Bonds, equities, and other asset classes have already been discounting 75bps rate hike by Fed amid inflation growth reported at 4-decade highs. Bond yields fell and global stocks witnessed a pullback as 75bps hike was no surprise. If inflation growth continues given supply & demand imbalances and rising energy & food prices, this would push policy makers to hike rates aggressively. Strengthening USD could lead to additional inflationary pressure to emerging markets as the value of imports would rise, INR touched record lows of 78.17 and trending towards 80. Record government borrowing, high inflation and rising global bond yields are driving money out of risk assets. To stem depreciation of INR, RBI would hike rates at a faster pace which can take Gsec to 8% levels.

Fed policy-meeting highlights

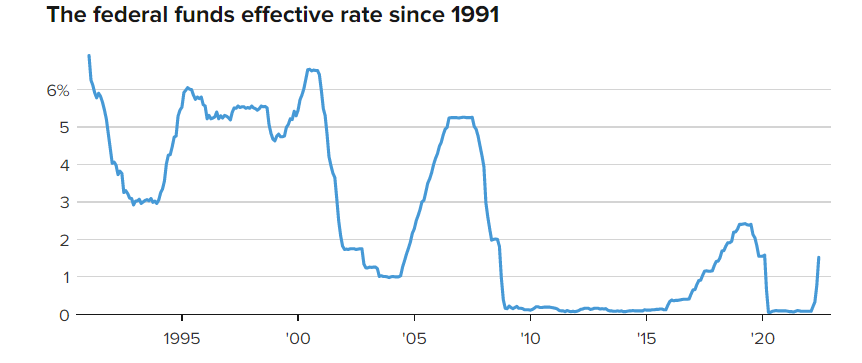

Fed hiked interest rates by 0.75% during its June 2022 policy-meeting, which is the most aggressive rate hike since 1994. Policy makers significantly cut their economic growth outlook for 2022, expecting 1.7% GDP expansion compared to 2.8% growth set in March policy-meeting. During the press conference Fed chair, Mr. Powell accepted that committee members failed to forecast inflation growth correctly and expecting either 50bps or 75bps rate hike in the July 2022 policy-meeting. On the balance sheet reduction front, Fed will continue with the initial pace of selling treasuries and mbs.

Source -cnbc

Factors forced fed to hike 75bps :

- Soaring energy prices

- Tight labour market

- Rising wage growth

- 4-decade high inflation

- Rising food prices

- Russia – Ukraine crisis

- Political pressures to contain inflation