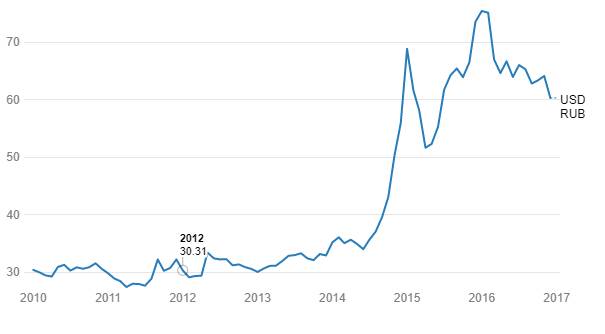

The year 2016 saw the least favoured currencies outperform. The Russian Rouble and Brazilian Real gained 21% and 17% against the USD respectively on the back of short covering from record lows as oil and commodity prices rebounded from lows.

The year 2017 could well favour the INR, that is down 2.5% against the USD in 2016. The INR touched all time lows in 2016 as the USD strengthened considerably against majors post Trump victory in November 2016.

The internal strength of the INR has never been better. Inflation is down, CAD is low and fiscal deficit is well under control. INR has held relatively firm as the USD strengthened against Euro and Yen largely on the back of strong macros.

Going into 2017, outlook for the Indian economy looks good despite expected short term fall in economic growth due to the effects of demonetisation. Government spending will push up economic growth even as inflation expectations are controlled and CAD and fiscal deficit are kept down. The INR will benefit from the improvement in economic growth as capital flows rise.

Introduction

The year 2016 has been a year of surprises for the global financial markets, many of them coming from the political arena rather than from the economic arena. On 23rd June, U.K. in a referendum voted to leave the European Union (Brexit) that caused the collapse of the GBP, the impeachment vote against former President Rousseff in Brazil in August added volatility to the Real, the overwhelming victory of Prime Minister Shinzo Abe in Japan’s Upper House Elections in July weakened the Yen and the attempted coup d’état in Turkey which drove down the Lira. U.S. in its presidential election voted in favour of Republican candidate Donald Trump, which came as the biggest surprise for the financial market in 2016 and led to an upsurge in the USD.

The Fed has raised rates twice by 25bps each in December 2015 and 2016 and is likely to raise rates by 75 bps to 100 bps in 2017. Prospects of economic growth and inflation in the U.S. economy is looking brighter largely on the expectation that Trump’s tax cuts and spending plans will provide a fiscal boost to growth and will underpin higher inflation expectations, which may create a smooth path for the Fed to normalise its monetary policy.

The US economy has rebounded solidly following a weak first-half performance, with U.S. gross domestic product growing at an annual rate of 3.5% in the three months ended 30th September up from a previous estimate of 3.2% and above the expectations for a reading of 3.3%. Consumer spending and housing activity are leading the way, underpinned by a robust job market and rising income gains. Labour market conditions continue to tighten, with monthly employment gains averaging 180,000 through November and the unemployment rate at 9 year lows of 4.7%.

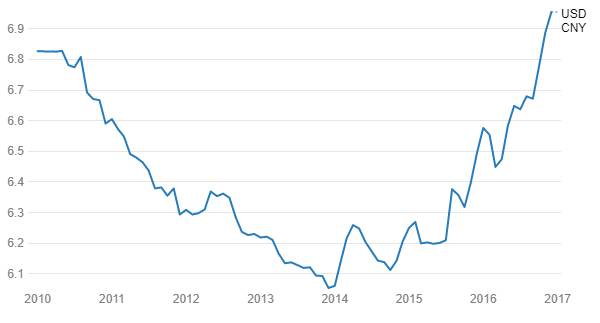

The USD gained sharply against majors including the Chinese Yuan, that saw weakness on worries of the health of the Chinese economy.

The year 2017 too looks like a strong USD year but given that the USD index is trading at close to record highs, gains would be muted. Markets will look elsewhere for currency bets in 2017, and INR would be a favoured currency.

Outlook for Major Currencies in 2017

USD

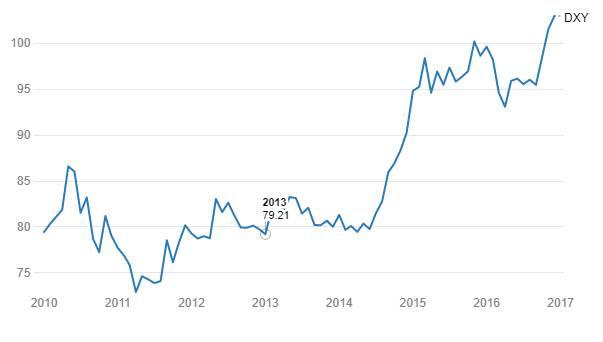

The USD in 2017 is expected to continue its bull run against major world currencies as financial markets are showing confidence in the ability of the Federal Reserve to upwardly adjust interest rate without disrupting the markets. USD gained in 2016 on expectations that the Donald Trump presidency will resort to fiscal stimulus in order to boost the growth in the U.S. economy, which could lead to higher inflation expectations. If Trump delivers growth, the USD could end the year stronger. However gains would be muted given that a lot of expectations are priced into the strength of the USD.

The USD has risen broadly against world major currencies since 8th November and is trading at its 14-year high level as market participants cheered a new US administration that was elected on a pro-growth ticket, which called for personal and corporate tax cuts and massive public sector infrastructure spending. Ignoring the risk of growth-challenging frictions, which may rise in the trade arena, markets have reacted to the electoral outcome as a growth positive event. USD gained on strong economic data and rising inflation expectations.

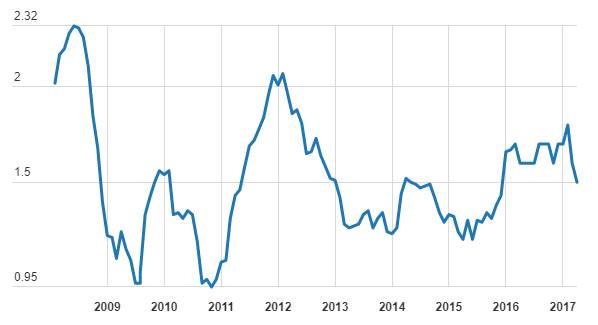

U.S. Core PCE (Excluding Food & Energy) Inflation Rate

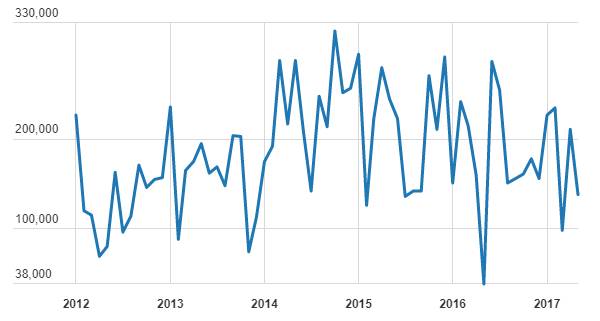

US - Monthly Job Data

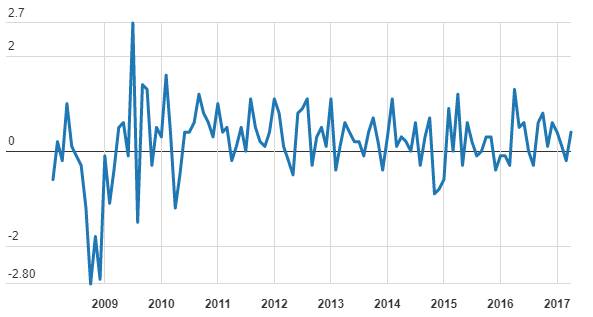

U.S. Retail Sales Growth (m-o-m)

USD Index (DXY)

Indian Rupee

The INR is down by 2.67% against the USD since 8th November 2016. The INR touched its new all-time low level of Rs 68.835 on 24th November 2016. The reason for the INR fall was largely due to the expected trade policies of the President-Elect Donal Trump, and Fed hiking interest rate by 25 bps in its December 2016 policy meet and giving guidance to hike rates 3 times in 2017. The sharp fall in the value of the Chinese Yuan too weighed on the INR.

A sustained strength in the USD could pull down the INR further in 2017 though the economy will withstand the fall easily given that its macros are good and the government has taken tough steps on tax evasion and is implementing the long awaited indirect tax reforms through GST.

USD/INR

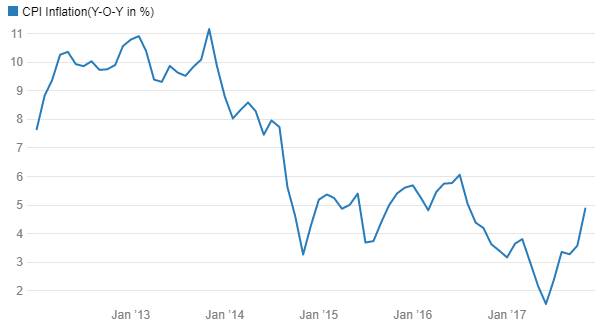

India’s fiscal deficit is pegged at 3.5% of GDP for fiscal 2016-17, down from 3.9% of GDP seen in fiscal 2015-16. Current account deficit is expected to be in the range of 1.5% to 2% of GDP, sharply down from levels of 4.7% of GDP seen in fiscal 2012-13. India inflation is unlikely to go down to 4% levels but will stay within the RBI 4% +/- 2% target range. Stable oil prices, improved supply as stalled projects take off will keep down inflation expectations. Demonetisation will keep down growth and inflation in the 3rd and 4th quarter of fiscal 2016-17 but the effect will wear off in fiscal 2017-18 as latent demand comes back into the economy. The INR will bounce back from lows as the Indian economy shows good growth with stable macros.

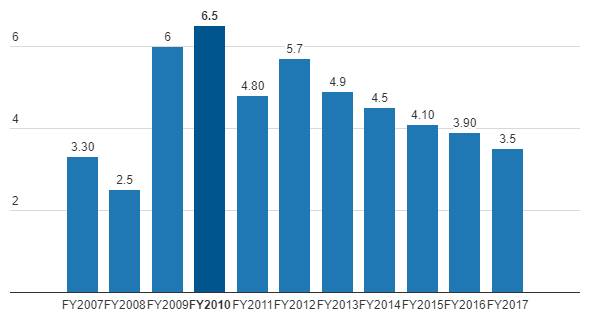

Fiscal deficit (% of GDP) India

CPI Inflation(Y-O-Y in %)

Euro

The euro (EUR) will largely be driven by growth and interest rate differentials in 2017. The Euro trading below parity against USD cannot be entirely ruled out. Further, the downside risks to the Eurozone outlook remain apparent, with growth struggling and inflation expectations showing little response to the policy steps already implemented. However, the Eurozone macros have definitely improved with CPI rising to multi year highs of 0.8% in November 2016 and unemployment rate falling to multi year lows.

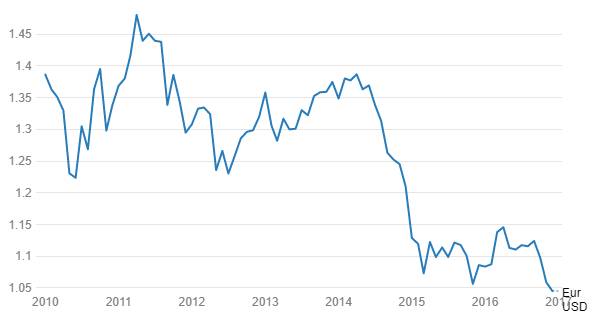

Euro in December 2016 is trading at its multi year low levels of Euro 1.047 against the USD post the Italian referendum that forced Prime Minister Matteo Renzi to resign. Euro has fallen by 3.6% against the USD in 2016 and by 21% over the last two and half years. The reason for the fall in the Euro is due to the fact that the Fed stopped QE in 2014 and started hiking rates in 2015 while the ECB increased the size of its QE and brought interest rates to negative territory.

ECB in its December 2016 policy meet has decided to taper the size of its bond purchase program from Euro 80 billion a month to Euro 60 billion starting April 2017. Further, the ECB is expected to gradually wind down its bond purchases program in 2017 and guide for higher rates in 2018 as it is becoming increasingly clear that the ECB cannot maintain its QE program at current levels indefinitely. Negative interest rates hurt if held for a long period of time. Euro too should bounce back from lows if ECB guides for QE halt and higher rates in 2018.

EUR/USD

GBP

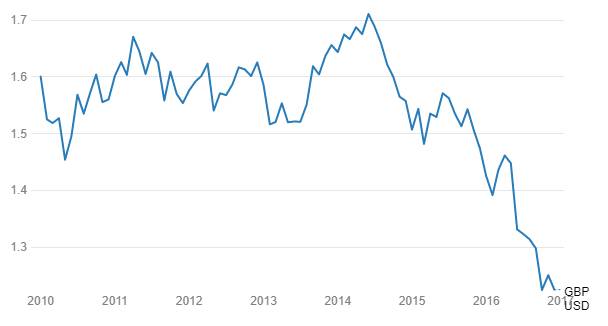

GBP in 2016 was the worst performing currency globally as it has depreciated by more than 16% against the USD largely over the uncertainty surrounding PM May’s ability to trigger Article 50 in early 2017 and on the expectations for further monetary stimulus by the Bank of England. GBP will continue to remain weak against the USD in 2017 as the uncertainty over the Brexit process and the expected triggering of Article 50 in the first quarter of 2017 is predicted to add uncertainty to investments in the UK.

Following the better-than-expected growth in the third quarter, and heightened expectations for inflation in 2017, the BoE has back tracked its interest rate guidance. Instead of hinting at a further cut, policymakers have taken a more neutral stance and this will help the GBP bounce back from lows.

GBP/USD

Japanese Yen

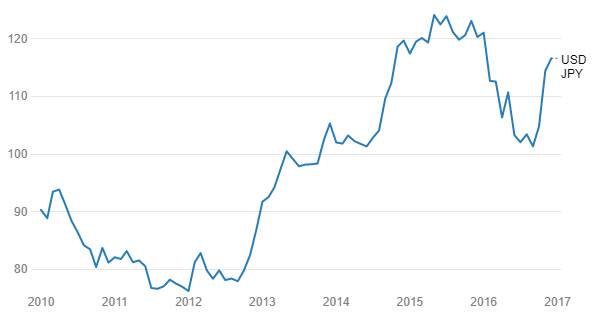

Japanese Yen has been on a sharp decline against the USD and has posted its fastest three-week fall since July 1995 after the USD started its rally against major world currencies on 8th November, post U.S. election results. Japanese Yen has depreciated by 9% against the USD since 8th November. The rise in carry appeal and divergent monetary policy are the primary reasons for the Yen weakness.

Bank of Japan (BOJ) will be the only Central Bank with QE in 2018 as inflation in Japan is way below the Central Bank’s target of 2%. On the other hand, Fed has already started raising rate while an uptrend in Eurozone inflation will provide ECB relief and could make the Central Bank withdraw QE in 2018. The JPY is likely to weaken against the USD and Euro on BOJ being the last Central Bank standing on QE.

USD/JPY

South Korean Won

South Korea and Japan are competitors in the international market as they compete in same product lines and weakness in Japanese Yen (JPY) will make South Korea’s exports uncompetitive, which will put downward pressure on the South Korean Won (KRW). South Korean Won (KRW) in 2016 has depreciated by 0.31%.

USD/KRW

Commodity driven currencies to stay stable in 2017

Currencies of commodity driven economies are expected to stay stable after rallying from lows in 2017. Commodity prices bottomed out in 2016 as markets factored in better growth prospects for the US post Trump victory in November. Eurozone too is witnessing economic recovery, albeit muted while China growth looks to have bottomed out at lower levels. China, which is the world’s largest consumer of commodities is still to recover from a growth slowdown seen in 2016.

Going into 2017, outlook for commodities is better than what it was in the past few years. Commodity prices have hardly recovered from peaks seen in 2007, which was the peak of a commodity price bubble, but after having fallen to extreme lows, prices can move up on better demand supply equation.

Currencies whose economies are closely tied to exporting commodities like Russian Ruble, Brazilian Real, Australian Dollar and New Zealand Dollar can stay stable as extreme negativity on commodities is taken out of the market.

USD/RUB

USD/BRL

Chinese Yuan

The Renminbi (Yuan) has fallen to multi year lows post Trump victory on 8th of November 2016. The fall in the Yuan was sparked off by expectations of Trump embarking on a trade standoff with China. China has also been devaluing the currency to improve its exports that has de-grown sharply and also to limit the capital flows coming in through interest rate arbitrage on the back of a seemingly strong currency.

USD/CNY

The election victory of Donald Trump in the US Presidential Elections has led to speculation on US trade policies as Trump’s stance on trade agreements is to renegotiate or even withdraw the agreements. The speculation on trade with the US is the primary reason for the fall in the Chinese Yuan as the US is its largest trade partner. The fall in the value of the Yuan is hurting other emerging market currencies as the belief is that the Yuan will be more export competitive than other currencies leading to a currency war where each country will want a weaker currency to compete with China’s exports.

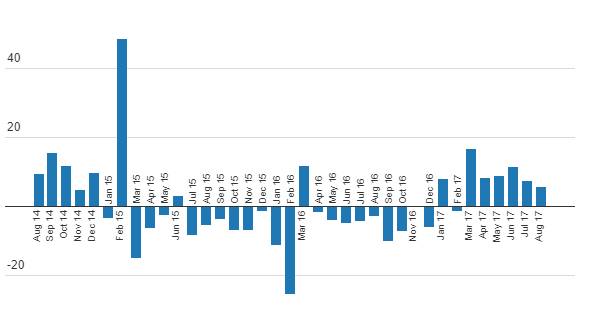

China Export Growth

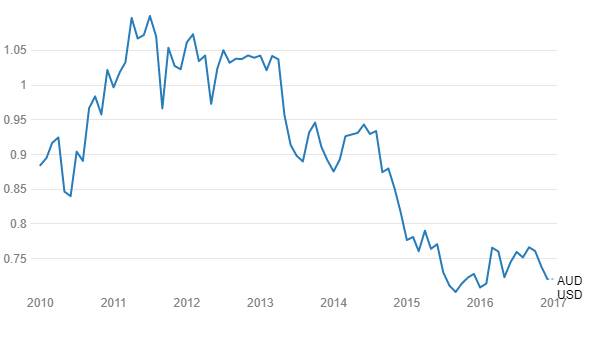

Australian Dollar

AUD dropped by 7% in the aftermath of the U.S. elections and in a world of increased protectionism, there could be a further weakness to come. The near-term outlook for AUD remains clouded as market participants consider the risks surrounding China, given the large trade links between the two countries. The threat of a slower Chinese economy if its export business softens, would have a big impact on demand for Australia’s raw materials and other exports.

AUD/USD