The recovery in financial markets last week following the Britain’s vote to leave the European Union was welcome relief to market participants. Equities, bonds and gold rallied even as currencies turned volatile. The Pound fell to 31 year lows, the Euro fell, Yen rose, Yuan fell and USD gained. Brexit has caused a situation where each of the big central banks of Fed, ECB, BOJ and PBOC want their respective currencies to weaken and stay competitive.

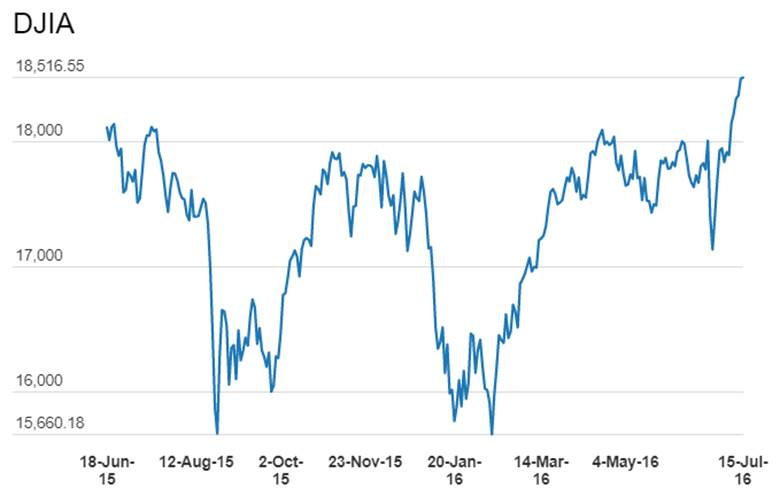

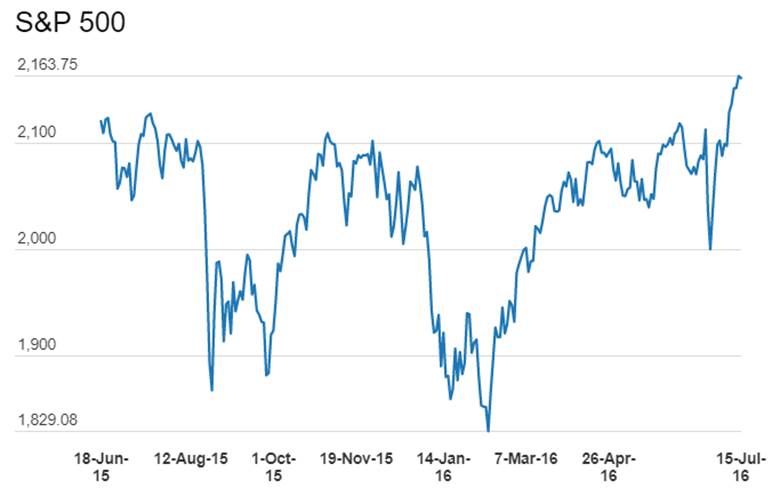

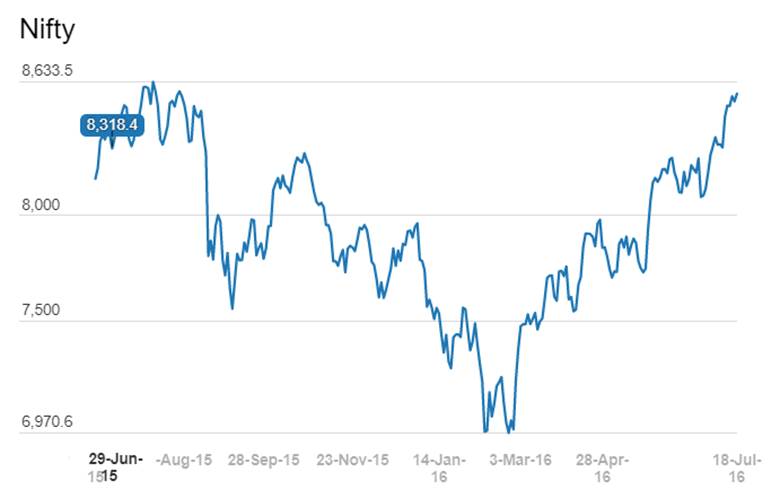

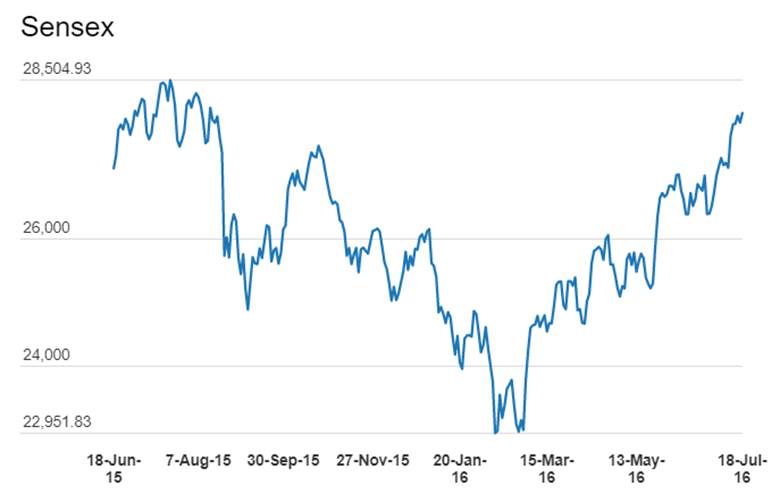

The so called currency wars have taken the US equity indices, the Dow and the S&P 500 to record highs even as other global equity indices including the Sensex and Nifty rallied sharply. Chart 1. Each central bank trying to weaken their currencies by ultra loose monetary policy, will flood markets with cheap liquidity that will find its way into equity markets. Commodity markets may not gain as much given a basic demand supply imbalance globally.

Currency Wars

After initially stabilizing from the shocking 23rd June UK referendum results, currency markets turned volatile as market participants became nervous after BoE on Tuesday warned the market on risks to financial stability following the Brexit vote. In its bi-annual financial stability report, the BoE said that the risks it had feared ahead of the Brexit poll had started to materialize. U.S. and Japanese government bond yields touched record lows as anxious investors continued to run for safety

The British pound fell to a fresh 31-year low to less than 1.30 against the USD in what markets see as a sign of increased contention among nations over currency values, which are critical in global trade and capital flows.

US Fed

USD post Brexit looks to be strengthening anew, which would further strain US exports. A stronger USD makes U.S. products more expensive in foreign markets, pushing the Federal Reserve to stay on the sidelines on interest rate action.

Minutes of the Fed’s last meeting in mid-June showed that Federal Reserve policymakers were divided over whether US economic conditions would be strong enough to weather an interest rate increase and also noted that the Brexit vote and weak May jobs growth as factors for waiting to hike rates.

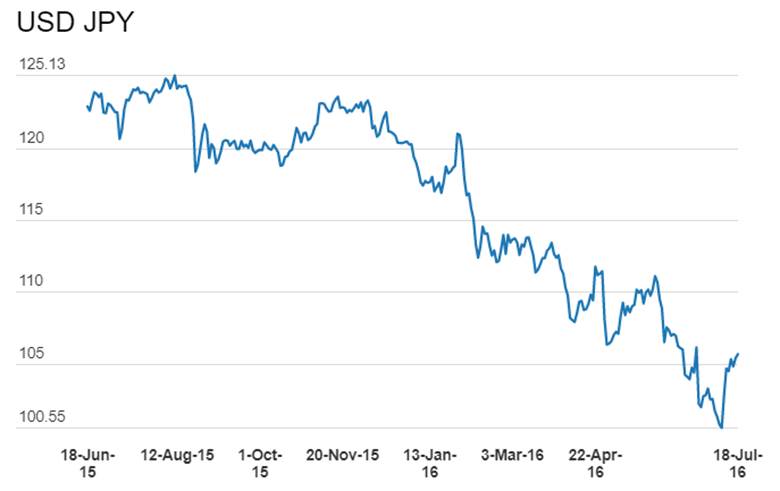

The USD had started rising from late 2014 on the back of falling oil prices, expectation of Fed rate hikes and the relative strength of the U.S. economy that attracted inflows of capital. Chart 2 The USD rally peaked early this year as markets too profits on the back of the Fed dithering over rate hikes and has retreated from peaks, but the British referendum to quit the EU has brought a resurgence of demand for the USD as investors seek the safe haven in security of U.S. Treasury bonds.

ECB and BoE

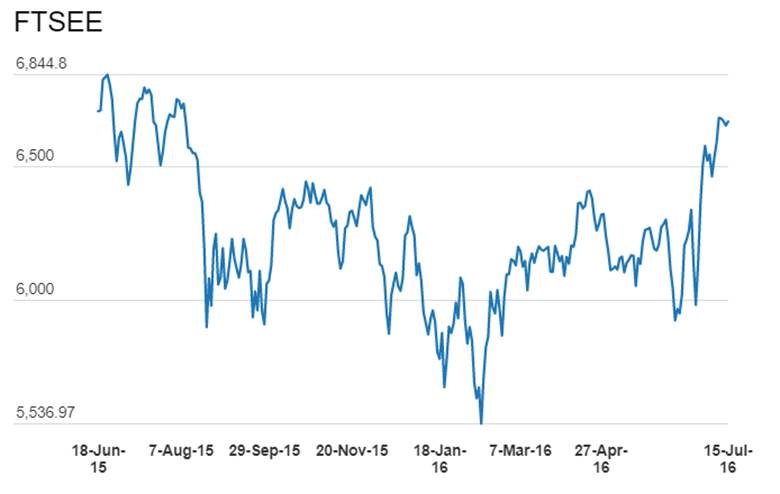

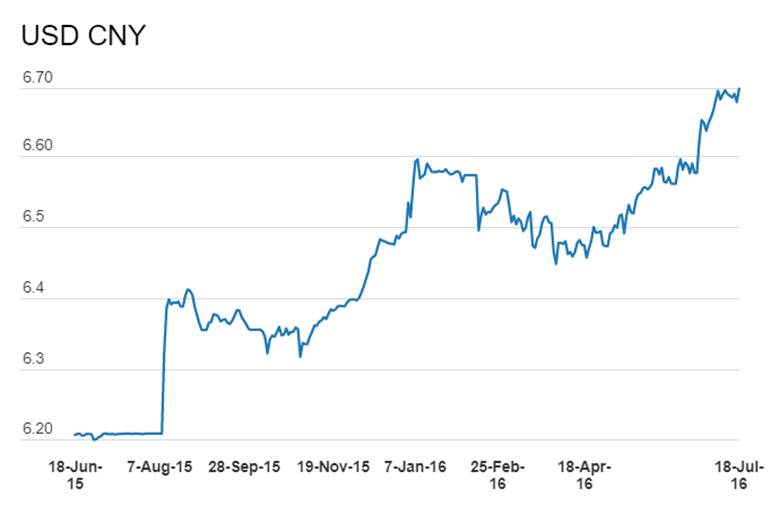

Brexit has heightened investors’ concern about recession in Britain. The British pound is down about 11% against the USD since the referendum. The European Central Bank is likely to hold down or lower rates in an effort to boost confidence and growth, which will add to the downward pressure on the Pound as well as the Euro. Chart 3

The Bank of England (BoE) in its biannual Financial Stability Report announced a new measure to cut counter cyclical capital buffer rate for U.K. banks to 0% from 0.5%. This will reduce regulatory capital buffers by GBP 5.7 billion (USD 7.5 billion), raising banks’ capacity to lend to households and businesses by up to GBP 150 billion. BoE Governor Mark Carney in a press conference said that the move represented a “major change” that would help the economy to cope with the Brexit consequences.

BOJ

Like the USD, the Japanese Yen is a safe-haven currency and it has jumped in recent days, much to the chagrin of Japanese officials who want to preserve their exports, fight deflation and boost economic growth. Japan has signaled that it is prepared to intervene to stem the strength in the Yen, which is up by about 15% to 105 Yen per USD from lows seen in 2016. The Yen fell to highs of below 100 to the USD post Brexit but has depreciated by 6% from highs largely over the perception that a Japanese Prime Minister Shinzo Abe landslide victory in the upper house elections gives him a free hand to draft economic policy. Japanese Prime Minister Shinzo Abe ordered a new round of fiscal stimulus spending.

PBOC

China, meanwhile, has been carefully managing the Yuan in the face of rising global pressures. Beijing has said that its policymakers are calculating the value of the currency, also known as the Renminbi, against a basket of many other currencies, not just the USD. On Wednesday, officials set the Yuan, which trades within a band of 2%, at 6.6857 to the USD. That is the weakest since late 2010. Market is expecting that the Yuan is likely to weaken further against the USD, which could renew tensions with U.S. lawmakers and other critics, who have long accused the Chinese of manipulating its currency to gain an edge in trade.