Demonetisation has caused the Liquidity math of RBI to go awry. RBI’s policy stance is to keep liquidity in a neutral territory. To that extent the central bank has been buying bonds through OMO’s and selectively intervening in the fx market to add primary liquidity in the system as Liquidity was seen as being in deficit.

Demonetisation of Rs 500 and Rs 1000 notes, which forms over Rs 14 trillion of the Rs 17.5 trillion in currency in circulation, on the 8th of September has completely turned around the liquidity position in the system. System liquidity has turned around from a deficit of Rs 332 billion to a surplus of Rs 2090 billion as of 17th September.

Banks have seen a surge in deposits as people deposit demonetised notes in exchange for legal tender. Given that there is a limit on withdrawal, the system will stay in high surplus liquidity till withdrawal limits are eased and cash returns to the economy for normal requirements. Hence the banking system liquidity is temporary and RBI will have to use reverse repos to take this liquidity out of the system until it gets back to normal.

RBI will not take any measures on SLR and CRR to suck out liquidity as it is seen as temporary in nature.

Banks have to maintain 20.75% of deposits as SLR and with the sharp rise in deposits, banks would need to buy government bonds and SDL to keep SLR at regulatory levels. However banks have excess SLR of around 29% as against regulatory limits of 20.75%, which works out to around Rs 8 trillion and banks do not really require to buy gsecs or SDL to maintain SLR.

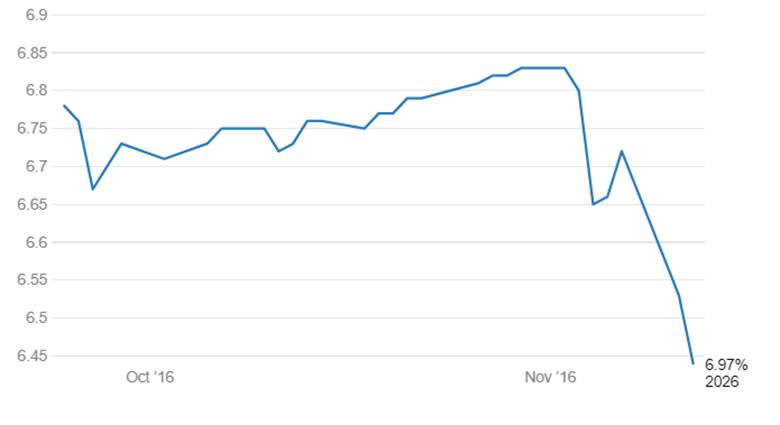

Banks would buy gsecs to park excess liquidity as Reverse Repo rate is 5.75% and treasury bill yields are below 6% while ten year gsec yield is 6.45%. Expectations of rate cut by the RBI due to inflation and growth seen as coming off on demonetisation will increase attractiveness of bonds. Gsec yields can come off further after having fallen 40bps post demonetisation.

6.97% 2026 G-sec yield movement