The creation of a few big PSU banks will help banks stay competitive through sheer size and reach and also enable the government to divest stake in such banks to lower its shareholding or even exit them at some point of time. The regulatory supervision will be tougher as will accountability leading to an overall healthier balance sheet.

In August 2019, the Government Of India announced mergers of 10 Public Sector Banks (PSBs) into 4 effective banks. PNB, Oriental Bank of Commerce and United Bank is one set, Canara Bank and Syndicate Bank is another set, Union Bank, Andhra Bank, and Corporation Bank is the 3rd set and Indian Bank and Allahabad Bank is the 4th set.

1. PNB + Oriental Bank of Commerce + United Bank

The entity will be the 2nd largest PSB with business of Rs 17.95 trillion and 2nd largest branch network in India, with 11,437 branches across India. Effective bank will have CRAR ratio of 10.77% and Net NPA at 6.61%.

PNB + Oriental Bank of Commerce + United Bank

Parameters | PNB | OBC | United Bank of India | Amalgamated bank |

Total business | 11822.24 | 4041.94 | 2081.06 | 17945.26 |

Gross advances | 5061.94 | 1715.49 | 731.23 | 7508.67 |

Deposits | 6760.3 | 2326.45 | 1349.83 | 10436.59 |

CASA ratio | 42.16% | 29.40% | 51.45% | 40.52% |

Domestic branches | 6,992 | 2,390 | 2,055 | 11,437 |

PCR | 61.72% | 56.53% | 51.17% | 59.59% |

CET I ratio | 6.21% | 9.86% | 10.14% | 7.46% |

CRAR ratio | 9.73% | 12.73% | 13.00% | 10.77% |

Net NPA ratio | 6.55% | 5.93% | 8.67% | 6.61% |

Employees | 65,116 | 21,729 | 13,804 | 1,00,649 |

2. Canara Bank + Syndicate Bank

The entity will be the 4th largest PSB with business of Rs 15.20 trillion and 3rd largest branch network in India, with 10,342 branches across India. Effective bank will have CRAR ratio of 12.63% and Net NPA at 5.62%.

Canara Bank + Syndicate Bank

Parameters | Canara Bank | Syndicate Bank | Amalgamated bank |

Total business | 10432.49 | 4770.46 | 15202.95 |

Gross advances | 4442.16 | 2171.49 | 6613.65 |

Deposits | 5990.33 | 2598.97 | 8589.3 |

CASA ratio | 29.18% | 32.58% | 30.21% |

Domestic branches | 6,310 | 4,032 | 10,342 |

PCR | 41.48% | 48.83% | 44.32% |

CET I ratio | 8.31% | 9.31% | 8.62% |

CRAR ratio | 11.90% | 14.23% | 12.63% |

Net NPA ratio | 5.37% | 6.16% | 5.62% |

Employees | 58,350 | 31,535 | 89,885 |

3. Union Bank + Andhra Bank + Corporation Bank

The entity will be the 5th largest PSB with business of Rs 14.59 trillion and 4th largest branch network in India, with 9,609 branches across India. Effective bank will have CRAR ratio of 12.39% and Net NPA at 6.30%.

Union Bank + Andhra Bank + Corporation Bank

Parameters | Union Bank | Andhra Bank | Corporation Bank | Amalgamated bank |

Total business | 7413.07 | 3985.11 | 3196.16 | 14594.34 |

Gross advances | 3253.92 | 1786.9 | 1350.48 | 6391.3 |

Deposits | 4159.15 | 2198.21 | 1845.68 | 8203.04 |

CASA ratio | 36.10% | 31.39% | 31.59% | 33.82% |

Domestic branches | 4292 | 2885 | 2432 | 9609 |

PCR | 58.27% | 68.62% | 66.60% | 63.07% |

CET I ratio | 8.02% | 8.43% | 10.39% | 8.63% |

CRAR ratio | 11.78% | 13.69% | 12.30% | 12.39% |

Net NPA ratio | 6.85% | 5.73% | 5.71% | 6.30% |

Employees | 37,262 | 20,346 | 17,776 | 75,384 |

4. Canara Bank + Syndicate Bank

The entity will be the 7th largest PSB with business of Rs 8.08 trillion and nationwide presence with strong networks in the South, North and East. Effective bank will have CRAR ratio of 12.89% and Net NPA at 4.39%.

Indian Bank + Allahabad Bank

Parameters | Indian Bank | Allahabad Bank | Amalgamated bank |

Total business | 4299.72 | 3778.87 | 8078.59 |

Gross advances | 1878.96 | 1635.52 | 3514.48 |

Deposits | 2420.76 | 2143.35 | 4564.11 |

CASA ratio | 29.18% | 32.58% | 30.21% |

Domestic branches | 6,310 | 4,032 | 10,342 |

PCR | 41.48% | 48.83% | 44.32% |

CET I ratio | 8.31% | 9.31% | 8.62% |

CRAR ratio | 11.90% | 14.23% | 12.63% |

Net NPA ratio | 5.37% | 6.16% | 5.62% |

Employees | 58,350 | 31,535 | 89,885 |

The government also extending capital support of Rs 552.50 billion to PSBs of which PNB will get Rs 160 billion, Union Bank of India will receive Rs 117 billion, Bank of Baroda will get Rs 70 billion while Canara and Indian Bank will receive Rs 65 billion and 25 billion respectively.

The government also announced reforms such as, making management accountable to the board, board committee of nationalized banks to appraise the performance of GM and above rank officers, appoint Chief Risk Officer from market and MCB loan sanction thresholds enhanced by up to 100 %, to enable focussed attention to higher-value loan proposals.

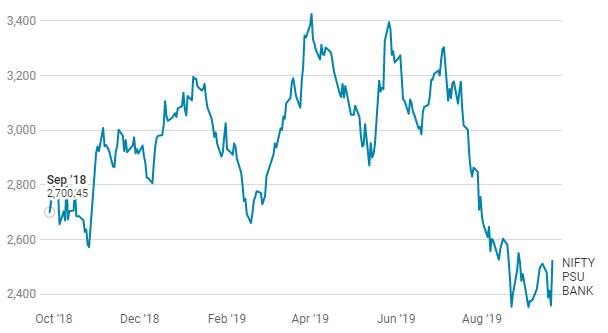

NIFTY PSU BANK

Previous Mergers

BoB + Vijaya Bank + Dena Bank were merged April 2019.In FY18, LIC took over IDBI Bank and SBI associated banks merged in to SBI.