Small cap and Mid-cap stocks have reached record highs due to strong liquidity flowing in the market & expectation of improvement in earnings especially after the implementation of GST. (Chart 1,2). Falling credit spreads will improve valuations for small and mid cap stocks as growth improves on debt funded business expansion, which in turn will lead to higher equity valuations, which again will lead to more appetite for the market to lend to such companies as balance sheet ratios improve.

BSE Small Cap, BSE Midcap Index Movement

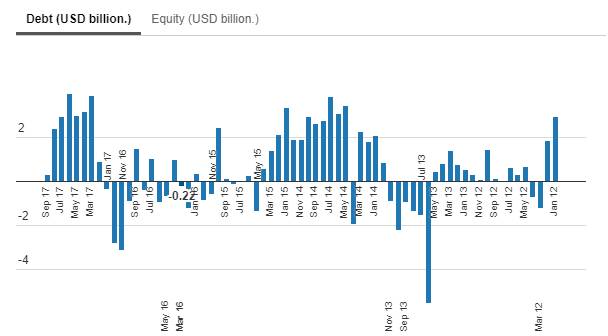

FII Investment in Debt & Equity (USD Billion)

In the market, there is famous saying “raise money when it is available not when you need the money”. This can be seen in the current environment, where more and more companies are choosing IPO route or Bond issuance to raise money, whether they need it or not.

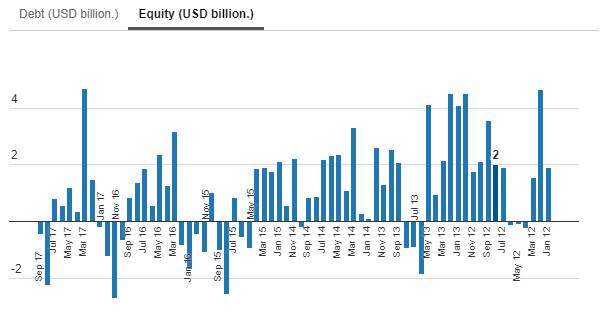

As of September 2017, 21 companies have raised Rs. 215.56 billion through IPO route. Bond issuance also increased multi-fold with 266 companies mopping up Rs. 2300 billion in April- July 2017 period. Commercial Paper outstanding is at Rs. 3595 Billion as of 15th August 2017, rising multifold over the past few years.

Total CP Amount Outstanding (Rs billion)

Factors which are helping corporates to raise money from the market.

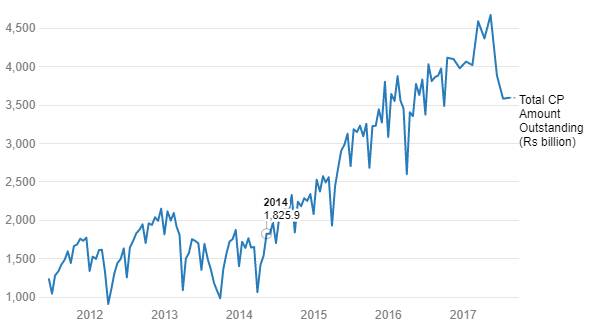

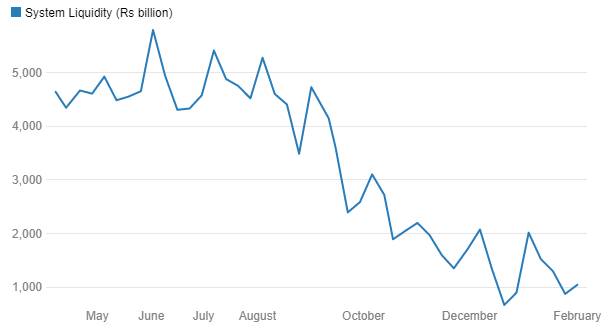

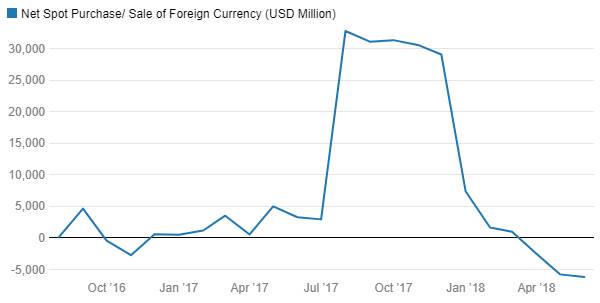

Liquidity- Since demonetization system liquidity has increased sharply. Demonetization has added around Rs 2 trillion of liquidity into the system as seen by the drop in currency in circulation from levels of Rs 17.4 trillion to Rs 15.4 trillion over the last one year. Other factors which are adding to system liquidity (Chart 4) is government spending and RBI fx purchases(RBI has been buying USD to limit the fast appreciation of the INR) (Chart 5,6,7)

Government is front loading its spending for this fiscal year and has been issuing CMB (Cash Management Bills) for Rs 1300 billion to lower its overdraft with the RBI. RBI has bought USD 11.8 billion in spot adding Rs 778 billion in the April-July 2017 period and has a forward purchase outstanding of USD 26 billion, which potentially can add Rs 1600 billion of liquidity into the system.

Surplus System Liquidity (Rs billion)

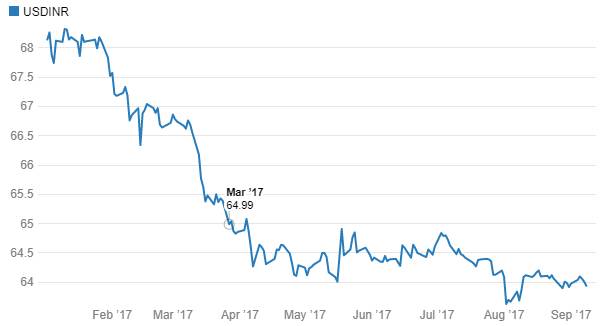

USD-INR

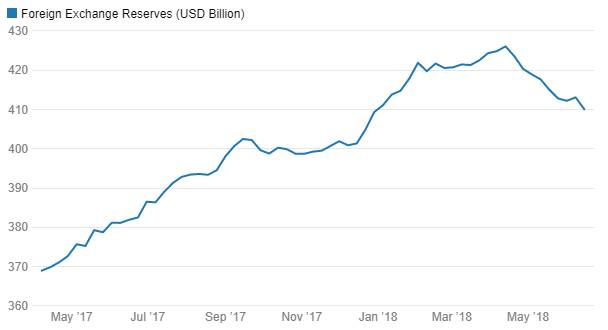

Foreign Exchange Reserves (USD Billion) - India

Net Spot Purchase/ Sale of Foreign Currency (USD Million)

Low-Interest rate environment

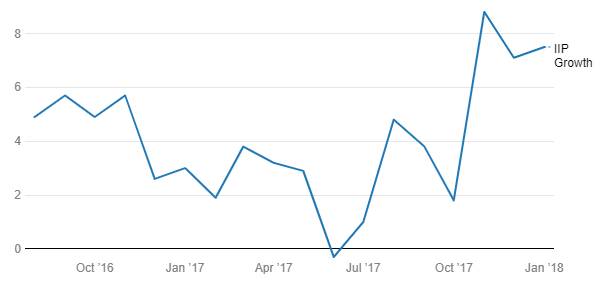

Due to demonetization and implementation of GST, inflation is trending lower in India (Recently released CPI data suggest consumer price inflation accelerated for second consecutive month, CPI rose to 3.36% in August 2017 from 2.36% in July 2017. Inflation rose to 5 months high, inflation still remains in RBI range of 2%-3.5%.) (Chart 8). Industrial production growth is sluggish (IIP marginally rose by 1.2% in July 2017 after seeing a contraction of 0.2% in June 2017) Chart 9. Lack of private sector investments, agricultural sector distress leading to farm loan waivers and stressed assets of banks are all contributing to lack of strong pickup in economic activity. All these data points toward more monetary easing by RBI.

In global economies, inflation remains well below central bank inflation targets and going forward it is expected that inflation will remain subdued as oil prices have stabilized and underlying global dynamics will push prices in lower direction as there appears to be more worldwide capacity for major commodities like steel and aluminium than there is demand.

CPI Inflation(Y-O-Y in %)

IIP Growth %

Falling Credit Spreads

Given abundant amount of liquidity in the system and due to increased FIIs & MFs exposure to corporate debt, credit spreads are falling (Chart 10). FIIs hold around Rs 2305 billion worth of Corporate debt while MFs exposure to corporate debt is Rs. 4605 billion

Going forward with RBI lowering the Repo Rate and maintaining neutral stance is highly positive for credit spreads. High system liquidity and prolonged low rates will see the market search for yields leading to credit spreads coming off.

Lower credit spreads will help equity market valuation to improve

More and more companies are choosing the bond market to raise money, where rates have fallen significantly over the past one year. Increase in the number of bond & CP issuance is a direct consequence of fall in interest rates, excessive liquidity, market search for higher yields and banks tightening lending norms due to rising incidence of bad loans and wilful defaulters.

Lower cost of borrowings helps corporates to keep down working capital costs leading to healthier earnings. Low-interest borrowing can fund business growth and increase profitability as businesses can expand for growth