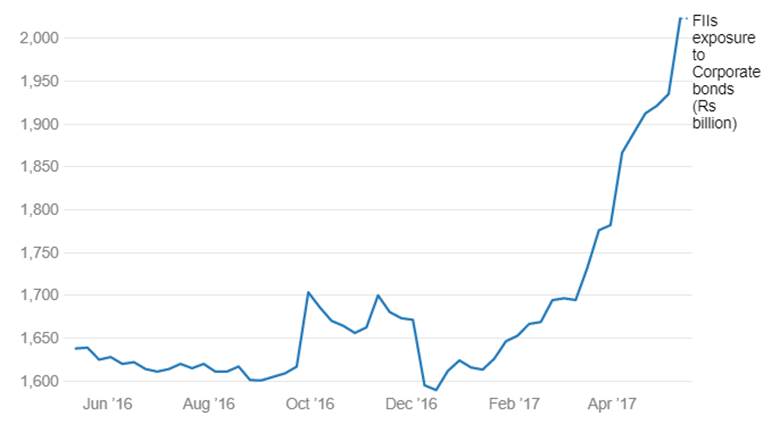

FII’s corporate debt exposure was at Rs 2023.30 billion as of 12th May 2017, the highest on record. FIIs corporate debt exposure was falling till December 2016, largely influenced by factors such as Brexit, US Presidential Elections, Fed Rate Hike Expectations and Demonetisation. Since December 2016, FII exposure to corporate debt has increased substantially on the back of factors such as strengthening INR, political stability and rise in economic confidence. Chart 1

Corporate bond yields bottomed out in January 2017 and started rising after RBI policy in February where the Central Bank changed its policy stance from accommodative to neutral. FII exposure to corporate debt is expected to increase further largely on the back of benign IIP and CPI data released on the 12th of May. Forecast for normal monsoons by the IMD, which is necessary for recovery in rural demand, IMF raising India’s growth forecast to 7.2% for the current fiscal year and 7.7% for 2018-19, indicate healthy corporate earnings in the upcoming quarters increasing the attractiveness of corporate debt for FII’s.

Apart from improvements in corporate earnings, higher credit spreads, stable repo rates, appreciating INR will also act as a catalyst for higher corporate debt exposure. Read our analysis

FII exposure to corporate debt increased by Rs 385 billion since May 2016. Higher yields in corporate bonds led to buying by FIIs. As of May 2017, AAA rated 3 years, 5 years and 10 years bond spreads were at 58 bps, 60 bps and 93 bps respectively.

FIIs exposure to Corporate bonds (Rs billion)

FII debt utilisation status stood at 77.80% of total limits.Corporate bond market trading volumes were 52% higher on weekly basis. Commercial Paper (CP) market trading volumes were 21% higher week on week and Certificate of Deposits (CD) volumes were higher by 19%.

Corporate Bonds Traded Levels

Three-year AAA corporate bonds were trading at levels of 7.40% as of week ended 12th May. Spreads decreased 6 bps at 58 bps. Three-year AAA NBFC bonds were trading at levels of 7.73% with spreads 2 bps up at 91 bps levels.

Five-year AAA corporate bonds were trading at levels of 7.58%. Spreads were 3 bps up at 60 bps. Five-year AAA NBFC bonds were trading at levels of 7.82% with spreads up 2 bps at 84 bps.

Ten-year AAA corporate bonds were trading at levels of 7.76% with spreads 21 bps up at 93 bps. Ten-year AAA NBFC bonds were trading at levels of 7.86% with spreads 16 bps up at 103 bps.

In the week ended 12th May, FIIs were net buyers of INR bonds for around Rs .79 billion for the week. Reported corporate bond traded volumes stood at Rs 167.04 billion with daily average volumes of Rs 33.40 billion. Volumes were 52% higher compared to the previous week.

CP traded volumes were at Rs 323.79 billion (21% more than previous week) with daily average volumes of Rs 64.75 billion. CD volumes were at Rs 137.67 billion (19% higher than previous week) with daily average volumes of Rs 27.553 billion.

Three months and twelve months PSU bank CDs were trading at 6.40% and 6.75% levels each at spreads of 12 bps and 28 bps respectively against T-bill yields. Three months’ maturity Manufacturing and NBFC sector CPs were trading at 6.50% and 6.90% levels respectively.

One-year maturity Manufacturing and NBFC sector CPs were trading at 7.15% and 7.40% levels respectively.

As on 12th May,FII debt utilisation status stood at 77.8% of total limits,229 bps higher against previous week. FII investment position was at Rs 3908 billion in INR debt. FII investment position stands at Rs 1884.93 billion in gilt securities that also includes investment in Interest Rate Futures and at Rs 2023 billion in corporate bonds.