The Fed is unleashing its powers on the US corporate bond market and this will benefit Indian issuers in the global markets as liquidity drives search for yields.

Under the Secondary Market Corporate Credit Facility (SMCCF), the Fed will buy a broad and diversified portfolio of corporate bonds to support market liquidity and the availability of credit. The facility will operate till 30th September 2020. Global central bank buying assets and Low rates across the world can lead investors in the search for yields make Masala bonds and Indian issuers of USD bonds attractive as yields can come down further.

Special purpose vehicle (SPV) to purchase in the secondary market corporate debt issued by eligible issuers such as individual corporate bonds, eligible corporate bond portfolios in the form of exchange-traded funds (ETFs), eligible corporate bond portfolios that track a broad market index.

Eligible Individual Corporate Bonds under SMCCF can purchase individual corporate bonds that have a residual maturity of 5 years or less. Eligible ETFs can purchase U.S.-listed ETFs whose primary investment objective is exposure to U.S. investment-grade corporate bonds, and the remainder will be in ETFs whose primary investment objective is exposure to U.S. high-yield corporate bonds. Eligible Broad Market Index Bonds to purchase individual corporate bonds to create a corporate bond portfolio that is based on a broad, diversified market index of U.S. corporate bonds.

SMCCF leverage the treasury equity at 10 to 1 when acquiring corporate bonds of issuers that are investment grade at the time of purchase and when acquiring ETF, also leverage its equity at 7 to 1 when acquiring corporate bonds of issuers that are rated below investment grade at the time of purchase and in a range between 3 to 1 and 7 to 1, depending on risk, when acquiring any other type of eligible asset.

SMCCF purchase eligible corporate bonds and broad market index bonds at fair market value in the secondary market.

The US Treasury to make a USD 75 billion equity investment in the SPV to support both the Facility and the Primary Market Corporate Credit Facility (PMCCF). The initial allocation of the equity will be USD 25 billion to the SMCCF and USD 50 billion toward the PMCCF. The combined size of the SMCCF and the PMCCF will be up to USD 750 billion. The PMCCF provides a funding backstop for corporate debt to Issuers so that they can better maintain business operations and capacity during the distress period of COVID-19.

As on June 2020,US junk bond yields fell to 6.69% from highs of 11.38% attended in March, while Eurozone junk bond yields fell to 4.60% from highs of 8.10% in March 2020.

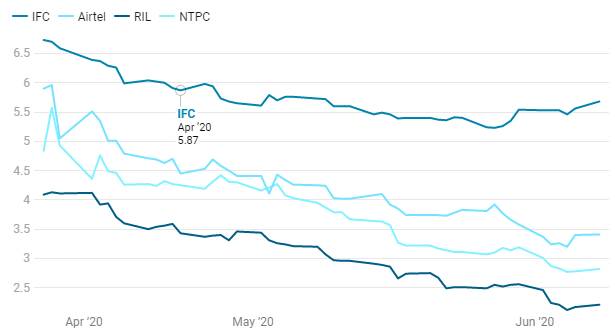

Indian global bond issuers such as NTPC,RIL, Airtel USD bond spreads fell sharply while CDS spreads also trended down ,IHS Markit data shows.

Indian Global Bond USD Issuers Yields - 5Y %