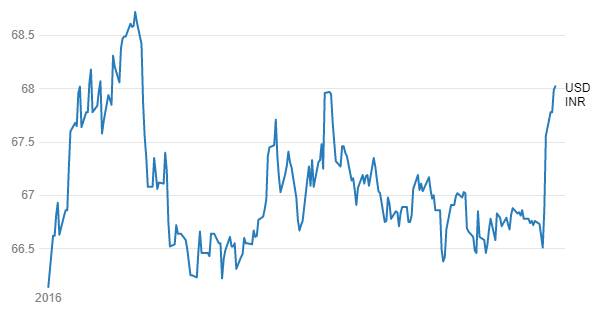

In the week ended 18th November, FIIs sold INRBONDS for USD 1.79 billion. FII’s offloaded G-secs for over USD 1.5 billion and around USD .3 billion of corporate bonds. However despite FII selling, government of India’s decision to demonetize Rs 500 and Rs 1000 notes helped gsec yields to come off. FII’s sold INR Bonds on the back of a global sell off in bond yields post Trump victory, which also led to the INR depreciating on broad USD strength. Ten year gsec yield has fallen by 50bps post demonetisation while ten year US treasury yields have risen 50bps post Trump victory. INR has fallen by close to 2.5% over the last two weeks. Going forward, we expect the sharp spike in global bond yields will not stop a rally in gsec yields as the demonetisation effect is stronger than global bond yield movements. Once global bond yields normalize and USD/INR levels stabilize, FIIs will increase exposure to INRBONDS.

USD INR Movement

FII debt utilisation status stood at 71.68% of total limits. Commercial Paper (CP) market trading volumes were 45.67% lower week on week and Certificate of Deposits (CD) volumes were 37.48% higher.

Corporate Bonds Traded Levels

Three-year AAA corporate bonds were trading at levels of 6.86% as of week ended 18th November. Spreads were 19 bps down week on week at 53 bps. Three-year AAA NBFC bonds were trading at levels of 7.53% with spreads 7 bps down at 120 bps levels. Three year AA+ NBFC bonds were trading at levels of 7.80% with spreads 7 bps down at 147 bps.

Five-year AAA corporate bonds were trading at levels of 6.96%. Spreads were 7 bps down at 51 bps. Five-year AAA NBFC bonds were trading at levels of 7.56% with spreads 4 bps down at 111 bps.

Ten-year AAA corporate bonds were trading at levels of 7.22% with spreads 9 bps up at 69 bps. Ten-year AAA NBFC bonds were trading at levels of 7.58% with spreads 10 bps up at 105 bps.

In the week ended 18th November, FIIs were net sellers of INR bonds for around Rs 125 billion for the week. Reported corporate bond traded volumes stood at Rs 256.72 billion with daily average volumes of Rs 64.18 billion. Volumes were 17.86% higher compared to the previous week.

CP traded volumes were at Rs 209.51 billion (45.67% lower than previous week) with daily average volumes of Rs 52.37 billion. CD volumes were at Rs 214.87 billion (37.48% higher than previous week) with daily average volumes of Rs 53.71 billion.

One month PSU bank CDs were trading at 6.15% levels. One-month residual maturity CDs were most active with volumes of Rs 91.12 billion. Three months and twelve months PSU bank CDs were trading at 6.25% and 6.55% levels each at spreads of 30 bps and 55 bps respectively against T-bill yields. Three months maturity Manufacturing and NBFC sector CPs were trading at 6.25% and 6.55% levels respectively.

One-year maturity Manufacturing and NBFC sector CPs were trading at 7.15% and 7.35% levels respectively.

As on 18th November debt utilisation status stood at 71.68% of total limit, 265 bps higher against previous week. FIIs investment position was at Rs 3381.85 billion in INR debt. FII investment position stands at Rs 1701.27 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 1680.58 billion in corporate bonds