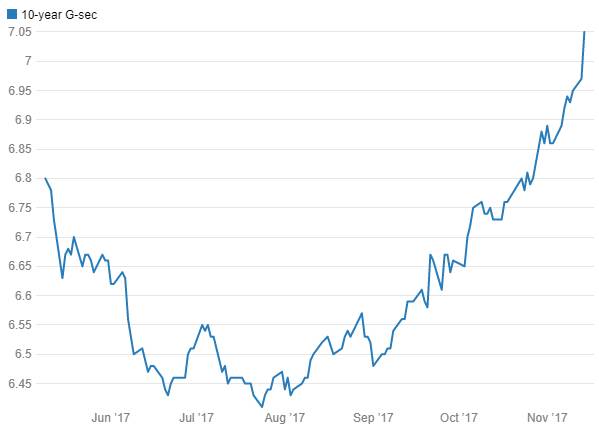

10 year benchmark gsec, the 6.79% 2027 gsec saw yields rise by 7 bps today and crossed 7% levels to trade at levels of 7.05%. Such levels were last seen in September 2016. 10 year gsec yield is up by almost 70 bps from lows seen in June 2017.

Bond market sentiments turned weak post October 2017 RBI policy review where the MPC (Monetary Policy Committee) sounded hawkish on inflation. Since then, news has largely been negative for the bond market leading to yields spiking up.

The 5 primary reasons for the 10 year gsec yield to shoot up over 7% are listed here.

India 10 Year G-sec Benchmark Bond Yield

1.Higher inflation

CPI inflation for October 2017 was at 3.58% and has been rising continuously for the last six months. Core CPI inflation at 4.6% levels has risen from below 4% levels and is at the uppder end of the RBI forecast range of 4.2% to 4.6% for this half of the current fiscal year. Bond markets are taking out all rate cut expectations from bond yields leading to rise in bond yields.

CPI Inflation

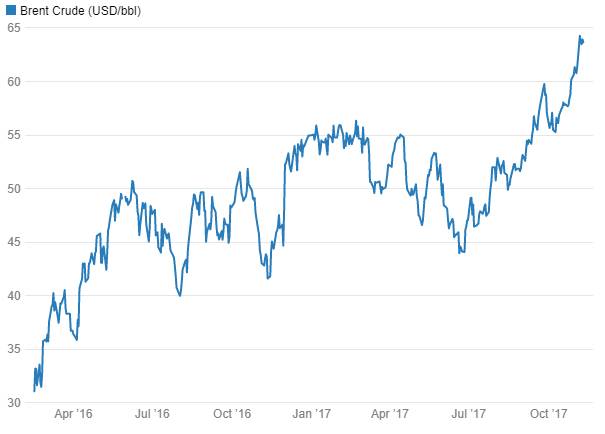

2.Rising crude oil prices

Oil prices closed just off 2 year highs on internal political issues in Saudi Arabia and expected improvement in demand amidst strong global economic data.In October 2017, brent crude crossed USD 60/bbl and is trading at around USD 64/bbl. Oil prices are up over 100% from lows over the last one year and have risen by over 10% in the last couple of months. India has hiked fuel prices on the back of rising crude oil prices leading to rise in inflation expectations, which is hurting bond yields.

Brent Crude (USD/bbl)

3.US Fed rate hike expectations

The new Fed Chair Jerome Powell, who will replace Janet Yellen, is expected to continue rate hikes at a slow and steady pace. Fed in its last meeting reaffirmed the strength of the US economy and labour markets and signaled a steady pace of rate hikes. The next rate hike will be in December 2017 and there would be a minimum of three rate hikes in 2018. US GDP grew 3% in the second quarter of 2017 against expectations of 2.5%. Job additions for October 2017 was a solid 261,000 jobs though below expectations of 310,000 job additions. Job numbers for August and September were revised upwards while unemployment rate ticked down to 4.1% from 4.2%.

US tax cuts is expected to spur economic growth, which will lead inflation higher. Equity indices are at record highs indicating strong growth prospects. Fed rate hike expectations tend to hurt bond market sentiments as RBI will be hesitant to ease policy on worries of financial market volatility due to capital outflows.

The INR has fallen to levels of Rs 65.30 to the USD, down by around 1% over the last one month and down by 3.5% from highs seen during the last one year. Fed rate hike expectations have increased risk aversion leading to FII’s selling debt this month to date.

4.Bond supply fears

The Rs 2.11 trillion bank recapitalisation plan and the Rs 6.92 trillion road construction plan entails huge supply of bonds. Supply whether direct or indirect will hit bond yields as both these plans lead to higher economic activity that could exert higher inflation expectations down the line filtering to rising bond yields. If the recapitalization bonds are given SLR status, banks will not have any appetite for incremental buying in government bonds and this could hurt demand supply equations in the bond market. Banks holding of government bonds at around 31% of NDTL is well over SLR limits of 19.5%.

5.FRBM targets

The government had projected a fiscal deficit of 3.2% of GDP for fiscal year 2017-18 from a fiscal deficit of 3.5% of GDP for fiscal year 2016-17.The budget for fiscal 2018-19 is just a few months away and with bank recapitalization, spending for roads and need for pump priming the economy, the government may not stick to its FRBM targets. Higher borrowing for next year too will hurt market sentiments.

Given that markets are facing supply, Fed rate hikes, budget and incoming inflation data that may not be positive, 10 year government bond yields may struggle to see any positive movements in prices, even at yields above 7% levels. Traders should play from the short side rather than the long side.