Power Finance Corporation (PFC) bonds rated AAA by all rating agencies are widely held by institutions, corporates and individuals. Institutions such as Mutual Funds, Insurance Companies, Provident Funds and Trusts are large holders of PFC taxable bonds. Corporates and individuals hold PFC tax free bonds. FII’s hold PFC bonds, both INR and foreign currency denominated bonds.

The AAA rating of PFC bonds has come under a cloud post the large provisions shown by the government owned lender in the 4th quarter of FY 2017. Gross and Net NPA’s have shot up substantially leaving the company under loss.

A downgrade by rating agencies from AAA to either negative outlook or AA+ could pressure yields on PFC bonds, impacting spreads. However, two factors work in favour of PFC, one is the government’s commitment to the lender to safeguard the interests of bond holders and two is the restructuring of SEB debt through issue of UDAY Bonds.

The market may be wary of a rating downgrade but spreads of PFC bonds may not rise by much as it will continue to be a favoured issuer. However in the near term, till government and rating agencies come out with a statement, markets will be nervous on PFC bonds and this could keep spreads at higher levels.

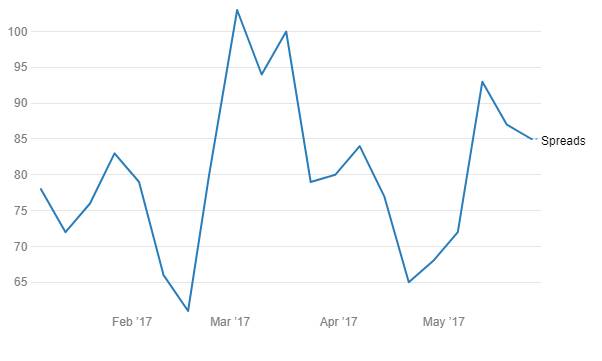

The spread between 10 year PFC bond yield and 10 year gsec yield (Chart 1), has marginally risen by 8 bps from January 2017 to May 2017. Spreads have not risen on credit concerns but could rise if market demand for PFC bonds fall.

Spreads between PFC 10 year & India 10 year yields

PFC Financial Results

PFC reported standalone net losses of Rs 3409.49 Crores for Q4 FY16-17, mainly due to lower interest income and increase in provisions. Provisions for Q4 FY16-17 rose by 8 times on yearly basis. For whole year provision rose by 3 times.

Gross NPA of total loan asset stood at 12% in FY-17, In FY-16 it was 3.15% and due to higher provisioning PFC reported loss for Q4 FY16-17. As per the management, Thermal power plants constitute largest portion of NPAs. Most of the thermal plants, which are part of the NPA’s are state owned. Under the credit concentration norms, the company has classified standard assets amounting to Rs 35994.70 crore as restructured standard assets.

PFC total asset value is Rs 2.5 lakh crores. PFC along with REC is the largest lender to state electricity boards. PFC has total loan exposure of Rs 2.4 lakh crores and it is estimated that PFC and REC has total loan exposure of Rs 4 lakh crores to the state electricity boards. The new Ujwal DISCOM assurance yojana (UDAY) aims to restructure this debt, it also restricts future borrowings by the states from these lenders and banks till their respective discoms turn around financials and operations.