Fixed income investment allocation

Fixed income plays an important part of asset allocation, as it provides certainty of cash flows and adds stability to the overall portfolio. Within the fixed income spectrum, there are many options such as bank and company deposits, small savings schemes such as PPF, Post Office and NSC, Insurance products, NPS, mutual funds, bonds and other products including managed funds.

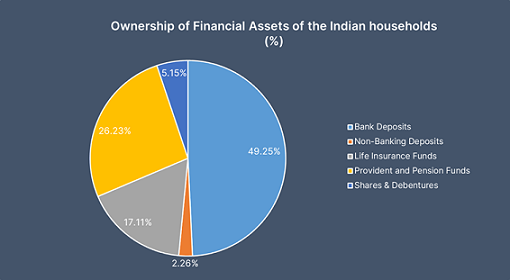

Bank deposits, PPF, post office and insurance form the largest allocation amongst households in India while mutual funds are picking up. Direct bonds are still at a very low percentage of allocation.Chart 1 shows RBI data on household savings allocations.

Mutual funds invest in bonds for generating returns and investors have a choice between investing in mutual funds or investing directly in bonds.

Fixed income mutual funds or direct bonds?

Fixed income mutual funds offer liquidity on call and also tax benefits if held for 3 years but they come with volatility, higher expenses and can underperform bonds. Direct bonds on the other hand can provide higher returns, stability of cash flows and lower volatility than mutual funds but they don’t offer tax benefits, do not offer liquidity on call and are not easy to buy and sell.

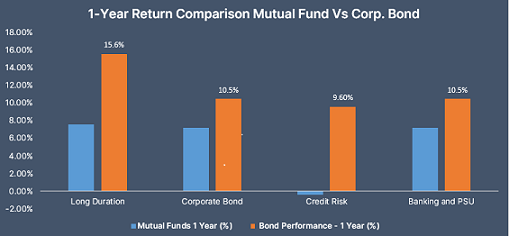

The chart below shows how bonds have fared against mutual fund scheme returns in the last one year. For comparison purposes, we have taken Nabard bonds for the AAA category of funds as NABARD is the safest PSU bond given its regulatory status and budgetary support. For credit risk category, Muthoot Finance bonds were taken. Clearly, bonds have outperformed mutual funds by a wide margin and this is due to the fact that funds invest in a large portfolio of bonds, where some bonds perform and others underperform, expense ratios eat into returns and also there are chances of volatility in AUM that makes portfolio churn more than necessary.

Direct bonds can have a larger share in fixed income investments

Given that bonds have strong advantages, fixed income investments can have a good mix of bonds and mutual funds. Mutual funds offer diversification and any credit event like a default, investors are more protected in mutual funds than direct bonds. Hence for higher credit risk, investors who do have have tools to evaluate credits unless they have good bond advisors, can go to mutual funds if required. For capital protecting and higher returns, bonds like NABARD offer better investments than mutual funds.