The Right Bond

Bonds literally come in various shapes and sizes and choosing the right bond that suits your financial objectives and risk profile is important. Bonds are not one size fits all type of investment, they have to fit the investor and this provides the right cash flows with peace of mind for investors.

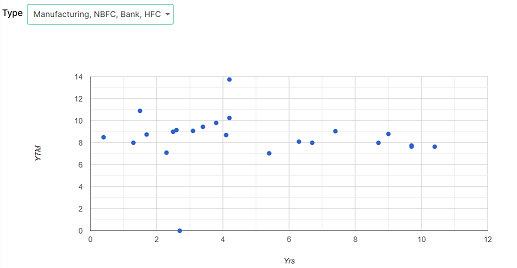

Bonds have different risk and maturity profiles that also determine the rate of interest or yield of the bond, Yields can vary from 4% to 10% and higher and choosing the yield that you require with the right risk profile is important.

The Right Price

The price of a bond is also the yield you get when you purchase the bond for investment. Once you have identified the right bond for investments, you go to the market to purchase the bond for investment. However, corporate bonds are not traded like government bonds or equities where there is clear price discovery online through electronic bids and offers or buy and sell prices. Corporate bonds are mostly traded through private networks and this hampers price discovery. The right bond may not come at the right price or you may invest in a bond at a price that is far higher than the market price, and this will fetch you much lower yield.

The Right Bond at the Right Price

Identify the bond that fits you and invest in the bond at the yield that you require. This will help you in your financial planning and enable you to optimise your savings. But, how do you invest in the right bond at the right price? Good financial advisors can help you invest in the right bond at the right price and many of them are using INRBonds for identifying bonds and discovering bond prices.

|

We would love to hear back from you. Please Click here to share your valuable feedback.