Sovereign Gold Bond (SGBs) are government securities that are denominated in grams of gold. It provides an alternative for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by Reserve Bank on behalf of the Government of India.

Ø Coupon Rate-Currently, SGBs offer interest at the rate of 2.50% (fixed rate) per annum on the amount of initial investment, paid semi-annually.

Ø The nominal value of Gold Bonds is calculated on the basis of a simple average of the closing price of gold of 999 purity, published by the India Bullion and Jewelers Association Limited, for the last 3 business days of the week preceding the subscription period.

Ø Maturity-The tenor of the bond is 8 years, while early encashment/redemption of the bond is allowed after the fifth year from the date of issue on coupon payment dates. The bond will be tradable on Exchanges if held in Demat form.

Sovereign Gold Bond Scheme 2021-22 Series VIII

The Sovereign Gold Bond Scheme 2021-22 - Series VIII will be open for subscription for the period from November 29, 2021 – December 03, 2021. The nominal value of the bond based on the simple average closing price for gold of 999 purity of the last three business days of the week preceding the subscription period stood at Rs 4,791 per gram of gold.

Units of SGB

The minimum investment in the Bond shall be 1 gram with a maximum limit of subscription of 4 kg for individuals, 4 kg for Hindu Undivided Family (HUF), and 20 kg for trusts and similar entities notified by the government. Bonds will be tradable on stock exchanges within a fortnight of the issuance on a date as notified by the RBI.

Redemption of SGB

On maturity, the Gold Bonds shall be redeemed in Indian Rupees and the redemption price shall be based on a simple average of the closing price of gold of 999 purity of previous 3 business days from the date of repayment, published by the India Bullion and Jewelers Association Limited

Taxation of SGBs

In the case of SGB, if one holds the bond to maturity, no capital gains tax. However, if one redeems before maturity, capital gain tax with indexation is applicable.

Advantage of SGBs

The SGB offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated. Investors are assured of the market value of gold at the time of maturity and periodical interest. SGB is free from issues like making charges and purity in the case of gold in jewelry form. The bonds are held in the books of the RBI or in Demat form eliminating the risk of loss of scrip etc.

The risk associated with SGBs

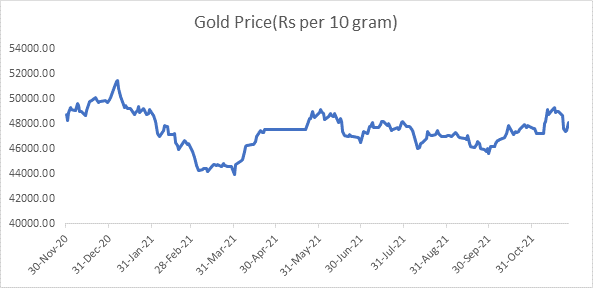

The major risk with SGB is fluctuation in underlying gold prices. There may be a risk of capital loss if the market price of gold declines. However, one does not loose units purchased. Apart from this lack of liquidity is another risk factor associated with this bond.

Purchase of SGBs

SGBs can be purchased from the offices of nationalized banks, scheduled foreign banks, scheduled private banks, Stock Holding Corporation of India, designated post offices, and through authorized trading members of stock exchanges.

SGBs can be purchased through online mode also. For that investor can download the forms online from the websites of the listed commercial banks or the Reserve Bank of India.

Purchase of SGB through RBI retail direct scheme

As per latest development, now retail investors can do transaction of Sovereign Gold bonds by opening Retail Direct Scheme (registering on RBI online portal https://www.rbiretaildirect.org.in/).

Procedure for Registration

Ø Investors can register on the online portal by filling up the online form and use the OTP received on the registered mobile number and email id to authenticate and submit the form.

Ø Instructions issued under RBI-Know Your Customer (KYC) Direction, 2016, updated from time to time, will be applicable for investors.

Historical SGB returns

Symbol | Issue month & year | Issue Price (Rs/gram) | Latest trade price (LTP)(Rs) | Absolute return (%) |

SGBSEP28VI | Sep-20 | 5117 | 4,705.30 | -5.55% |

SGBFEB28IX | Feb-20 | 4260 | 4,743.00 | 15.09% |