Hope of an economic recovery in the financial year 2022 is faltering with many states going into lockdown on the resurgence of corona virus in India. The violent spread of the virus has taken the markets by surprise and there is growing pessimism on the business front due to lockdowns and due to the fact that governments, both centre and state, do not have funds to spend for virus relief. The only hope now seems to be the pace of vaccinations and this could take months to cover a large part of the population of India.

In this scenario, bond investments in weaker issuers turn more risky and you would have to monitor your investments closely.

Which bonds to invest in during this risky period?

Given that weaker issuers can face higher credit risk, it is best to avoid investments in such issuers. Normally, weaker issuers offer higher yields and searching for higher yields in this market is risky.

If you are searching for higher yields, then it is better to invest in long maturity bonds of PSUs or the best of AAA/AA+ issuers. A few issuers in the AA category can also provide good yields with lower maturity period. However with inflation rising, long bond investments carry higher interest rate risk. Also, ratings may not reflect the forward outlook for an issuer.

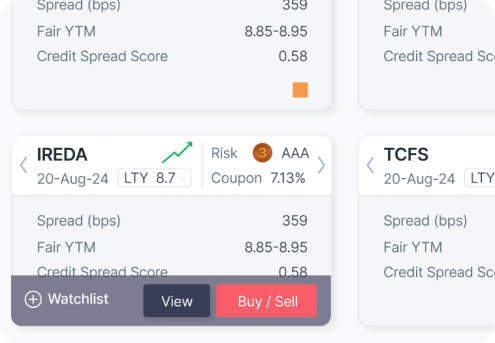

INRBonds has a proprietary credit spread score (CSS), which is rating agnostic and gives a forward looking outlook on issuer credit risk.

�

�

Monitor your existing bond investments

It is important to monitor your existing bond investments in an environment where businesses could face challenges. Financial profiles and outlook can change fast and this can cause credit spreads to rise, which causes bond yields to rise and prices to drop. You may even want to think about selling bonds that have weaker financial outlook.

Stay safe in bonds as well as in health during covid 2nd wave.

We would love to hear back from you. Please Click here to share your valuable feedback.