The draw down of government surplus of over Rs 1.8 trillion in just a fortnight in April is unprecedented and could be the key factor in the shortage of cash in the country. The sharp increase in government spending, on various items such as IT refunds, salaries, subsidies and projects could have led to excess demand for cash, for which the system was not prepared. RBI and banks could not have expected this spurt in spending leading to the cash shortage.

The system will normalise itself going forward. The fact that currency in circulation to GDP ratio has come off from 11.18% as of September 2016 (pre demonetization) to 10.77% as of March 2018, is also a reason for banks not stocking up on cash.

Currency Shortage

In April 2018, few states in India including Madhya Pradesh,Uttar Pradesh, Andhra Pradesh, Bihar, poll facing Karnataka and Telangana, faced currency shortage due to spurt in demand for cash from the public. RBI clarified that the shortage may be due to logistical issues of replenishing ATMs frequently and undergoing the recalibration. RBI said sufficient cash is available in the RBI vaults and currency chests and also that printing of notes has been ramped up in all the 4 note presses

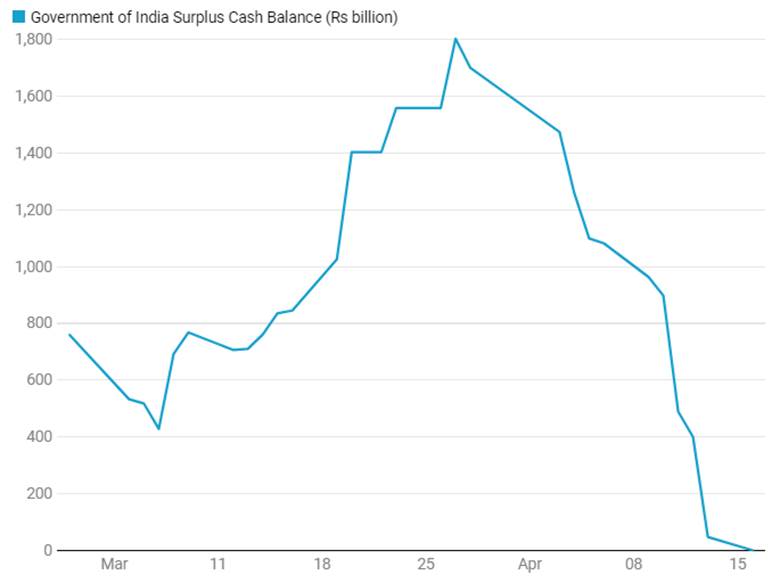

Government of India Surplus Cash Balance (Rs billion)

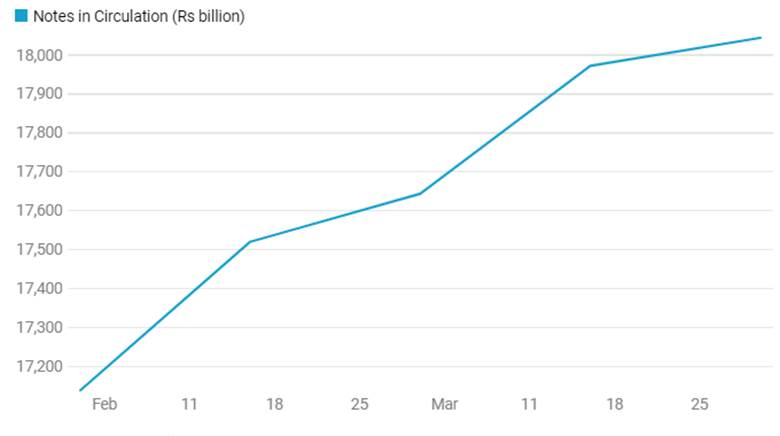

Notes in Circulation (Rs billion)

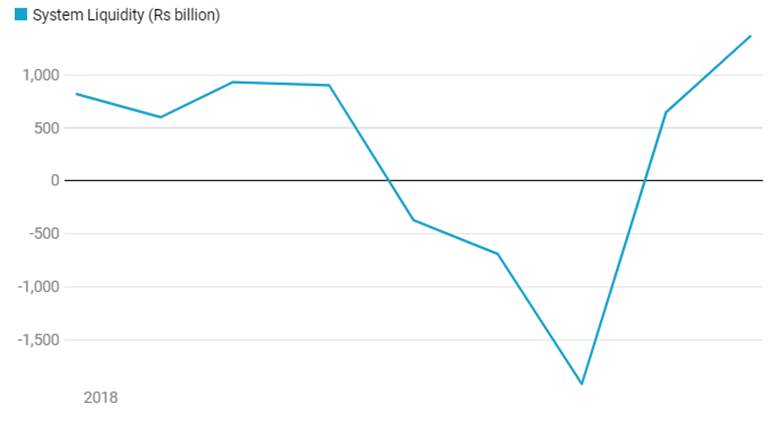

System Liquidity (Rs billion)

Currency shortage, demand for cash and system liquidity are interlinked. Liquidity tightened in March 2018 on the back of government cash balances, which swelled up on advance tax outflows in mid March and on the back of financial year end hoards. In March 2018, the government surplus cash built up from Rs 759 billion to Rs 1803 billion, leading to fall in system liquidity.

Since March end, government surplus cash fell from Rs 1803 billion to zero as of mid April. The surge in government spending eased system liquidity that was in deep deficit of close to Rs 2 trillion as of end March. Strong 4th quarter fiscal 2017-18 advance tax collections has helped bolster government finances that saw fiscal deficit exceeding 100% of target. Since February, notes in circulation has risen by Rs 904 billion impacting system liquidity.Total notes in circulation was Rs 18044 billion as of March 2018.