Fixed Income investors are struggling with returns on Fixed Deposits plunging to 2% to 3% post-tax and long tenure bonds are prone to duration risk given the interest rate cycle is changing. How does one achieve higher post-tax returns, without minimal credit risk and liquidity risk?

Lately gold has been in the limelight as it is considered as safe-haven for investors during uncertain times. Conflict between Russia & Ukraine has pushed investments into gold from risky assets. Adding gold into the fixed income asset allocation can provide healthy returns with downside risk capped by the fixed income element. Sovereign gold bonds are extremely tax-efficient and attractive, but liquidity is low and so is the size of investment in public offers.

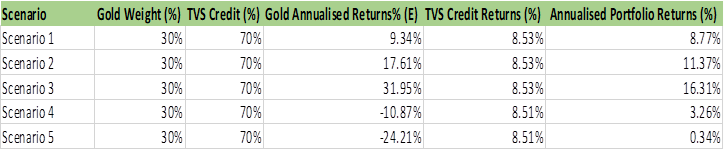

For investors who are looking to take exposure in Gold, we have constructed a new Goldilocks portfolio of Gold ETF and TVS Credit 2.5-year bond with weights 30% and 70% respectively. This portfolio is structured to absorb positive returns from rising gold prices and can stem losses in case of a sharp fall in gold prices. Pay-off returns are given in table below:

We had initiated a Goldilocks portfolio in October 2020 with Gold ETF and Muthoot Finance 3 year bond with weights of 50% each. Since then, the portfolio yielded 4.4% (annualised) despite gold yielded 1% since October 2020.

Gold ETF A Gold ETF is an exchange-traded fund (ETF) that tracks the domestic physical gold price. They are passive investment instruments that are based on gold prices and invest in gold bullion. Gold ETFs are units representing physical gold which may be in paper or dematerialized form. One Gold ETF unit is equal to 1 gram of gold and is backed by physical gold of very high purity.

Trading of Gold ETF: Gold ETFs are listed and traded on the National Stock Exchange of India (NSE) and Bombay Stock Exchange Ltd. (BSE) like a stock of any company. Gold ETFs trade on the cash segment of BSE & NSE, like any other company stock, and can be bought and sold continuously at market prices.

Purity & Price: Gold ETFs are represented by 99.5% pure physical gold bars. Gold ETF prices are listed on the website of BSE/NSE and can be bought or sold anytime through a stockbroker.

Creation Unit Size: Creation unit size is the minimum quantity of gold or units of gold ETF which an investor can buy or sell directly from a fund house. Generally, it is equivalent to 1 kg of gold.

Where to buy: Gold ETFs can be bought on BSE/NSE through the broker using a Demat account and trading account. A brokerage fee and minor fund management charges are applicable when buying or selling gold ETFs.

Taxation: Short-term capital gains on units held for less than 36 months is added to the investor�s income and taxed according to the applicable slab rate. Long-term capital gains on units held for more than 36 months are taxed at 20% with indexation benefits.

Redeem of Gold ETFs: Gold ETFs can be sold at the stock exchange through the broker using a Demat account and trading account. Since one is investing in an ETF that is backed by physical gold, ETFs are best used as a tool to benefit from the price of gold rather than to get access to physical gold. So, when one liquidates Gold ETF Units, one is paid as per the domestic market price of the gold.

Physical Gold Redemption: AMCs also permit redemption of Gold ETF Units in the form of physical gold in �Creation Unit� size, if one holds the equivalent of 1kg of gold in ETFs, or in multiples thereof.

Advantage of investment in Gold ETF

- The purity of the gold is guaranteed, and each unit is backed by physical gold of high purity.

- Transparent and real-time gold prices.

- Listed and traded on the stock exchange.

- A tax-efficient way to hold gold as the income earned from them is treated as long term capital gain.

- No wealth tax, no security transaction tax, no VAT, and no sales tax.

- No fear of theft � Safe and secure as units held in Demat.

- ETFs are accepted as collateral for loans.

- No entry and exit load.

Tracking Error of Gold ETFs

In general, there is a difference between the NAV of the gold ETF and the actual value of physical gold. This is known as tracking error that reflects price differential.

The tracking error arises primarily due to the management expenses, transaction costs, and cash amount held by the ETF. Consequently, it causes to fall in NAV in relation to that of the underlying physical gold. Therefore during a fixed horizon, the return of gold ETF is less than that of actual gold.