Jindal Steel & Power recently got its credit rating upgrade from major credit rating agencies Crisil, ICRA and Care. Crisil upgraded JSPL long-term rating to investment grade BBB- with a stable outlook from D (default). The recent upgrade by Crisil is mainly due to following factors, improvement in liquidity post it’s Qualified Institutional Placement (QIP) of Rs. 12 billion, divestments of its non-core assets of around Rs. 18 billion, and successful refinancing of its term loans in India and overseas operations.

JSPL upgrade from default is a sign of an overall improvement in economic outlook for India. The company saw improvement in its steel business, was able to place equity shares indicating demand for steel companies and was also able to restructure debt. Steel companies under NCLT are seeing good bidding interest with Bhushan Steel and Uttam Galva seeing interest from all quarters.

The Credit Ratio, which is the number of upgrades to downgrades, is showing more upgrades than downgrades though in value terms, downgrades have been higher Table 1. Focus on bank NPA’s are trending at high double digit levels to advances has led to more stressed assets being put up for sale. As banks clean up their books, credit risk will be transferred largely to ARC’s and Private Equity players. This will lead to stress going out of balance sheets of lenders leading to a healthier banking system.

JSPL had faced challenging times post-August 2014, soon after deallocation of captive coal blocks, around which the company had established large steel and power plants. An additional levy of Rs. 33 billion imposed along with the captive coal block de-allocation order of the Supreme Court of India had a significant impact on JSPL. Soon after, the rampant dumping of steel by China and few other countries had a huge impact on all steel players in the country.

Winds of Change

If a large part of capital is stuck and yielding nothing, it is bound to have a negative impact on financials. In FY17, on a consolidated basis, JSPL incurred an interest cost of Rs 33.89 billion. This, however, is now correcting. The Angul expansion is now operational and expected to reach its rated capacity of 3.5-4 million tonnes in the coming year. This will ease financial burden considerably. As the project starts to generate more and more cash, it will ease interest cost pressure leading to higher profitability.

The outlook for Steel remains positive as both demand & prices remain robust, internationally & domestically. As global economic situation strengthens, investment levels are set to rise across geographies, supported by the shutdowns & curtailments in China on back of environmental norms, which should provide support to the Steel demand in the long run. Trade-related barriers could lead to some weakening of the overall sentiment though lack of capacity as compared to existing demand in developed economies could make it largely unsustainable and uneconomical in the long run. With the steel intensity increasing within the country, coupled with government’s push towards more steel structures, buildings and infrastructure, the demand in the country is set to rise further, albeit gradually.

Power Business of JSPL comprises 3400 MW of operational power plants. Power plants are operating at a very low PLF (plant load factor) of 31% as a result of a lack of power purchase agreements (PPA). However, winds of change are blowing here as well. The company has sold 1,000 MW plant to JSW Energy, which will fetch close to Rs 45 billion. For the remaining plants, losses are being controlled with more and more fuel being procured domestically from Coal India as against imported coal, On an annual basis, JPL revenues increased by 31% and EBITDA rose by 37% for the year FY18. The EBITDA cialis margin for FY18 stood at 35% compared to 34% for FY17. JPL also achieved a net cash profit of Rs 7.78 Billion.

Power Demand and exchange rates are observed to be touching fresh highs in the current Financial Year. With the Govt. of India stated policy of providing ‘Power for All on a 24×7 basis’, the demand is expected to increase substantially. This is likely to result in a fresh upsurge in long Term PPAs by Utilities who will be obliged to fulfil this commitment of the Government on a sustained basis. In the near term too, demand for power is expected to get a boost on account of forthcoming State and 5 Central elections over the coming two years. However, coal continues to remain a major challenge, both in terms of availability and the consequential impact on prices, which are observed to be rising over the past 6 months. This key challenge to be mitigated significantly with the introduction of Commercial Mining as proposed by Govt. of India, wherein coal mining shall once again be opened up for the private sector.

As of March 2018 company is still loss-making, however, JSPL loss has reduced over the year, in 2016 JSPL posted a loss of Rs 30.87 billion, in 2017 JSPL posted a loss of Rs 25.38 billion and in 2018 JSPL posted a loss of Rs 16.16 billion.

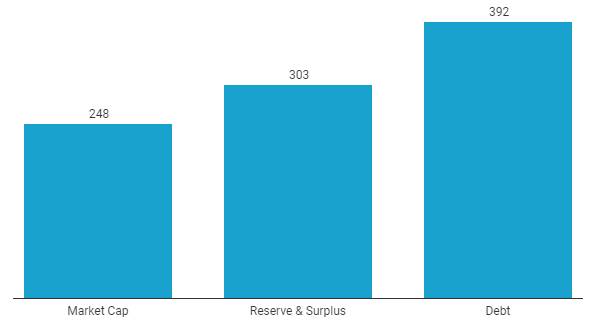

JSPL Financial Data

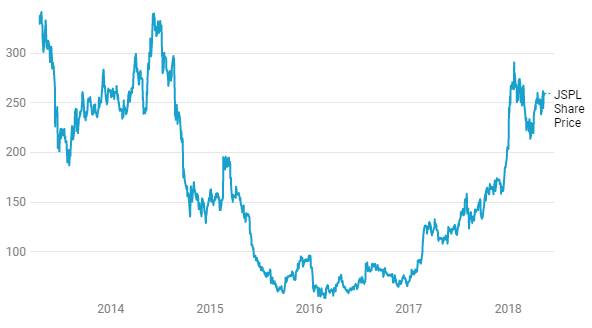

JSPL Share Price