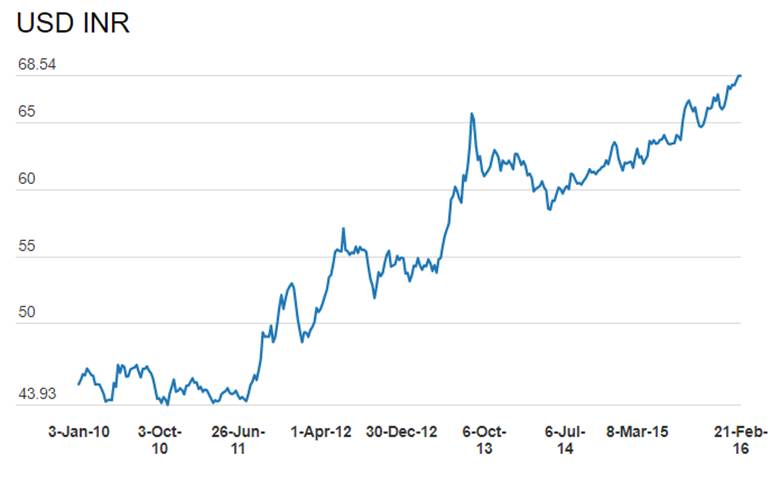

The INR at levels of Rs 68.64 to the USD is just 0.20% off all time lows of Rs 68.80 seen in August 2013. Chart 1. INR is down around 10% over the last one year largely on the back of global risk aversion caused by China Yuan Devaluation. Foreign portfolio flows have dropped considerably in fiscal 2015-16 year to date on the back of risk aversion from robust flows seen in the last fiscal year.

The fall in the value of the INR is not seen as negative by policy makers unlike the panic reaction seen in 2013. In fact policy makers are welcoming the fall in the value of the INR.The INR fall does not stand out given that most of the emerging market currencies are down against the USD. Table 1.

Policy makers from staving off a free fall in the INR in July 2013 on the back of Fed talk of stopping asset purchases are now clamoring for depreciation in the INR. The reason for wanting a weak INR is India’s export growth that turned negative in fiscal 2014-15 and has continued to be negative in fiscal 2015-16 year to date. Exports are down 17.6% in the first ten months of the current fiscal year. Weak global economy has hurt exports.

Is a policy of depreciating the INR to achieve export competitiveness a correct policy? The answer is a definitive NO. RBI trying to depreciate the INR by either lowering interest rates or by buying USD can lead to longer term repercussions that may be difficult to control. Lowering interest rates without fundamental backing of inflation and fiscal deficit will lead to low to negative real interest rates that can stifle savings in the economy. Buying USD leads to high liquidity infusion that can affect interest rates as well as cause long term inflation expectations to rise.

To be sure, the INR has weakened considerably against the USD over the last one year. INR is down over 10% against the USD. The weak INR in 2013 prompted the government to adopt policies to control fiscal and current account deficits and to keep down inflation expectations, all of which have worked in strengthening the macro economic fundamentals of the economy. Fiscal and current account deficits are down from 4.8% and 4.7% of GDP to 3.9% and 1.3% of GDP over the last three years. Inflation is down from double digit levels to levels of 5.6%.

A policy of weak INR will also stop capital flows as cost of hedging becomes expensive. FIIs could even pull out of INR bonds if INR depreciates, as unhedged exposures will cause losses. FIIs had invested a record USD 27 billion in INR bonds in fiscal 2014-15 but in this fiscal they have invested a total of less that USD 1 billion. Falling INR could prompt FII’s to sell bonds and if they sell bonds then interest rates are likely to rise in the economy. Ironically, FII bond sales will help depreciate the INR and this could lead to a self fulfilling cycle of more FII selling and faster depreciation of the INR and this policy makers cannot digest.

The government is seeking high investments into India for the country to grow but a weak INR policy will deter investments especially portfolio investments.

The INR is best left alone and policy makers should concentrate on strengthening economic fundamentals that will lead to productivity gains, which in turn will lead to export competitiveness.