Central banks have taken the leverage from the government and the private sector globally. The reversal of this trend where Central Banks stop taking leverage while government and private sectors starts to take leverage can lead to a strong equity rally, which could build into a bubble over a period of few years. Central bank leverage has gone into a bond bubble, which is likely to end as the equity bubble starts to take over.

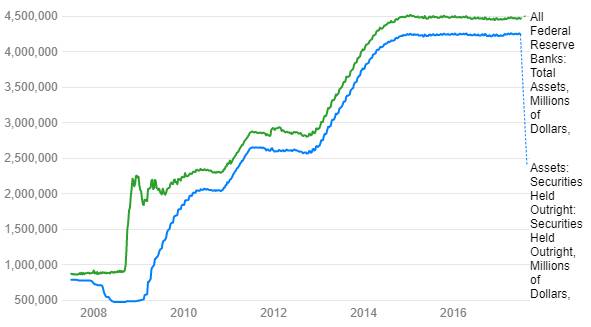

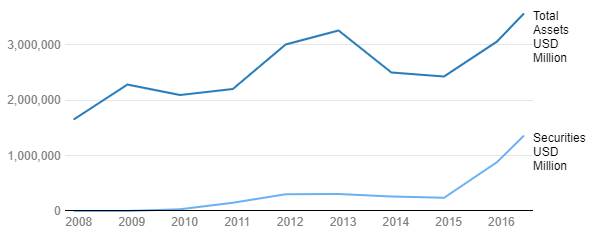

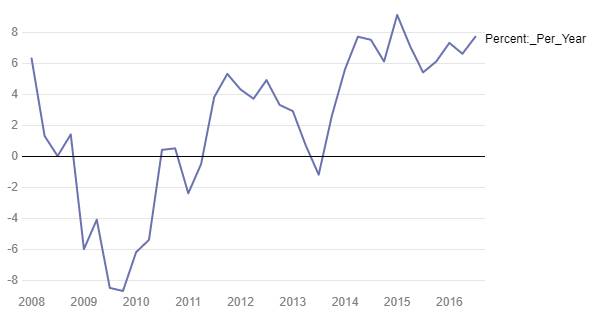

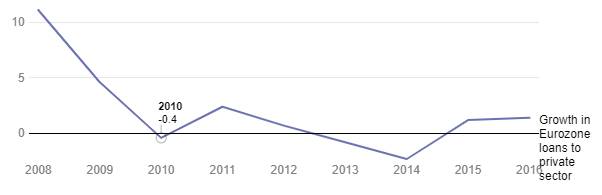

The following charts show how central banks have leveraged their balance sheets while government and private sector have deleveraged their balance sheets over the last few years.

Fed Balance Sheet Assets

ECB Balance Sheet Asset (USD Billion)

US Bank credit Growth

Euro zone Loans to private sector

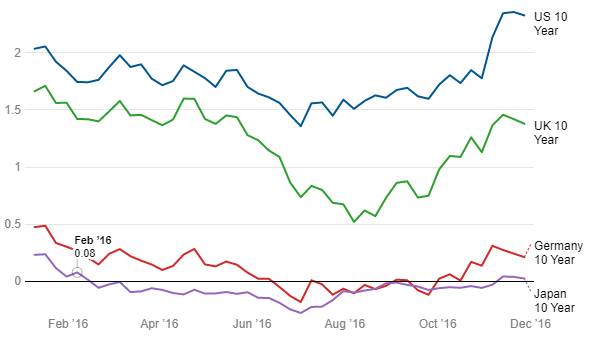

The post-crisis period has been marked by deflationary pressures and demand for bonds has risen significantly. Bond yields of developed countries fell to record lows and in Japan and Germany, yields were in negative territory(Chart 6). The record low levels of yields have created a bond bubble and this bubble could burst if US President Elect Donald Trump sets a precedent by inflating the US budget deficit to improve US economic growth. The US, however, is witnessing a tight labour market, where unemployment levels, at 4.9% as of October 2016, are at close to long term averages and if the government starts to spend, inflation could rise substantially on upward wage pressure.

US, UK, Germany, Japan 10 year Yields Movement

Global Bond Bubble

The bond bubble environment, which existed pre-U.S. Election traces its origin to the 2008 financial crisis. After a wave of taxpayer-funded bailouts, governments lost any willingness to stimulate their economies through fiscal measures. However, central banks had to restore consumer confidence that had dropped off the cliff and slashed interest rates and commenced bond buying programs from freshly printed money, also known as QE or Quantitative Easing.

At the same time, deepening trade links among the world’s economies depressed prices, as did technological developments and a tendency to save among an ageing population.

Bank of America Merrill Lynch, in a research report, said that quantitative failure had set in with the unprecedented measure of charging lender and paying borrower when interest rates went into negative territory. Negative rates have forced investors to pile into cash while forced bond-buying by central banks has resulted in a “buy what central banks buy” mentality, driving bond prices even higher and yields even lower.

The beneficiaries of low-interest rates were rich individuals and companies who borrowed at low rates and according to BoAML, Record low bond yields have signalled the peak of deflationary policy, leading to a shift from globalisation to protectionism and democrat to republican.

TIPS, Treasury and Commodity

The Republican’s victory has seen a spike in inflows to Treasury Inflation Protected Securities (TIPS), the par value of which is linked to the Consumer Price Index (CPI).

Investors poured USD 1 billion into TIPS in the week ended Nov. 9, the second-biggest inflows since records began in October 2002, data from Thomson Reuters’ Lipper service

These inflows are a sign of rising or spiking inflation expectations since Trump’s protectionism is expected to lead to higher import prices and his fiscal stimulus is expected to heat up the economy.

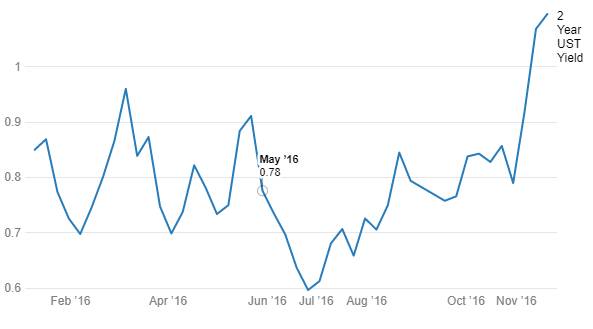

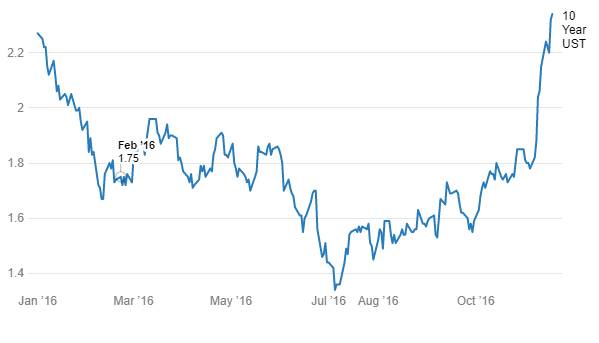

The bond bubble appears to have been punctured as well. Yields on 10-year Treasuries (Chart 9) rose 44 basis points post-election to 2.29%. Meanwhile, 2-year Treasury yields rose less quickly, leading to a steeper yield curve (which can, in turn, be interpreted as a sign of rising inflation expectations).

2 Year UST Yield Movement

10 Year UST Movement

Rise in deficit spending makes government debt a riskier investment, even if the chances of default remain negligible. CFRB committee which is responsible for Fed budget estimated in September that Trump policy, which includes tax cuts and infrastructure and defence spending will decrease tax revenue while federal debt held by the public will rise to over 86% of gross domestic product (GDP), from 77%.

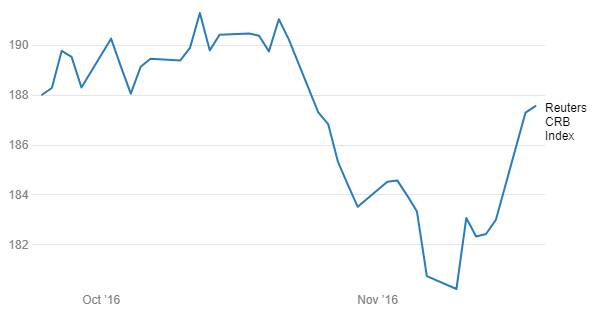

As the winds shift, commodities are already beginning to benefit, commodities appear to have bottomed out and have begun to recover. Trump’s victory appears to have accelerated the rally.

Reuters CRB Index