The Fed removed the word accommodative from its policy statement while hiking rates in the FOMC Meet that ended on 26th September 2018. The Fed has guided for a rate hike in December 2018, three more in 2019 and one in 2020, taking the fed funds rate to 3.25% to 3.50% . from current levels of 2% to 2.25%.

The Fed stance was widely expected by the market and market reaction was muted with minor movements in the S&P 500 index, 10 year UST yield and the USD.

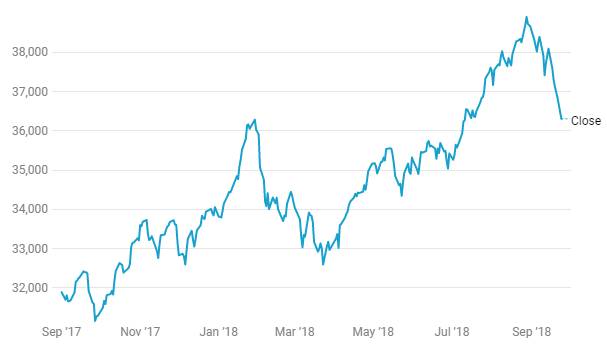

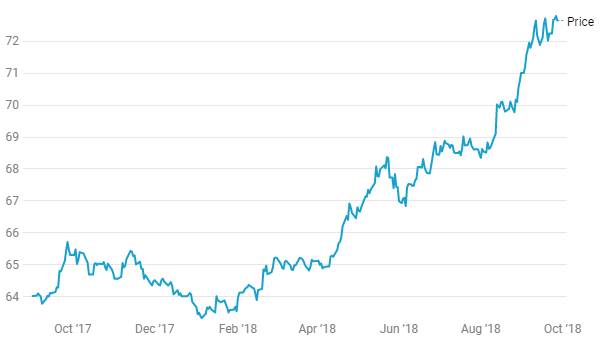

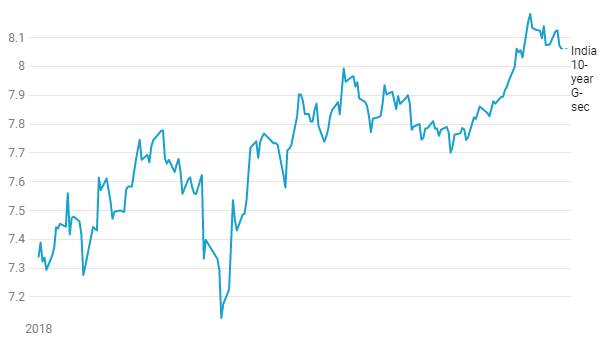

The impact of Fed rate hike and guidance on Indian markets is more as a part of wider issues rather than the single driving force for the markets. The INR has been hit by debt outflows and global risk aversion. The 10 year Gsec yield has risen due to factors such as FII selling, RBI rate hikes, government borrowing and liquidity. Sensex and Nifty have corrected from highs on NBFC Sector Issues.

The Fed rate hike adds on to the negatives surrounding the market at present, and RBI is expected to raise rates in its policy meet next week, that will cause more uncertainty for markets. Political risk will also keep markets on the edge, with important state elections that is seen as an indicator for the outcome of 2019 general elections. Markets will also watch for any negative earnings guidance from companies in the 2nd quarter FY 19 results.

On a positive note, economy is showing traction, monsoons have been more or less normal though skewed, 2nd quarter earnings are expected to be on track and global economy is strong. This will keep markets largely supported.

The Federal Open Market Committee raised the federal funds rate by 25bps to 2% to 2.25% during its September 2018 policy-meeting, in line with market expectations. US GDP growth forecasts for 2018 were raised to 3.1% from 2.8% in the June 2018 projection and for 2019 to 2.5% from 2.4%. 2020 forecast was left steady at 2%. The unemployment rate is seen higher at 3.7% in 2018 (3.6% in the June 2018 projection) and at 3.5% in both 2019 and 2020. Inflation forecasts were left steady at 2.1% for 2018, easing to 2% from 2.1% in 2019 and unchanged at 2.1% in 2020. Policymakers expect one more rate hike this year, 3 rate hikes in 2019 and 1 in 2020.

Factors for fed rate hike:

· The US labor market has continued to strengthen and economic activity has been rising at a strong rate. Job gains have been strong in recent months and the unemployment rate has stayed low. US unemployment rate was at 3.9% in August 2018.

· The US economy growth expanded at an annualized rate of 4.2% during Q2Fy18, slightly beating market forecasts of 4%. This is the strongest growth rate at which the US economy expanded in the last 4 years.

· Annual inflation rate in the US fell to 2.7% in August 2018 from 2.9% in July 2018 and below market expectations of 2.85%. It is the lowest reading in four months amid a slowdown in cost of fuel, gasoline and shelter.

· Corporate profits in the US increased by USD 47.3 billion (2.4% Y-o-Y), to an all-time high of USD 2,012.6 billion during Q2Fy18, following a 8.2% jump in the previous period and missing market expectations of an 8.6% advance. Increase in corporate profits shows the increase in demand for US products (manufacturing & service) globally and uptick in expenditure patterns of US citizens.

Sensex - 1 Year Chart

USD/INR - 1 Year Chart

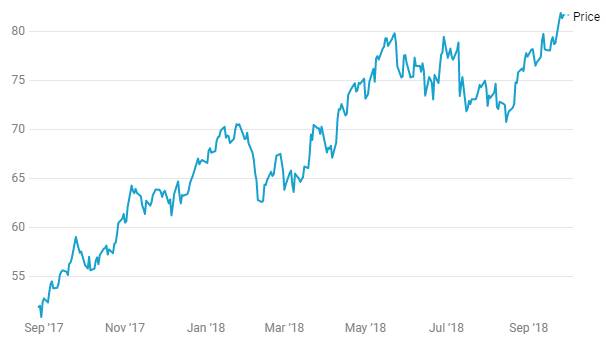

Brent Crude Oil Price - 1 Year Chart

10-year G-sec