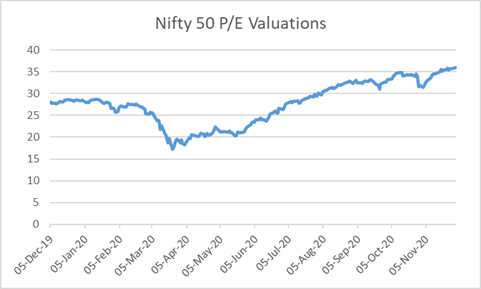

Equity valuations have risen sharply on liquidity flows and this can cause concern for investors if earnings growth fails to meet expectations. At such high valuations, it can make sense to book profits and invest in corporate bonds in the 2-year maturity bucket that offer yields of over 6%. This strategy will enable investors to reduce volatility in their portfolios and allow them to reinvest when markets stabilize at reasonable valuations. Such trades of booking profits in equities and investing in corporate bonds can be done in a calibrated manner as equity markets may just trend higher before any longer-term correction.

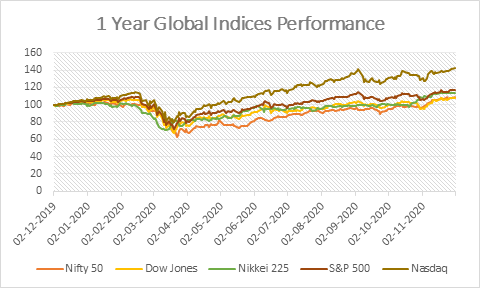

In November 2019, we published a note on how the Indian economy is going through multiple uncertainty factors slowing down economic growth, and yet stocks were trading at expensive valuations. There's a lot happened since then; global equity indices have corrected by more than 25% due to the rapid spread of Covid -19, which lead to the lockdown of economies. However, currently, citizens of earth have adopted to live with Covid-19 and move on. Vaccine for Covid-19 is ready and expected to roll out by the end of this year or Jan-21. Stock markets have bounced back from lows and are currently trading at all-time highs even though economies are showing a negative growth trend. Sensex & nifty are up by 8% each (YTD) supported by record FII inflows even as DII were heavy sellers. Midcaps & Smallcaps stocks have outperformed Largecaps in the month of November 2020.

Effectiveness with respect to vaccine development remained the key trigger as markets started to price in an earlier resumption of normal economic activity. Risk appetite for investors has improved post announcement of Covid-19 vaccine. Global equity markets, commodities and high yield credits rallied sharply even as safe haven assets such as USD & Gold prices showed contraction.

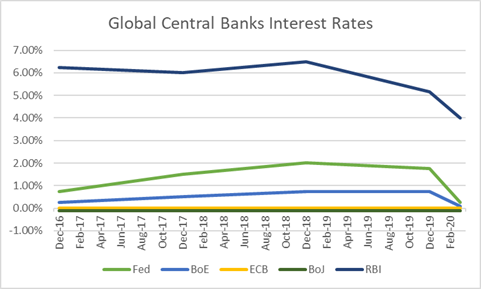

Central Bank policy rates in the US, Europe, Japan, India, and the UK are at all-time lows and expected to stay in that range in the near future. Lower interest rates flooded the market with massive liquidity, which are pushing markets to new highs.

The biggest question is whether current valuations are sustainable, given the bleak outlook?

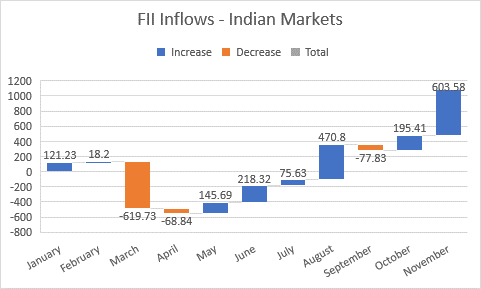

FIIs have invested whooping Rs. 1082 billion (YTD) in the domestic market and November 2020 witnessed the highest inflows in the last two decades of Rs.603 billion. Expectations of better earnings growth coupled with fiscal & monetary stimulus boosted FII inflows in previous couple of months. On the global front, fiscal & monetary policies in the USA & Europe have a significant role in the movement of FII inflows/outflows in/from emerging markets. For example, when the US announced cuts on corporate tax back in 2018, US markets witnessed colossal FII flows from emerging markets. Currently, after the US presidential elections, there has been a weakness in USD, which lead to FII inflows into emerging markets.

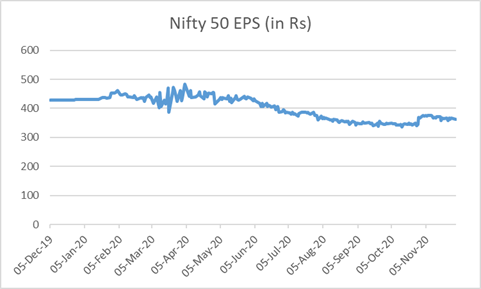

On the earnings front, September quarter earnings have been better than expectations (Compared to Q-o-Q) for most companies as they’ve reported margins expansion due to lower tax rates & costs. However, a sudden surge in revenues is due to pent-up demand as the economy has opened from lockdowns. On a yearly basis, demand levels have not reached pre-covid levels yet, but the markets' valuations are at all-time highs. The following charts show the P/E & EPS of Nifty 50 as of 30th November 2020.

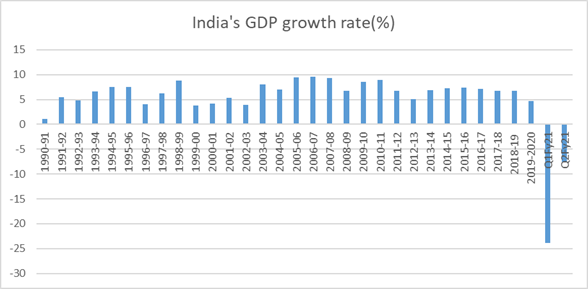

On the macro-economic front, the Indian economy shrank 7.5% (Y-o-Y) during Q2Fy21, less than expectations of an 8.8% drop, amid easing lockdown restrictions from June 2020. In India, annual consumer price inflation increased to 7.61% in October 2020 from a downwardly revised 7.27% in September 2020, above market expectations of 7.3%. It is the highest level since May 2014, remaining well above the central bank 2%-6% target range. India's industrial production rebounded 0.2% from a year earlier in September 2020, the first month of growth since February 2020, and easily beating market expectations of a 2% slump.

In addition to the current economy slowdown, stress in financial sector had a multiplier effect on economy growth in the form of credit default issues. NPAs have significantly increased for banks in last couple of financial years. But, due to moratorium banks are now under reporting NPAs. Two bank failures in the same year, leading to bond holders losing capital are unnerving investors, especially in weak private sector banks. Institutions are shunning away from lending to such banks and this leads to a liquidity crunch that makes the banks fail.

To sum it up, the Covid-19 vaccine may likely to bring the Indian economy back on its feet. Covid-19 pandemic has resulted in slowdown in virtually all sectors, affecting jobs and creating uncertainty of employment. Near-term correction in market looks evident as the earnings growth of India Inc does not justify the run-up in Nifty 50 & Sensex. However, positioning the portfolios with the stocks that have reported consistent growth and have long-term growth visibility would be a better trade-off in the current scenario.