Finance Minister today has announced slew of measures to revive the Indian economy. Effective corporate tax rate cut from 30% to 25.2% would. Revenue foregone on reduction in corporate tax and other relief measures would be Rs 1.45 trillion annually for the Government. What are the short and long term implications of the tax rate cut?

Short Term and Long Term Implications

The government announced the big bank rate cut to boost flagging economic sentiments that were reeling under lack of investment and consumer demand, showing up in falling corporate revenues.

On the equities front, tax rate cut would give direct benefit to the equity share holders as the companies would use the excess profits either for dividends or for re-investing purpose. Major relief is for the companies which are currently paying higher tax rate and also for companies which are using MAT credits. Companies that are earning high profits and are cash surplus will benefit immediately from the rate cut.

In the short term, both investment demand and consumer demand are not likely to see a sharp pick up on the back of the tax rate cut. In the longer term, the lower tax rate would attract more investments from domestic and foreign companies that can raise both investment and consumer demand, however this will take time to filter in to the economy.

The INR appreciated on the back of the rate cut on expectations of FII flows and FDI investments but again INR movement will also be affected by global issues of trade war and geo politics.

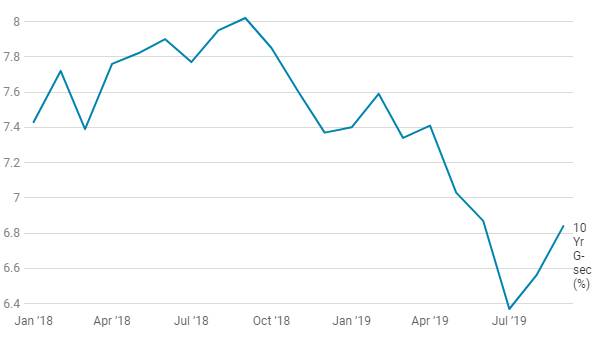

On the bonds front, 10 year g-sec yields surged by by 25 bps on worries of increasing fiscal deficit due to corporate tax rate cut. FM has mentioned that Rs.1.45 trillion will be foregone annually because of corporate tax rate cut, which gives signs of new borrowing plans coming up soon. Increase in Government borrowings will push interest rates higher which will set off tax rate cut benefit for leveraged corporate’s.

In the longer term, lower tax rate does improve tax collections as corporates tend to pay rather than avoid tax and also through higher economic growth and this will keep fiscal deficit in check.

S&P BSE Sensex

USD/INR

10 Yr G-sec Yield (%)

India Economic Data

India Economic Data | Latest | Month | Previous Month | Month on Month Change % |

IIP growth % y-o-y | 4.30% | Jul, 2019 | 2.00% | 2.30% |

Manufacturing % y-o-y | 4.20% | Jul, 2019 | 1.20% | 3.00% |

CPI y-o-y | 3.21% | Aug, 2019 | 3.15% | 0.06% |

Exports USD billion | 26.05 | Aug, 2019 | 26.33 | -1.06% |

Imports USD billion | 39.58 | Aug, 2019 | 39.76 | -0.45% |

Trade Balance USD billion | -13.53 | Aug, 2019 | -13.43 | 0.74% |

Bank deposit growth % y-o-y | 9.70% | Aug, 2019 | 10.60% | -0.90% |

Bank credit growth % y-o-y | 10.20% | Aug, 2019 | 12.20% | -2.00% |