NBFC CP and Bond spreads have risen sharply since the IL&FS default and markets are still risk averse on the sector. Short end credit yields stayed at higher levels on concerns of a freeze in credit markets. CP yields rose on credit worries and liquidity issues as markets froze on risk aversion. CD yields rose on system liquidity worries. Credit risk funds and low duration funds underperformed against long duration funds and gilt funds. The gilt fund with 10-year constant duration has outperformed all the funds.

10-year G-sec yield fell sharply in October 2018 with the yield falling by almost 19 bps from levels of 8.02% seen on 28th September to close the month at 7.83%.

Positive Drivers of G-sec Yields

CPI Inflation– Consumer price inflation came in at 3.77% in September 2018, compared with 3.69% in August 2018. However, Core CPI inflation is sticky and is hovering around 5.82% in September 2018.

Inflation is currently running below the MPC forecast. RBI projected CPI inflation for Q2FY19 at 4% and 3.9%-4.5% in H2FY19 and 4.8% in Q1FY20, including the HRA impact for central government employees. Excluding the impact of HRA revisions, CPI inflation is projected for Q2FY19 at 3.7% and 3.8%-4.5% in H2FY19 and 4.8% in Q1FY20.

While MPC has been cautioning about upside risks to inflation, actual readings have been below expectations for the last few months. However, the MPC has warned that inflation could spike in H2 due to higher fuel prices, a weaker rupee and increased support prices for farm crops.

India CPI Inflation

Lower Government Borrowing- The government announced Rs 700 billion lower than budgeted borrowing for the October 2018- to March 2019 period. Government borrowing for the second half of 2018-19 is easily achievable if there are no major disruptions in the market. Bond redemption worth Rs 756.30 billion and Rs 705 billion less borrowing than budgeted will help borrowing go through smoothly. Net borrowing is Rs 1713 billion in the second half, which is 14.48% lower than the net borrowing seen in the first half of fiscal 2018-19. Government would be issuing short maturity bonds in the 1-4 years bucket. More issuance will be planned in the short- and long-term maturity buckets, a barbell strategy aimed at keeping down yields on the 10-year bond.

OMO- As system liquidity has turned negative, RBI is continuously trying to infuse liquidity through OMOs. RBI purchased bonds worth Rs 360 billion in October 2018 and planned to buy Rs 400 billion worth of bonds in November 2018.

Measure by Government & RBI to stem rupee fall- The USD 75 billion currency swap agreement with Japan will help stabilize the INR that has fallen to record lows on the back of various domestic and global issues. The lines may not be drawn into but the fact that it’s there will provide confidence to markets on USD liquidity for the country. Currency swaps between central banks lead to an improvement in risk appetite as the currency swaps increase liquidity in a particular currency, helping a country to tide over temporary liquidity issues.

Japan and India entered into a currency swap agreement worth USD 75 billion, with this bilateral swap arrangement, India will be able to buy dollars from Japan at a fixed rate, which will be returned at a future date in exchange for INR. This swap agreement is expected to stabilize the INR, which has fallen by 13% in the last one year. India and Japan had signed similar kind of agreement in 2012 & 2013 to check currency volatility during the taper tantrum period.

Earlier RBI has taken several measures to control the fall in the INR. RBI eased norms for companies in the manufacturing sector to raise overseas funds and allowed Indian banks to market Masala Bonds. As per the revised policy, eligible ECB borrowers who are in the manufacturing sector will be allowed to raise ECB up to USD 50 million or its equivalent with a minimum average maturity period of 1 year. The earlier average minimum maturity period was three years.

Negative Factors for G-sec Yields-

FIIs Turn Net Sellers of Bonds in September

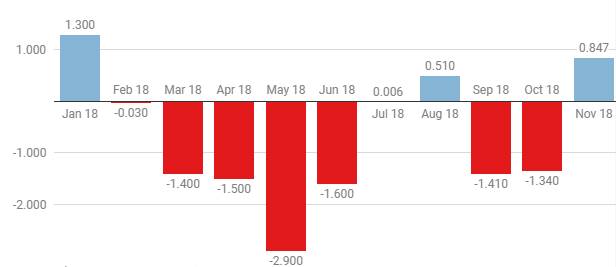

FIIs are continuously selling INRBonds. In the month of October, FIIs sold bonds worth USD 1.42 billion, in calendar year 2018 so far, FIIs have sold around USD 8.44 billion worth of INR Bonds. Two important factors that are causing this withdrawal are interest rate hikes by Federal Reserve and a falling rupee.

In the fiscal year 2017-18, FIIs pumped in money into INR Bonds, taking up limit utilization (limits were enhanced to attract flows), which in turn helped strengthen the value of the INR. Debt flows are leveraged and despite a clear lack of interest rate arbitrage, FIIs bought into INR Bonds on a positive outlook for the INR as the oil prices were down, current account deficit was low and capital flows helped increase the value of the INR. In fiscal 2018-19, the whole scenario changed. Fx reserves that were built up in fiscal 2017-18 saw falls with RBI turning net seller of USD from being a net buyer last year.

Debt flows can be extremely harmful if not monitored properly and that is one of the reasons why the RBI is reluctant to increase debt limits substantially.

FII Investment in INRBonds (Billion $)

Global Central Bank Policies

Federal Reserve raised the federal funds rate by 25bps to 2%-2.25% during its September 2018 policy meeting, in line with market expectations, this is the 3rd rate hike in the year 2018 and it is the 8th time the Federal Reserve raised borrowing costs since it started in late 2015. The rate hike was expected as US economic growth is strong, Unemployment is low, and inflation is relatively stable.

Fed rate-hike outlook for the rest of 2018 and 2019 stayed the same as well. The central bank is expected to raise rates again in December and another three times next year. The Fed economic outlook has improved. GDP growth for 2018 is now expected to come in at 3.1%, up from the previous expectation of 2.8%.

Federal Reserve minutes suggest that Fed members are hawkish and believe that the central bank should continue to increase interest rates to ensure a stable economy. Most members also anticipate a further gradual increase in Federal Fund rate, as it would most likely be consistent with a sustained economic expansion, strong labor market conditions, and inflation near 2% over the medium term. However, minutes also suggest that a few members are concerned over the impact tariffs might have on GDP.

ECB– The European Central Bank kept its policy unchanged and stayed on course to end bond purchases by the end of December and to raise rates next summer. ECB President Mario Draghi said he predicts inflation will rise towards the end of this year. Draghi said that while measures of underlying inflation remain generally muted, they have been increasing from earlier lows. Looking ahead, underlying inflation is expected to pick up towards the end of the year and to increase further over the medium term.

Outlook for G-secs – Government bond yields fell in October on the back of RBI OMO bond purchases, lower CPI inflation print for September 2018, INR rallying from record lows and drop in UST yields from multiyear highs.

The OMO announcement will provide support to bond yields in the near term but markets will stay nervous on borrowing and rate hike worries.

Government bond yields will stay ranged, as RBI OMOs lead to the lower supply of bonds in the market while rate hike expectations and uncertain markets prevent yields from falling.

Outlook for Corporate Bonds- Short end credit yields stayed at higher levels on concerns of a freeze in credit markets. Credit risk aversion post IL&FS default has still not gone out of credit yields despite the measures taken by the RBI and the Government. NBFC CP and Bond spreads have risen sharply since the IL&FS default and markets are still risk averse on the sector. Large NBFCs and HFCs such as India Bulls and DHFL have highlighted their strong liquidity profile but market nervousness persists. Credit risk mutual fund schemes are facing redemptions on default worries and that is still keeping credit yields high.

Outlook for CPs & CDs- MFs are the largest lenders in the CP market and if there is lack of liquidity amongst MFs, working capital for companies may dry up if MFs go slow in CP investments. Issuers will then have to pay a higher cost for borrowings, leading to lowering of profitability and postponement of capex