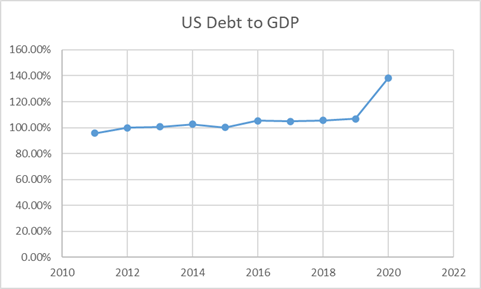

The PIIGS crisis in 2011-12 was caused by huge debt to GDP ratios of EU countries. Markets worried about the countries ability to service debt given lack of growth and inflation. Nothing has changed in both debt to GDP ratios, low inflation and low growth and only ECN bond buying is keeping rates down for EU debt.

US is going down the same path as EU nations and with more stimulus ahead debt to GDP ratio can go even upto 200%. At these levels US credit rating should be junk. The consequences of very high US debt and if the debt fails to raise growth and inflations can be severe going forwrad.

In the case of US growth and inflation coming back to normal, then taxes will be raised to pay off debt and this will hurt markets across the world.

High government debt and policy accomodation

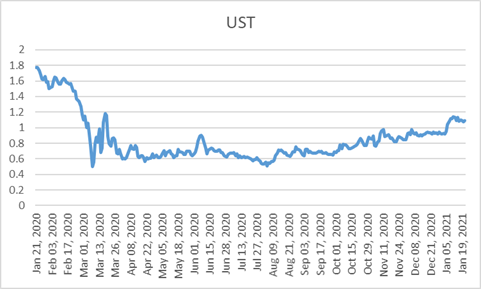

To revive economic growth, governments are increasing debt for fiscal stimulus while central banks lower rates and pump in liquidity. Currently, economies can see an uptick in growth primarily because of the low base effect. UST yields have bounced back to 1.09% from lows seen in 2020, Dow Jones, Nasdaq, and S&P 500 are at record highs amid the vaccine's effectiveness, which would spurt economic growth.

Treasury secretary, Janet Yellen, said 'act big' on Covid-19 relief package, stating that the economic benefits far outweigh the leveraged Fed's balance sheet risks. Currently, the US has announced a USD 5 trillion stimulus since the outbreak of the Covid-19 pandemic, which is a quarter size of the US's total GDP. The debt to GDP ratio of the US stood at 140% from 106% seen in 2019.

Despite massive stimulus checks, employment growth in the US is nowhere close to pre-Covid levels. The latest non-farm payroll data shows the US economy cut 140,000 jobs in December 2020, well below market expectations of a 71,000 rise. Fed minutes suggested that uncertainty surrounding the economic outlook remained elevated. Fed's balance sheet is currently stretched to USD 7 trillion from USD 4 trillion seen before the Covid-19 pandemic.

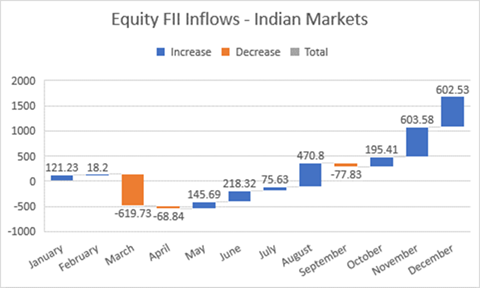

A new stimulus package is positive for the emerging market. Massive FII inflows will push asset prices in emerging markets to new highs, as seen in the past couple of months. Sensex & Nifty are trading at record highs despite lack of earnings growth visibility. FIIs have invested whopping Rs. 1684 billion (YTD) in the domestic equity market, and November 2020 witnessed the highest inflows in the last two decades of Rs.603 billion.

The outcome of the 2008 Crisis:

Economic weakness in all the economies was despite unprecedented fiscal and monetary easing post the 2008 financial crisis, which saw governments cutting loose fiscal ammunition and central banks pumping in vast amounts of liquidity at record low rates. At that time, economies were able to slowly come out of the crisis, but the defenses against further shocks weakened. Government debt ballooned, inflation refused to pick, and rates stayed at record lows. Fed took 10 years for the first-rate hike since 2008 while ECB has not raised rates since. Japan has been on stimulus for 30 years with no results.

So, Now?

The economies will be weaker with high government debt and low rates that hurt an aging population as they cannot afford rising costs despite headline inflation at record lows. When the next shock happens, which will happen given how the world is affected by climate change, economies will be left almost defenseless, and no amount of fiscal and monetary stimulus will work.