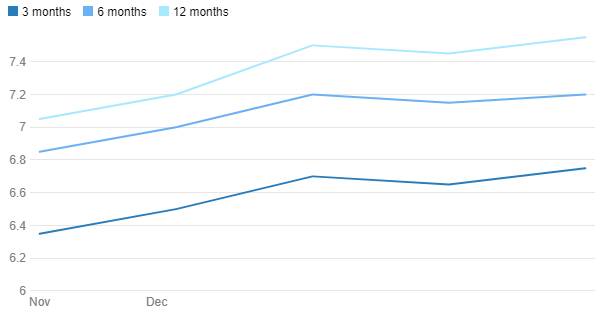

In November 2016, Commercial Papers (CP) 3 months, 6 months and 12 months maturity yields bottomed out at levels of 6.35%, 6.85% and 7.05% respectively as system liquidity surged on the back of demonetisation and hopes of rate cuts by the RBI in its December policy review. However, RBI kept rates unchanged leading to sharp rise in money market securities yields. CP 3 months, 6 months and 12 months maturity yields rose by 40 bps,35 bps and 50 bps to levels of 6.75%, 7.20%% and 7.55% respectively. CP yields are expected to trade range bound with a downward bias as system liquidity will be comfortable going forward.

Commercial Paper Yields (%)

FII debt utilisation status stood at 66.31% of total limits. Commercial Paper (CP) market trading volumes were 55.57% higher week on week and Certificate of Deposits (CD) volumes were lower by 5.11%

Corporate Bonds Traded Levels

Three-year AAA corporate bonds were trading at levels of 7.08% as of week ended 23rd December. Spreads were 3 bps up week on week at 67 bps. Three-year AAA NBFC bonds were trading at levels of 7.78% with spreads 3 bps up at 137 bps levels. Three year AA+ NBFC bonds were trading at levels of 8.15% with spreads 2 bps down at 174 bps.

Five-year AAA corporate bonds were trading at levels of 7.33%. Spreads were 1 bps up at 63 bps. Five-year AAA NBFC bonds were trading at levels of 7.83% with spreads 4 bps down at 113 bps.

Ten-year AAA corporate bonds were trading at levels of 7.43% with spreads 7 bps down at 78 bps. Ten-year AAA NBFC bonds were trading at levels of 7.86% with spreads 1 bps down at 121 bps.

In the week ended 23rd December, FIIs were net buyer of INR bonds for around Rs 1.94 billion for the week. Reported corporate bond traded volumes stood at Rs 164.97 billion with daily average volumes of Rs 32.99 billion. Volumes were 8.25% higher compared to the previous week.

CP traded volumes were at Rs 191.18 billion (55.57% higher than previous week) with daily average volumes of Rs 38.23 billion. CD volumes were at Rs 172.68 billion (5.11% higher than previous week) with daily average volumes of Rs 34.53 billion.

One month PSU bank CDs were trading at 6.35% levels. Three-month residual maturity CDs were most active with volumes of Rs 66.42 billion. Three months and twelve months PSU bank CDs were trading at 6.20% and 6.50% levels each at spreads of 0 bps and 20 bps respectively against T-bill yields. Three months maturity Manufacturing and NBFC sector CPs were trading at 6.32% and 6.75% levels respectively.

One-year maturity Manufacturing and NBFC sector CPs were trading at 7.28% and 7.55% levels respectively.

As on 23rd December, debt utilisation status stood at 66.31% of total limits, 4 bps higher against previous week. FII investment position was at Rs 3128.56 billion in INR debt. FII investment position stands at Rs 1516.82 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 1611.74 billion in corporate bonds.