Interest rates are rising

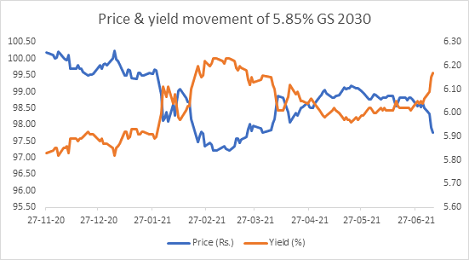

The market indicator of rising or falling interest rates is the yield or price movement on government bonds.If government bond yields rise or prices fall, then its is said that interest rates are rising and if government bond yields fall or if prices rise, interest rates are falling.

In the Indian government bond market, we have seen yields rising or prices falling on government bonds in the last 8 months. The reason is due to rise in inflation and rise in government budget deficit. As we all know and experience, despite covid led economic slowdown, prices of food, fuel and even other goods and services have risen sharply over the last one year. Government official inflation indicator, the CPI or consumer price index is up by over 6% in June 2021.

How does rising interest rates affect you?

Rising interest rates affect you both on your asset side and liabilities side. On you asset side, the value of your investments in fixed income products like bonds, mutual funds and ULIPs fall and also that your investments in fixed deposits made earlier is earning less than the interest rates offered in new deposits. Higher interest rates may also affect equity and commodity prices negatively, as cost of holding these assets rise due to rise in cost of capital.

On the liability side, cost of loans (home, vehicle, personal, consumer durables, credit cards) all rise, making it more expensive for you to acquire assets or spend on goods and services.

What should you do when interest rates rise?

When interest rates are rising, it is best to keep your fixed income investments in bonds or other products that repay capital in a very short period of time, from 1 to 3 years maximum. It is also good to see whether the stocks you own, directly or through mutual funds, are affected by higher interest rates. If you are fine with taking a bit of risk, investments in bonds that provide higher than market yields can immunise your investments against rising interest rates.

On the borrowing side, taking fixed rate loans rather than floating rate loans is best when interest rates are rising. Longer maturity loans are better than shorter maturity loans

We would love to hear back from you. Please Click here to share your valuable feedback.