US Inflation is spiking

Inflation in the US is spiking with CPI for May 2021 at 5%, the highest level since 2008 while core CPI level at 3.8% was the highest seen in 3 decades. The jump in inflation is largely due to the demand in the economy from covid relief measures, sharp rise in commodity prices and the huge money printing by the Fed.

The Fed has more than doubled its balance sheet in the last one year and has kept interest rates at close to 0% to help the US economy tide over the covid crisis. US government debt has gone up well over 100% of GDP as it doled out trillions of USD as relief measures. US is also spending its way out of trouble with trillions of USD in infrastructure spends.

The very large stimulus provided by the US government and Fed has led to sharp rise in asset prices with equities at record highs, real estate at record high prices, junk bond yields at record lows. The asset price rise has also contributed to demand leading to inflation.

Fed is starting to talk taper

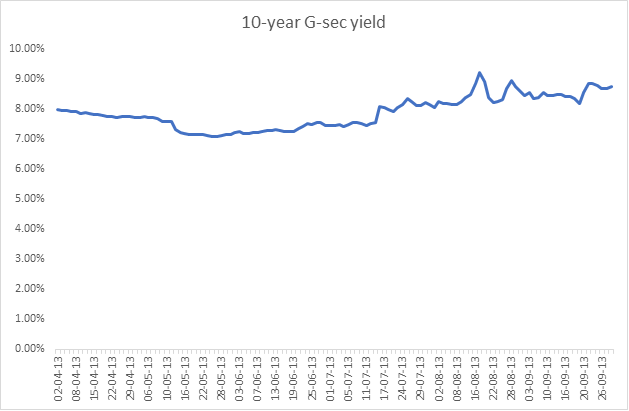

Fed in its recent statements has started to talk about the scaling back of its asset purchase program, which has seen its balance sheet cross over USD 8 trillion. The last time Fed spoke of tapering asset purchases, which was in 2013, bond markets in India saw a huge fall in prices, as foreign investors sold heavily on a depreciating Indian Rupee. RBI was forced to raise rates and many bond investors saw capital losses as bond prices fell. The volatility in markets was termed as Taper Tantrum

This time around, markets have taken taper talks calmly and bond prices have been largely stable. However, the fear of taper talks will always persist given the violent reaction seen in 2013.

Will taper tantrum haunt Indian bonds again?

The Fed, when it tapers asset purchases, will also keep interest rates at record lows for a while before starting to raise them. This will take at least 2 years time. Bond prices in the US have already fallen for longer maturity bonds on markets factoring inflation effects.

In India, RBI has been holding bond prices from falling as it supports a huge government borrowing program. FIIs have very low exposure to Indian bonds as their limit utilization has halved over the last few years. Hence any taper tantrums will not see heavy selling by FIIs and the Indian Rupee will see less volatility. RBI has also built good fx reserves, which at usd 600 billion is at all time high levels.

Indian bonds will feel the heat from any market taper tantrums but will not be as volatility as seen in 2013. The best bonds that can protect investors against taper tantrums are bonds that mature in the next 1 to 2 years and are offering yields of 7% and above, as the investors will get reasonable returns and will be able to deploy the maturity cash flows at higher yields.

INRBonds Quickinvest gives you the best bonds to invest in against taper tantrum.

We would love to hear back from you. Please Click here to share your valuable feedback.