own spends.

Why is Storage of Bitcoin Important?

Bitcoin are represented by strings of numbers that make up the public and private keys. If someone gets hold of those digits, they can steal the bitcoin they represent. If you lose the keys, that bitcoin is lost to you forever. It’s not like credit cards, where you can report a theft and have a transaction voided or get a replacement in the mail if you lose the card. Obviously safe storage of bitcoin is extremely important, so owners of bitcoin use reputed digital wallets for eg Coinbase or store in it a USB or hard drive not accessible to hacking on the internet.

What Can You Buy With a Bitcoin?

Many merchants are using the bitcoin as an acceptance for payment for goods. A few of them worth mentioning are Amazon,Home Depot, Expedia,Tesla Motors, Subway & Overstock.com Some accept direct payment via bitcoins and some ecommerce sites accept bitcoins as a payment to buy their vouchers.In fact there are stories of Lambhorginis, and Mansions being sold in exchange of bitcoins.In India, you can use bitcoins for mobile recharge, to buy Flipkart vouchers, movie tickets and pay utility bills.

Bitcoin as an Investment

Although merchants accepting Bitcoin as payment for goods are increasing, individuals are buying bitcoin mainly as an investment. In early 2013 bitcoin was traded at about USD13 per bitcoin, it hit a high in November 2013 of over USD1,200. A staggering gain, but soon after hitting the all time high it fell to USD225 per bitcoin. Right now the price of a bitcoin is hovering around USD 15000.

It is supremely volatile, which is its advantage as well as disadvantage.

This year bitcoin began the year priced at around USD 900. By 13th October 2017, the price had risen to USD 5800, a rise of almost 544 per cent. No wonder it is generating a tremendous amount of interest.

A lot is happening in the US regarding bitcoins ,The New York Stock Exchange has launched a Bitcoin index, NYXBT; the Bitcoin Investment Trust (GBTC), the famous Winklevoss twins of the facebook fame have launched Gemini, a fully licensed and regulated Bitcoin exchange, in early October. They also have applied to start an ETF, which, like GBTC, could appeal to institutions, pension plans that might want exposure to Bitcoin but would not be able to invest in the currency directly themselves.

In India almost 20 service providers and start-ups related to Bitcoins have sprung up. Currently, there are four bitcoin exchanges in India: Coinsecure, Zebpay, Unocoin and BTCX.

Criticisms Against Bitcoin

The biggest criticism is its reputation for being used illegal activities. The FBI took down an online drug bazaar , SilkRoad where Bitcoin was the preferred medium of exchange.

Bitcoin and other cryptocurrencies are unregulated, no government backs it and once you own it you or on your own as it exists only in your computers.

There have been number of instances of hacking, this year itself in august hackers penetrated a secure authentication system at a bitcoin exchange called Bitfinex, and stole about $70 million worth of the virtual currency.

Earlier in 2014, Japanese based Mt. Gox which was the largest bitcoin exchange lost USD510 million of customer’s bitcoin to hackers and filed for bankruptcy.

Losing your bitcoin if your digital wallets or exchanges are hacked is real problem and there is no where you can file a FIR and no cop is going to go out to retrieve them.

What is the Conclusion on Cryptocurrency and Bitcoin?

There are about twenty Cryptocurrencies in circulation litecoin, peercoin, namecoin, ether and primecoin to name a few. Bitcoin is the most popular one yet. There are vehement critics calling it an evil and many ardent supporters out there of these currencies.

Being unregulated and open to theft is a primary risk of owning a bitcoin. Even so there is enough evidence to support that unless a better technology surfaces and supersedes it this is here to stay. The value can swing dramatically and optimists predict that the value of bitcoin can go up to USD10, 000.

Blockchain as a technology which is potential to disrupt banking. It can service unbanked individuals, make it possible to transact small amounts, cut costs and make financial transactions more efficient.

Regulation may follow technology and soon the archaic laws may be updated to formulate laws on digital money. In fact in the US on 19 September 2016, a federal judge ruled that bitcoin qualify as money. This decision was linked to a criminal case where the accused hacked into the systems of JPMorgan Chase & Co and some other organisations.

The whole idea of an asset which is not correlated with any commodity or any economy or anything just its demand and supply is audaciously attractive for investors/speculators. The potential of unimaginable profits if the price gain further traction makes investors form a beeline to buy these albeit as a small portion of their overall investment portfolio.

The prime accusation against central banks right now is that of being reckless currency printing machines devaluing its value. Cryptocurrency may start getting preference if investors feel that there is possibility of getting insulated from the central banks policies of negative interest rates and their race to the bottom and beyond.

Bill Gross a noted Bond expert recently published in his October 2016 note that Bitcoin may be better investment options than shares. To quote him “Investors/savers are now scrappin’ like mongrel dogs for tidbits of return at the zero bound. This cannot end well.”

Bitcoin is an interesting concept and only time will tell whether it turns out to be another Ponzi Scheme or a revolutionary new order of things to come. Today the biggest problem with the regular currencies is that there seems to be an unlimited deluge of supply which can be provided by government; this is circumvented by cryptocurrency as its supply is capped. It is portable, anonymous, divisible and scarce.

Like any new technology or idea it may take a while to gain acceptance but in a world which is disillusioned with low interest rates this may well become a panacea of all central banks ills.

This is not to say that we recommend to buy bitcoins or any other cryptocurrency but this, like any other disruptive technology warrants a watch.

Bitcoin/USD