Gold prices are down

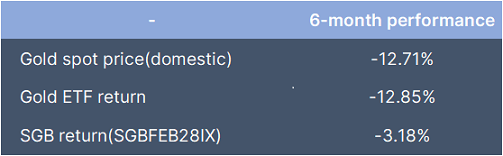

Gold prices have come off over the last 6 months on factors like higher equity prices and rising government bond yields. Gold is seen as a safe haven asset when there are market crises and with vaccinations for covid easing economic stress, gold is losing its glitter with investors. The table below shows returns on gold, gold ETF and SGB over the last 6 months.

Gold can still prove to a good safe haven asset

The current optimism in equities is largely due to the heavy spending by governments that is financed by debt. Government spending is supported by huge Money printing by central banks, who are buying government bonds. This heavy money support from central banks to governments is not going to end soon and economic growth is unlikely to shoot up for governments to pay off debt. This will lead to loss of confidence in currencies, and gold will get back its glitter as markets target any precious asset that is in limited supply.

Gold + Bonds make a good portfolio

Gold is a safe haven asset but price is volatile while bonds provide stability in returns. A gold plus bond portfolio can provide a good risk adjusted portfolio. It is interesting to note that Gold ETFs are more volatile than Sovereign Gold Bonds (SGB) and they have fallen more than SGBs in terms of price. A Gold ETF plus bond portfolio is better when prices have fallen while when prices are high, SGBs are better.

Click here to read about our Gold + Bond portfolio details and analysis

We would love to hear back from you. Please Click here to share your valuable feedback.