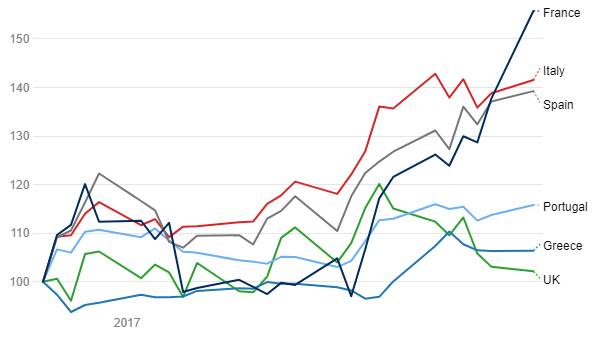

Political risk rather than economic risk is a big worry for Eurozone as seen by rising spreads between bond yields of countries facing elections. Brexit and Trump victory have given a thrust on populism and this does not bode well for both markets and economies.

Yields of benchmark 10 year bonds across the Eurozone have risen sharply and has widened the spreads between Germany 10 year bunds and other Eurozone 10 year benchmark bonds. The sharp upward movement in yields and spreads came after the release of German inflation data last week. The data showed that German inflation hit a four-year high level in the month of January and is at 1.9% followed by 1.7% in December last year. France inflation came in at 1.6% and Spain inflation came in at 3% in January, heightening the concerns on unwinding of the ECB’s monetary stimulus program. Further, the fact that Germany’s election race is narrowing which could signal fiscal stimulus in the bloc’s biggest economy, weighed on bond yields.

French government bond yields hit 16-month highs, facing additional upward pressure from uncertainty surrounding upcoming presidential elections, a key political risk event for Europe this year. The chance of one of the two established French political parties regaining power in May’s vote was seen to have diminished after they failed to make a good showing in pre-election polls. The Socialists picked a hard-left candidate and Conservative leader Francois Fillon battled to contain a scandal over fake pay.

Greece’s bond yield rose sharply by 30 bps over the last few weeks and is trading at 7.13%, largely on worries about whether the International Monetary Fund will participate in a bailout program for the country.

Portugal 10-year benchmark bond yields is at 3.693% and the spread with respect to Germany bunds is at 382 bps. Italy 10-year benchmark bond yields is at 1.748% and the spread with respect to Germany bunds is at 191 bps. Greece 10-year benchmark bond yield is at 7.13% and the spread with respect to Germany bunds is at 761 bps and Spain 10-year benchmark bond yield is at 1.338% and the spread with respect to Germany bunds is at 131 bps.

The rise in Germany bund yields has also widened the spread between the U.K 10 year benchmark bond and German 10 Year bund and is at 95 bps. The economic data of U.K. economy this month was disappointing with manufacturing, service and construction activity slowing and consumer credit dropping. Pound was also hit after the Bank of England kept rates on hold at 0.25% and raised its forecasts for growth and inflation.

Eurozone, Germany 10 Year Bond Yields Spread Movement

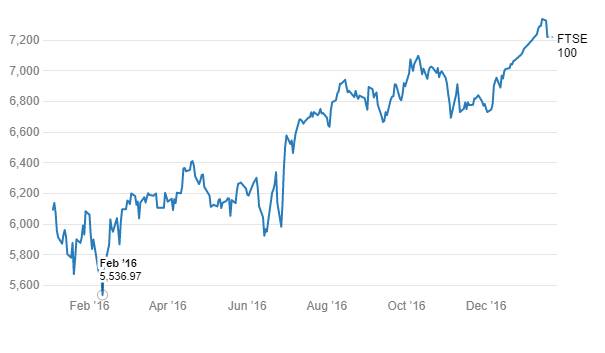

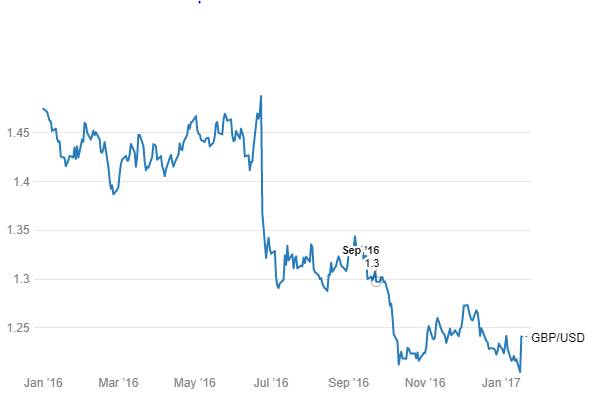

Brexit, which was supposed to cause turmoil in the UK economy, has surprising led to the FTSE 100 UK equity index reaching record highs. The British Pound has been the biggest loser while the UK gilt yield spread with German bunds has risen, and this leads to the question whether a falling currency and leaving the EU on the back of popular demand is actually positive for the UK economy. UK 10 years gilt yield has risen largely on the back of a sharp rise in US 10 years treasury yield that rose 60bps post Trump victory.

Brexit is still a couple of years away as implementation takes time and it will take a while to understand the economic implications of leaving the EU but until then positive market movements suggest economic gains rather than economic losses.

Netherlands and France are going in for general elections this year and there are murmurs of the referendum if right wing candidates win. At this point of time, markets seem pretty unperturbed as Euro is trading at close to record lows against the USD even as European equities and bonds have rallied. Markets could turn volatile prior to elections but will then regain poise as the Eurozone economy is showing good signs of improvement. Read our analysis – The Tide is Turning for the Eurozone Economy.

Brexit – Hard Landing

After 23rd June referendum where Britain chose to be no longer part of EU, the focus has now shifted to when Britain will complete all the necessary formalities and legalities when will it be able to move out of the European Union and will it be Hard Brexit or Soft Brexit.

Hard Brexit means Britain will give up its EU Membership and in return will gain full control over its budget, law making and most importantly Immigration. Soft Brexit means Britain will be no longer be a member of EU and it would not have a seat in EU but it will have access to the EU single market, Goods and services would be traded with the remaining EU states on a tariff-free basis. In return, Britain will have to make payments to the EU budget. Norway and Iceland are not the members of EU but have access to EU single market through the European Economic Area.

UK Prime Minister Theresa May in her speech on 17th Jan 2017 confirmed UK will leave European single market, which means UK is heading for Hard Brexit.

UK 10 year Gilt, FTSE and GBP Movements Pre & Post Brexit

UK, Germany 10 Year Bond Yields Movement

FTSE 100 Movement

GBP / USD Movement

What next Post Brexit – Nexit, Frexit?

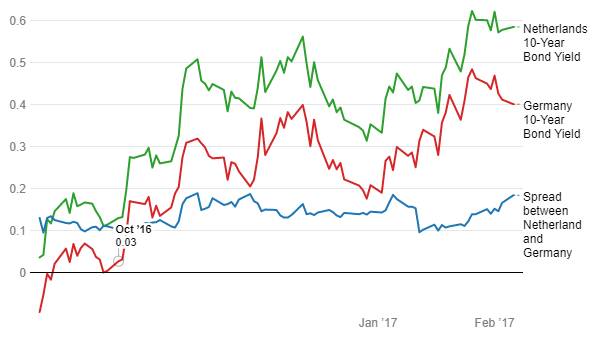

Nexit– Netherland Exit. After Brexit, Netherland Geert Wilders, leader of anti-Europe party, had said Netherland should hold a referendum on EU membership.

On 15th March 2017, Netherland is going for general election, recent survey point to strong gains for Geert Wilders, However, there is mixed sentiment among Dutch voters with just 52% in favour of holding a referendum

Netherlands bond yields have largely maintained the spread with German bund yields suggesting that markets are not perturbed by Nexit.

Netherland, Germany 10 Year Bond Yields Movements

The reason why Netherlands bond market is not panicking about Nexit is due to fact that Netherland is Triple A Rated, same as Germany, which will allow Netherland to borrow cheaply. Any worries about a Nexit that could raise Eurozone break-up risks may be more obvious in the selling off weaker countries bonds such as Italy and Portugal.

Frexit– Post financial crisis in 2008, France has been facing sluggish economic growth. France GDP growth has remained in a range of 0% to 0.5% since 2009. High level of unemployment at around 10% and continuous threats from terrorism is causing anxiety among the French. Brexit has pushed uncertainty in the minds of the French and almost 61% of French population do not want to be the part of EU.

France is going in for general elections in April 2017 and Le Pen (French presidential candidate) has said if she wins the election she will hold a referendum to decide the country’s membership of the group within six months. However, latest polls suggest Mr Fillion will win the first round of voting with 32% against 22% for Ms Le Pen. But polls can’t be trusted because polls were not expecting Brexit and Trump win.

What France 10 year Bond Yields suggest?

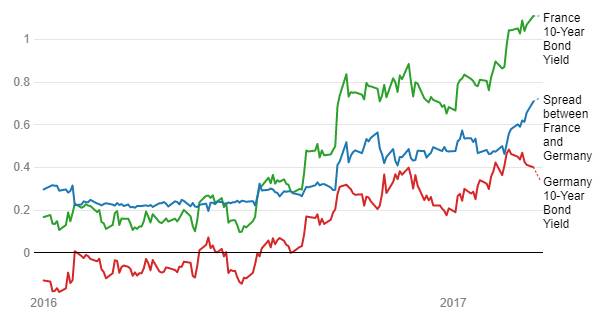

France, Germany 10 Year Bond Yields Movement

The spread between German and French 10 year bond yields have risen sharply suggesting political risk in yields.