China bond connect program could create outflows from emerging markets or prevent fresh inflows of foreign investments to emerging markets, as FIIs ramp up exposure to China debt. China, given its size, can absorb large flows into its debt market and with PBoC working towards deleveraging the financial system, China debt could become extremely attractive for FIIs.

China Bond Connect

China equity is included in leading emerging market indices(MSCI Emerging market index and ACWI Index). China is now planning to get into Bond indices. China has launched a bond connect program, which will provide foreign investors entry into the China bond market. Bond connect program allows foreign investors to invest in China’s 9 trillion-dollar bond market without having an onshore account. As per PboC, access to the market will be restricted to qualified investors such as central banks, sovereign wealth funds, commercial banks, insurers, brokerage firms and investment funds.

Why is China Launching the Bond Connect Program?

As per Bloomberg Estimates, Foreign investors hold just 1.5% of Chinese debt, which is much lower than the average 20%-30% that foreign investors holds in other emerging markets.

China is trying to reduce its risk from bank balance sheet with the bond connect program, as Chinese banks hold the maximum amount of China’s debt.

The bond connect program will help develop a robust credit ratings industry, which will create a good investable environment for FIIs to invest in China.

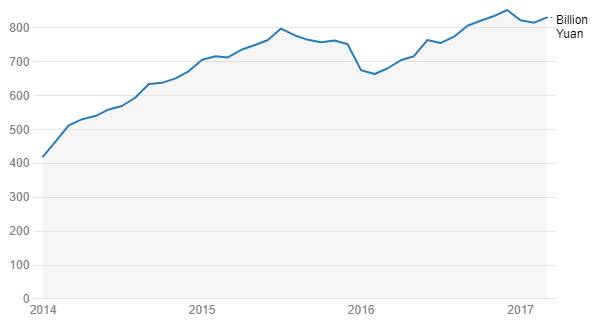

In February 2016, China opened its interbank bond market to overseas investors but it was not successful as foreign investors had to deal with Mainland China trade settlement process, which is a tedious process. (Chart 1)

Foreign holdings of Chinese Onshore Notes

Impact of Bond Connect on PBoC

As per a report by Federal Reserve Bank of New York, China bond yields are more sensitive to change in manufacturing, producer price and production data. PBoC also focuses on controlling the currency as financial conditions in China is largely determined by the value of the Yuan. Going forward, when foreign investors become part of Chinese debt, PBOC would then have to convey a clear message on where it stands on inflation, employment and growth, which would determine yields on Chinese governments bonds and the value of the Yuan.