SEBI has placed strictures on Mutual Funds investments in Perpetual Bonds

SEBI has told MFs to restrict investments in perpetual bonds and also change the valuation norms of perpetual bonds, which would make the bonds valued to maturity, which is 100 years. The policy regulation on perpetual bonds is clearly designed to protect investors from both write offs, as in the case of Yes Bank and from issuers not exercising the call option on the bonds, which would then make the bond maturity 100 years.

Risk of write off

Perpetual bonds, also know as additional tier 1 bonds (AT1) have clauses that the bonds are to be written off fully i.e investors in the bonds have to take full capital loss, when the issuer goes into deep financial stress, Yes Bank was technically liquidated by RBI as it did not have enough capital to act as a going concern, and AT1 bonds of the bank was written off. In other cases, AT1 bonds will be converted to equity or bond holders will not receive interest on the bonds.

Given that many banks, HFCs and NBFCs have faced deep financial stress in the recent past, SEBI is worried that perpetual bond investors can face defaults in some of the weaker issuers.

Risk of bonds not being called

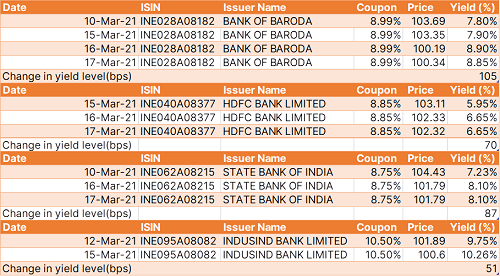

Perpetual bonds have a call option embedded in them where the issuer has the discretion to call the bonds before maturity. Perpetual bonds have maturity of 100 years and call option is at 10 years from issue or anytime before that. The bond market was assuming that bonds will be called at 10 years and was trading the bonds as 10 years to maturity bonds and not 100 years to maturity bonds.

The issuer does not give certainty of calling the bonds and if the issuer has capital constraints at the time of call option or if interest rates are high or cost of capital is high, they have no reason to call the bonds. The bonds then become 100 years bonds.

Given the financial stress in the banking, HFC and NBFC sector, many issuers are having capital constraints and SEBI is worried that the bonds will not be called leaving investors holding an asset that they did not want in the first place.