The year 2017 will continue to favour the INR that is up by 6.01% against the USD in 2017 so far. The INR touched all time lows in 2016 as the USD strengthened considerably against majors post Trump victory in November 2016.

The internal strength of the INR has never been better. Inflation is down, CAD is low and fiscal deficit is well under control. INR has appreciated against Euro and Yen largely on the back of strong macros.

The year 2017 so far has not favoured the USD as most of the major world currencies are up against the USD. Fed rate hike effects on the USD has been negated by political issues in the US. European currencies like Euro and British Pound have sharply appreciated by 6.92% and 3.91% against USD in 2017 so far. The strength in the European currencies is due to political uncertainty easing in the region after Emmanuel Macron’s victory in the French presidential elections. Centrist candidate Macron won the race to the French presidency, defeating anti-EU candidate by a landslide margin, garnering 66% of the French votes. The Euro spiked following Macron’s victory. British Pound has come under a cloud on hung parliament in the recent elections increasing uncertainty on Brexit negotiations.

Introduction

The year 2016 has been a year of surprises for the global financial markets, many of them came from the political arena rather than from the economic arena. U.K. in a referendum voted to leave the European Union (Brexit) that caused the collapse of the GBP, the impeachment vote against former President Rousseff in Brazil in August added volatility to the Real, the overwhelming victory of Prime Minister Shinzo Abe in Japan’s Upper House Elections in July weakened the Yen . U.S. in its presidential election voted in favour of Republican candidate Donald Trump, which came as the biggest surprise for the financial market in 2016 and led to an upsurge in the USD.

The year 2017 earlier looked like a strong USD year but given the uncertainty in U.S. politic arena and Federal Reserve being cautious on rate hikes and Euro and EM currencies finding favour with markets, USD has given up its gains.

Outlook for Major Currencies in 2017

USD

The US dollar (USD) was soft in the past few months, with the dollar index (DXY) falling back to levels prevailing around the time of the US Presidential elections in November. The transfer of political risk from the Eurozone to the US has prompted capital inflows into Eurozone stocks, supporting the EUR. USD Index (DXY), which tracks the movement of the USD against six major currencies, is down by 5.30% year to date and the index is up by 2.86% in the last one year.

The US economy will recover from its Q1 growth stumble and the Federal Reserve is widely expected to tighten policy by 25 bps in its upcoming policy meeting on 14th June but the asymmetric growth and diverging monetary policy trade has faded somewhat in the recent past. Further, the global growth momentum is picking up narrowing the US expected growth advantage this year.

The US economy stumbled in early 2017, with real GDP growth advancing at an annual rate of just 1.2% in Q1. The slowdown was primarily attributable to a sharp pullback in consumer spending which has since shown signs of rebounding. Consumer fundamentals—a robust job market, rising incomes, and improved household balance sheets—remain favourable. Labour market conditions continue to tighten, with the unemployment rate at a decade-low 4.4%.

Federal Reserve is highly likely to hike interest rate at its June 14th FOMC meeting and once more this year in December. In between these hikes FOMC will evaluate growth and particularly inflation dynamics.

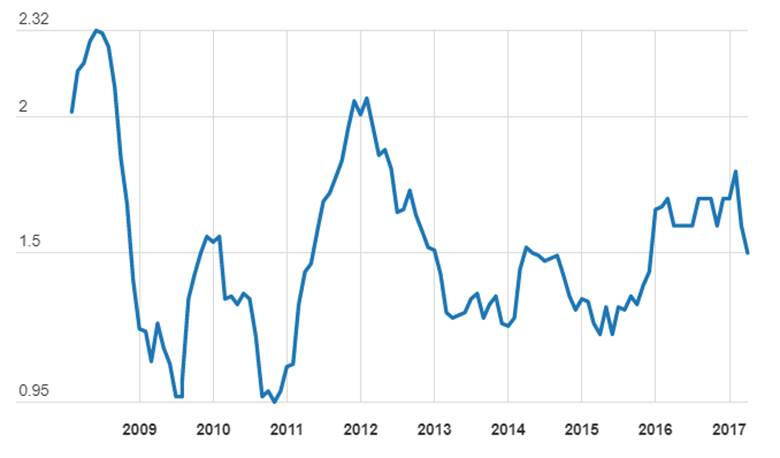

U.S. Core PCE (Excluding Food & Energy) Inflation Rate

Indian Rupee

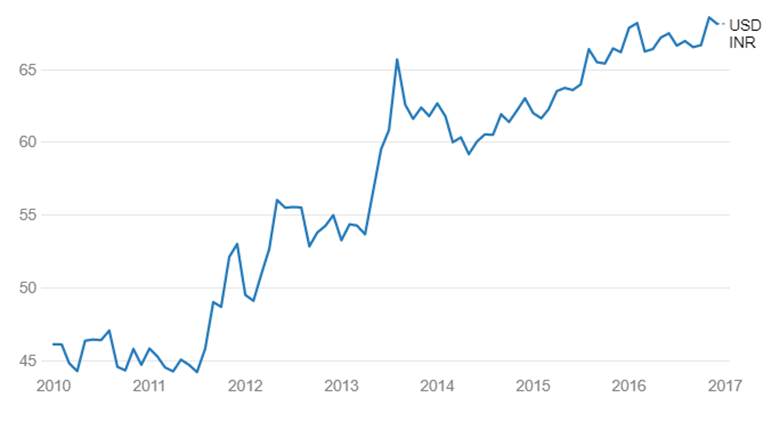

INR is in a sweet spot and can potentially rally by around 7% levels from current levels of Rs 64.25 to the USD to go to Rs 60 to the USD in the next one year.

The INR is up by 7.07% against the USD since November 2016 when it was trading slightly above its all-time low level of Rs 68.8 (seen in August 2013) against the USD. Both domestic and global factors are playing in favour of the INR, domestically the country is witnessing strong political stability that can lead to faster pace of reforms including introducing the key indirect tax reform GST in July 2017 and improved macros. Globally India is the brightest spot amongst emerging economies that are hit by low oil and other commodity prices.

INR started to strengthen after sharp fall witnessed during November 2016 – January 2017, which was largely due to the broad strength in the USD. USD Index rallied and traded at multi year high levels after Donald Trump became the 45th President of U.S. Further, the fact that at that time India’s growth was expected to come off for a couple of quarters due to demonetisation, which led to FII’s selling Indian equities and debt leading to the weakness in the INR.

Now, the political situation has improved in the country as the ruling party at the center, BJP, won the key U.P. State Election, which is seen as an affirmation of Prime Minister Modi’s policies especially since the assembly polls were held after the controversial demonetisation. BJP winning the UP election will also improve the majority in Rajya Sabha and markets expect that the BJP majority in Rajya Sabha will increase the speed of reforms as key bills ( launching the countrywide goods and services tax, labour and land acquisition bills) can be passed without hurdles.

India’s macros of inflation, fiscal and current account deficit are strong leading to the country standing out among its global peers. Read our Fixed Income Strategy Note for India’s Macro trends.

Further, the Fed being less hawkish has disappointed the market expectation for an accelerated pace of monetary tightening. The accelerated rate hike expectation was dampened as the Trump administration is struggling to push through any major fiscal policy to stimulate economy amid current political uncertainty in the U.S.

USD/INR

Euro

EUR USD has strengthened in recent months reflecting positive economic momentum. Relief came after the victory of Macron in the French presidential election runoff. which signaled that political risks in France and across Europe are receding. Further, the recent economic reports have indicated that the economic recovery in the Euro area is gathering momentum, which is expected to give the European Central Bank more room to turn neutral on monetary policy at the end of the year. Nonetheless, the pace of exit is likely to be linked to the outlook for inflation. On this point, recent data have been more mixed and the lack of pickup in core inflation should push the ECB to remain cautious and move on a gradual basis. However, the Euro could see some strength coming in as both political and economic risks start getting priced out of the currency.

Euro appreciated by 6.92% against USD year to date and marginally depreciated by 0.5% against USD in last one year.