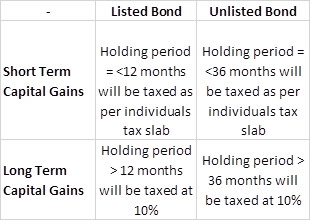

Interest income earned or capital gains on fixed investment products are subject to income tax. However, each one of them are taxed differently depending on the type of the instrument. As per our tax consultant, profit booked from the sale of a bond are taxable as short term or long-term capital gains depending on the duration the asset is held. Capital gains from sale of Bonds will fall under short term taxation or long-term taxation based on the tenure of holding the bond. Taxation for listed & unlisted bonds are differently treated in India, following table shows the differences:

Tax Rules on Interest Income

Tax on Tax-Free Bonds

· Interest earned on tax free bond is completely tax-free.

· Capital gain tax is applicable ( Subject to Short term or Long term ) in case of selling bond at higher price than purchase price in secondary market.

Tax on Periodic Interest Paying Tax Bonds

· Interest earned from bonds is taxed as per individuals tax slab.

· It is advised to pay tax on interest received from bonds on annual basis rather than accumulating till maturity. However, in the case of zero-coupon bonds ( interest paid at maturity) tax on interest income will be taxed on maturity date.

Example:

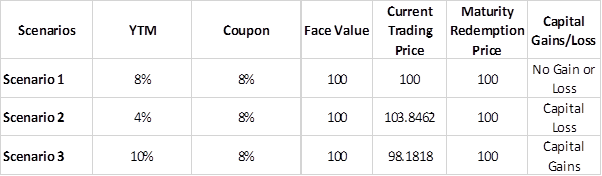

Assume, you have invested in a bond and how capital gains & capital loss are treated as per different scenarios are given in following table:

Please check with your tax consultant before filing your tax returns.