The Euro rose by over 2.5% against the USD while equities fell and bond yields rose globally on markets disappointment on ECB policy. European and US equities fell by 1.5% to 3.5% while bond yields rose 13bps to 25bps. The market move is largely seen as profit taking given rally in USD, bond yields and equities on expectations of ECB accommodation.

The INR will see strength as markets cut shorts while Sensex and Nifty will fall. Ten year benchmark bond yields will rise on rise in global bond yields. However going forward, the divergence between ECB and Fed will be prominent as Fed hikes rates mid December and markets will tend to use Euro as the default funding currency for carry trades. Markets will bounce back with USD strengthening, equities rallying and bond yields falling.

The ECB cut deposit rates by 10bps from negative 20bps to negative 30bps and lengthened the duration of its Euro 60 billion a month QE by six months to March 2017, taking up the total QE size to Euro 1.5 trillion. ECB president Mario Draghi on Thursday the 3rd of December said that the central bank will leave all its options open to get the Eurozone back on an inflationary path.

ECB cut inflation forecasts by 0.1% for the Eurozone, Inflation is expected at 1% and 1.6% for 2016 and 2017 respectively. Growth forecasts were however raised for 2017 from 1.8% to 1.9%.

Eurozone needs sustained policy accomodation

Eurozone inflation as measured by the CPI printed at 0.1% in November from 0.1% levels in October 2015 and from negative 0.1% levels seen in September. Eurozone GDP growth was at 0.3% in the third quarter of 2015 down from 0.4% and 0.5% seen in the second and first quarters respectively. Unemployment rate was at 10.8% in September 2015 down from 10.9% seen in August. The Eurozone economy is looking to come out of a deep slump and requires sustained monetary accommodation given lack of fiscal space in most of the Eurozone countries.

ECB QE and the Euro

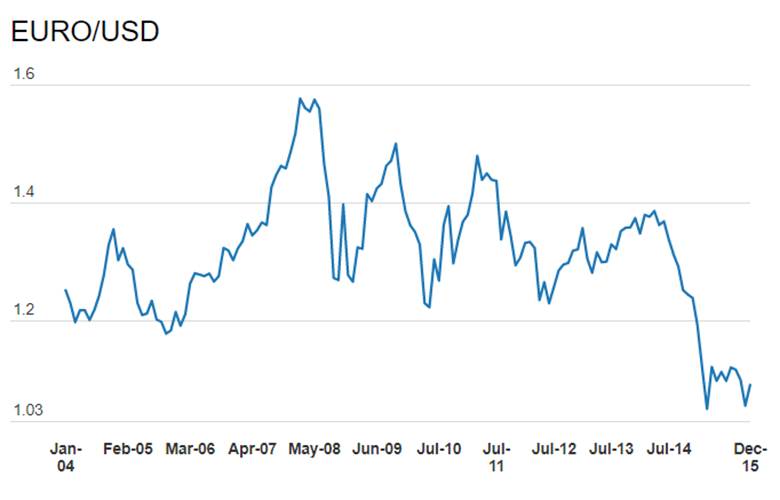

The Euro has fallen over 23% against the USD from levels of USD 1.39 to twelve year low levels of USD 1.06 over the May 2014- November 2015 period. The reason for Euro weakness is the relative actions of the ECB and Fed. The ECB had cut its policy rate to all time lows of 0.05% and its discount rate to -0.20% in its September 2014 policy. The ECB commenced an asset purchase program of Euro 60 billion on the 10th of March 2015. The asset purchases will go on until September 2016 and will total Euro 1.1 trillion. The QE will encompass government bonds, asset backed securities and covered bonds

The Euro weakening this time around is more positive than negative for markets. The reason is that with Eurozone rates at close to zero percent and expected to stay down for a while, the markets are starting to fund carry trades with the Euro as the funding currency. The ECB infusion of liquidity through asset purchases and refinance operations will ensure that the system is flooded with cheap liquidity. The cheap Euro liquidity has driven down bond yields of PIIGS countries that are now trading at much lower levels than levels seen in 2012.