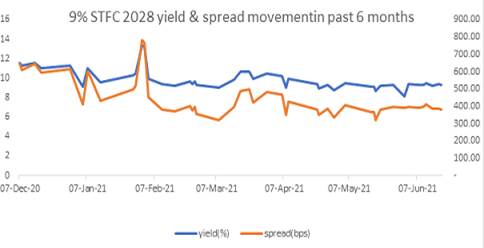

Shriram Transport Finance Co Ltd (STFL) bonds were shunned by institutional investors in the year 2020 as covid hit the highly leveraged company with high NPAs. Bond yields shot up despite the fact that rating agencies maintained their rating of high safety.

Retail investors started to buy STFL bonds at high levels of yields and they have seen good price appreciation since then, as yields have dropped substantially from highs.

However, the bond still trades at much higher yields than its peers despite the company raising equity and announcing bond buyback. This makes the bond a still riskier investment in the market.

Shriram Transport Finance has decided to buy back bond issued in January 2019 worth up to Rs 4.50 billion at a yield of 8.75% per annum. Shriram Transport Finance has also raised Rs 19.99 billion through a qualified institutions placement((QIP) of equity shares.

0% STFC 2023 is trading at the level of 7.87% with a spread of 362 bps while 10.75% STFC 2023 is offering yield of 7.85% with a spread of 360 bps. 10.25% STFC 2024 is yielding at 8.98% with a spread of 473 bps while 8.85% STFC 2023 is trading at the yield of 8% with a spread of 374 bps.

Why is STFL trading at yields far above its peers?

The bond market decides the yields of bonds and various factors come into play. These factors include demand-supply and perception of risk. Clearly bond market perception of risk of STFL bonds is way higher than rating agencies perception of the bonds as seen by the very high safety ratings. However, as seen in IL&FS, DHFL and other very high rated bonds that defaulted, ratings follow bond markets with a huge lag and not the other way round.

STFL is facing challenges in its Commercial Vehicle lending business due to COVID-19 and general economic downturn earlier but is supported by strong capital adequacy, which indicates that it can withstand some shocks. But the bond market is not buying into the capital adequacy theory and investors should always keep an eye out for bond market views.

Retail Investors are investing in STFL bonds, for its high yields

STFL is seeing good trading in terms of frequency of trades in the market, largely driven by retail investors. Mutual Funds have stopped investing in STFL bonds. Retail investors are willing to buy the risk spread available on STFL bonds. The question is, will they be rewarded with the high returns offered by the bonds or will they see capital loss in case of further deterioration in risk of the bond? Time will tell.

INRBonds gives you the credit report, fair yield, risk score and liquidity on STFL bonds here.

We would love to hear back from you. Please Click here to share your valuable feedback.