Structured debt issue

InvITs are trusts that invest in a pool of infrastructure assets such as roads or power grids/ transmissions. The assets must generate income from toll collections or from electricity distributors/consumers as these collections are distributed as dividends to investors. InvITs are issued in the form of units, which can be bought and sold in NSE/BSE.

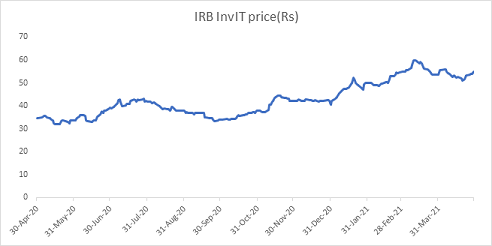

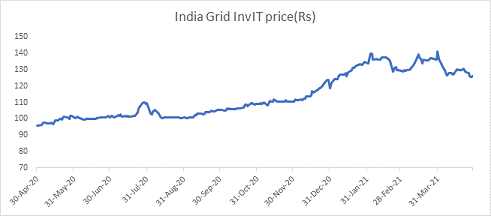

Investors in InvITs get dividend income from the payouts, which are usually quarterly and this dividend income could be higher than fixed deposit interest. Investors can also get capital appreciation if assets are sold.

InvITs also issue bonds

InvITs can also issue bonds, which carry fixed rate of interest. The bonds are traded in the bond market and investors can buy or sell the bonds in the market. The difference between units of InvITs and bonds of InvITs is that in units, the payout can change while in bonds the payout is constant and in bonds the investor gets the capital invested at maturity while in units, the investor can get higher or even lower capital invested if sold in the market.

Risk in InvITs

InvITs carry risk. If the underlying assets generate low cash flows or even stop generating cash flows, the investor in units can lose capital and also dividends can fall or even stop. Investors in bonds face interest rate risk, credit risk and liquidity risk.

InvITs are likely to see more issuances as infrastructure companies start to securitise their assets and investors are better off investing in InvITs with more knowledge.

We would love to hear back from you. Please Click here to share your valuable feedback.