Retail Bond Market in India - Opportunities in Digitisation

I. Synopsis

Increasing retail participation in the Indian bond markets both corporate bonds and government securities (Gsecs) - can bring in a new set of investment opportunities for the small investors. RBI's initiative to retail Gsecs can expand the options for safe and secure investments for the small investor, while interest in corporate bonds would multiply by streamlining the digital listing and settlements processes. Information led low cost, efficient and real-time digital platforms can enable retail investors to invest in these bonds with transparent pricing and seamless settlements.

This note identifies some enablers for small investors to benefit from these new asset investment opportunities through digital platforms.

II. Corporate bonds, a key lever for funding India's growth, can be simplified to attract greater retail participation

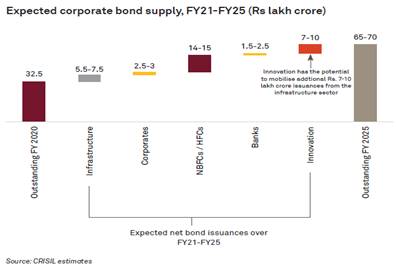

Corporate bond fuelled growth is inevitable for India to become a USD 5 trillion economy. Corporate Bond market in India stands at 17% of GDP, of which the household investment exposure is less than 3%, has a potential to grow multi-fold. As per a Crisil report, corporate bonds issuances outstanding could touch 22% of GDP by 2025.

Bonds are emerging as an important investment for asset allocation among retail investors. Low FD rates have prompted investors to search for alternatives and the uptake in bonds has increased over the years. Although the retail bond market has grown 5x over the last few years, the number of investors remain at only around 3 lakhs in the country.

The low penetration of bonds among retail investors could be attributed to several challenges they face currently. Some of them are highlighted below:

1. Access to quality bond information

It is difficult to get a priori information about the issuer and it's credit quality. This information is also spread over many documents, agencies and reports and not available in an organised format. Investors have seen several credit defaults by issuers (IL&FS, DHFL, Reliance Capital and others) and easy and timely access to this information was not available. Also, credit rating agencies are not swift enough to review ratings and inform investors to take timely action.

2. Lack of fair price information & availability of bonds

When compared to the equity markets, the bonds markets are still developing. Secondary market is largely over the counter (OTC) for corporate bonds unlike government bonds that is fully electronic. To participate in the corporate bond market, the buyers and sellers use offline methods like messaging and email to search for bonds. This is an inefficient process making bonds and price discovery difficult. In addition, availability and prices (offers and bids) are not transparent due to the absence of a mature marketplace for real-time transactions.

3. Inefficient and manually driven trade & settlement process

Settlements require many steps across parties leading to delays and failed settlements.

Enablers for enhancing retail participation in the corporate bond market

Increasing retail participation in the bond ecosystem can enable access to capital for funding the requirements of a fast growing Indian economy. Using information technology based digital platforms can bring greater efficiency and transparency to the bond market. In the process, several fractured processes can be fixed digitally.

Platforms like INRBonds.com are moving towards the path of enabling the digitization of the corporate bond market in India and has the vision of becoming a digital provider for Indian bonds ecosystem. In order to kick start retail adoption, a understanding the needs of the retail customer is critical.

Bonds have been the preserve of government and financial institutions such as banks, mutual funds, insurance co, etc. Small treasuries, high net worth and retail individuals have not accessed the bond markets because of the inherent difficulty in researching, selecting, buying and selling bonds. As retail customers become more mature in owning bonds, institutions that service them will also have to provide greater transparency and efficiency. Digital platforms can fill the information gaps while making the entire process of buying and selling easy and efficient.

We have identified eight key factors to make corporate bonds more accessible to these new customer segments:

1.Provide high quality research and content:

Bond information is not easily available while research is still largely in the realm of institutional service providers. Training is offered by various entities but still has huge scope as bond market knowledge is still very low. By providing easy to understand information, more retail and intermediaries will be attracted to invest in the bond markets.

2. Ease of identifying bonds:

There are over 10000 bonds available in the market. Each carries a different risk and reward profile. There should be an intuitive way of presenting the bonds based on the needs of the investors.

3. Need to Develop A-Category Bond Market:

There is a need to develop and deepen the market for A category bonds as this would allow corporates to tap funding at lower interest rates and enable investors to diversify their portfolio to yield better returns without a substantial increase in the overall portfolio risk.

4. Increase participation in the market:

When a large number of buyers and sellers are available to transact, the higher the transparency and better the price discovery. This involves enrolling new participants - from retail and institutional segments to buy or sell bonds. The financial advisory intermediaries and wealth managers are an important segment of customers to be onboarded. This onboarding will be key for the success of any bond marketplace.

The second area of focus is to increase participation in the market through de-fractionalisation. Most corporate bond issues are through private placement with face value of Rs 1 million. Public bond issues have a face value of Rs 1000 to Rs10,000, but such issues are too few. Splitting the Rs 1 million to Rs 10,000 lots can widen the retail base, however this might need several regulatory approvals and acceptance from the settlement agencies. It is also not difficult to imagine a situation in the near future where the ease of access to a good set of retail buyers enables the issuers to opt entirely for a public placement instead of private placements.

5. Seamless transaction support:

Enabling simple intuitive interface for enabling price discovery is a first step towards attracting retail participation. Providing a complete closed loop communication for all transactional activities would greatly enhance the user experience. In contrast, the current process is largely through telephonic or private messaging systems and transparency in dealings is not guaranteed.

6. End to end settlement:

Transactions take place in OTC markets and settled between counterparties albeit through clearing houses of NSE and BSE. Every transaction involves KYC, manual fund and securities transfers. This is very cumbersome and is a key put off for the infrequent buyers and sellers. A simple and exchange compliant settlement process can greatly expand the interest of bond investors.

7. Data analytics:

Corporate bond issuers face the problem of lack of data to price their bond offerings and they usually compare yields to bank rates. Yields are also given by arrangers that can factor in a large spread for most but the most frequent and largest of issuers. Data analytics can bring more issuers into the market.

The practice of pricing a bond (both primary and secondary) in today's market, is not really driven by what has been actually happening in the market and how the market has been treating similar issuers. Data analytics can bring here a more realistic picture than calculating yields based upon some theoretical formulae.

8. Bankruptcy reforms will boost investor confidence:

Bankruptcy reforms have led to material growth in corporate bond markets in many countries. Effective implementation of the IBC in India can lead to more investors gravitating towards lower-rated bonds.

Corporate bonds to GDP ratio nearly double across geography in five years after bankruptcy reforms

Country | Year of bankruptcy reforms | Pre-reforms* | Post-reforms* |

UK | 2002 | 68.4% | 106.8% |

Brazil | 2005 | 12.7% | 26.3% |

China | 2007 | 18.8% | 33.4% |

Russia | 2009 | 8.1% | 13.1% |

India | 2016 | 13.4% | Effect to be seen |

III. How to use RBI Retail Gsec Enablement for creating both investment and credit solutions for small investors

RBI has announced a policy to enable retail investors to get easy access to Gsec market, including treasury bills, sovereign gold bonds and state development loans. Gsecs can offer first point of entry into bond markets for new investors, increasing the bond investor base multi-fold while helping the micro savers through easy access to loans against securities. High retail participation in Gsecs will give a very large thrust to the entire bond market spectrum and will assist in speeding up the corporate bond market reforms.

Retail Gsecs and Corporate bonds

Transacting in Gsecs for retail is a whole lot simpler and cheaper than transacting in corporate bonds. The differences between retail Gsec and corporate bonds transactions are as follows

1. All Gsecs can be transacted in lots of Rs 10,000 while only very few corporate bonds can be transacted in lots of Rs 10,000.

2. Corporate bonds listed on stock exchanges are bought and sold like equities.

3. Corporate bonds of value of Rs 2 lakhs and above are transacted through the settlement and reporting platforms of NSE and BSE, which at this point of time does not offer straight through settlement process like equities, making it cumbersome to settle.

4. Corporate bonds can only be held in demat form.

Despite the lack of ease of transaction in corporate bonds and the lack of liquidity in BSE and NSE, retail individuals investments in corporate bonds are far, far higher than investments in Gsecs, even counting the investments made through gilt funds of the mutual funds. Greater intermediary effort in promoting corporate bonds (due to spreads), promise of higher yields and better quality information availability are leading reasons for this investor preference. With a few focussed efforts, retail participation in Gsecs can be improved.

Here are some enablers for increasing participation in the Gsec market

1. Active bank participation

Banks will have to offers gsecs to their FD holders and act as market makers to provide liquidity to investors. Banks deposit base is around Rs 176 lakhs crores and 26% of deposits, amounting to Rs 46 lakhs crores is invested in Gsecs (including SDL). Banks can sell gsecs to their customers from their own books, at a marginal spread for odd lots and small lots. This will earn banks revenues from their Gsec holdings as well derisk their balance sheets against interest rate volatility. Banks can get a new revenue stream by earning spreads to provide liquidity to investors and by providing credit against Gsecs for customers.

2.Enhanced investor awareness

There needs to be sustained investor awareness campaign as at present, awareness of the benefits of Gsecs is extremely low. Emphasis to be given on

1. Highest safety in terms of credit

2. Highest liquidity

3. Benefits in financial planning

4. Easy access to loans

5. Safety and zero cost of transacting

6. Sovereign gold bonds as better alternative to physical gold

3.Widening the bond investor base and deepening the overall bond market

The benefits and ease of Gsec investment will bring in a large number of first time bond investors into the market. These investors can then be cross sold corporate bonds and other credit products that will then deepen the corporate bond market.

IV.Conclusion

India has already assumed leadership position in digitisation of financial products through adoption of world-class services like UPI, NEFT, RTGS etc. The bond market is ripe for a digital revamp to join the list of other world class services. The RBI has pioneered digitisation in the government bond market. With the newly announced policy of retailing them, avenues for further digitisation opens up, offering new revenue streams for banks and digital intermediaries while offering a safe investment option for retail customers. As customer awareness and adoption of government bonds increases, SEBI can usher in reforms to drive digitisation and increase the depth of the corporate bond markets too.