Bond Investments by NRI

NRIs can invest in bonds issued in India through an automatic route. They can invest in primary bond issues and also invest through the secondary market. Any investment done in secondary market should be routed through a PIS account. For other products, the investment can be done through direct subscription route.

NRIs must have a saving bank account before they start to invest. There are two types of bank accounts NRIs can operate depending upon their income:

� Income from India: Non-Resident Ordinary (NRO) Bank Account

� Income out of India: Non-Resident External (NRE) Bank Account

Both the accounts are savings accounts maintained in Indian Rupees. You can remit your foreign income earned outside India in NRE bank account, which is fully repatriable. Income in India is parked in NRO bank account, which is partially repatriable.

To make direct investment in the secondary by trading on recognized stock exchanges in India, NRIs need to open PIS bank account - a type of saving bank account that will only have secondary market transaction and charges, and TDS applicable. PIS bank account is not required for making investments in mutual funds and applying in IPOs.

Portfolio Investment Scheme (PIS) is a scheme of the Reserve Bank of India (RBI) defined in Schedule 3 of Foreign Exchange Management Act 2000 under which the 'Non Resident Indians (NRIs)' and 'Person of Indian Origin (PIOs)' can purchase and sell shares and convertible debentures of Indian Companies on a recognized stock exchange in India by routing all such purchase/sale transactions through their account held with a Designated Bank Branch.

There are two types of PIS account:

� NRE PIS account

� NRO PIS account

NRI Bond Investments through the secondary market and the settlement process

NRIs must open a NRE PIS account for the purpose of investments in secondary market on repatriation basis. For the purpose of investments in secondary market on non-repatriation basis, investments have to be directly made from NRO Savings Bank (SB) account.

NRE PIS account is independent of NRE Savings Bank (SB) account which NRIs can maintain for their other needs. The PIS account will capture the proceeds of share sale/purchase transaction and such transactions will be reported by the Bank to the RBI.

STEP 1. � Select the Bond/s that you want to invest in

The first step involves browsing through the latest bonds available in the market. It is advisable that NRIs invest only in NRI eligible Bonds if they plan to invest and hold units in their own Demat accounts. NRIs can invest in Bonds available in the secondary market.

If you are an NRI, you can choose corporate bonds, public-sector bonds, or tax-saving bonds based on your financial goals. You can check out the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) websites to get information related to bonds.

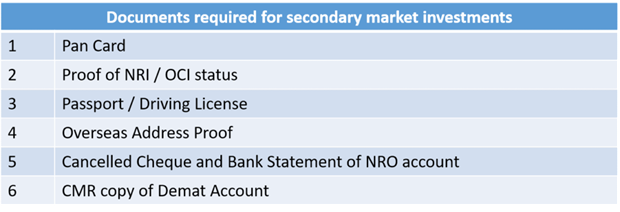

STEP 2. � Documentation

The following documents are required:�

STEP 3. � Receiving the Bond Units in Demat Account

For the purchase of bonds from the secondary market, Sample Deal Sheet or consideration sheet is generated with all the details of the transaction (buyer details, seller details, price, yield, etc). Investor will have to sign and send a scanned copy to complete the purchase process.

Then investor has to remit the purchase amount for the bond to ICCL/NSCCL or directly. You can use manual or online RTGS payment to remit the money.� (ICCL/NSCCL are the counterparty settlement bodies in India.)

The bond units will be transferred by ICCL/NSCCL to your Demat account on the same day.

Primary Bond Investments by NRIs

The issuing company is required to issue shares to NRI on the basis of specific or general permission from GOI/RBI. Therefore, individual NRI need not obtain any permission.

To invest in bonds as an NRI, one must utilize the �NRI Window� which gets enabled while issuing of the bonds by the issuer. The rules and regulations for investing are the same for NRIs and OCIs (Overseas Citizen of India).

Types of bonds NRIs can invest in.

���������� Public Sector Unit (PSU)

���������� Secure Corporate Bonds and Non-Convertible Debentures (NCDs)

���������� Government Tax-free NRI Bonds

���������� Treasury Bonds � Guaranteed Returns

���������� Municipal and Zero-Coupon Bonds

���������� Infrastructure Bonds

���������� Bonds issued by National Highways Authority of India (NHAI), Rural Electrification Corporation (REC), Power Finance Corporation (PFC) etc.

NRI Investment in Bonds: Procedure

NRIs can either subscribe to primary bond issues through an online brokerage platform or issue a Power of Attorney (PoA) to a known person, who can apply on behalf of the NRI Investor in physical form. The Indian debt market provides bonds for NRIs on both repatriable and non-repatriable basis.

NRI investments in bonds can be made through both NRE (Non-Resident External) and NRO (Non-Resident Ordinary) accounts.

���������� Repatriable basis: Applications are to be made from a Demat account linked to an NRE account, if applying online. Physical applications should be done using INR denominated check/ bank draft from an NRE account.

���������� Non-Repatriable basis: Applications are to be made from a Demat account linked to an NRO account if applying online. Physical applications should be done using rupee denominated check/ bank draft from an NRO account.

Procedure of Sale and Receiving Interest

The bonds are listed on stock exchanges after allotment and they can either be held till maturity or can be sold before maturity. A point to note here is that the selling of bonds on stock exchanges can be done only if the purchase is done through a Demat account.

For the bonds bought and sold using an online Demat account, the proceeds of the sale/redemption and the interest earned shall be credited to the bank account linked to the Demat account.

In cases of physical application, a copy of a canceled check of the bank account to which the sale proceeds are to be credited is to be attached along with the application.

For purchases initiated through an NRE account, the proceeds of the sale and the interest earned can be credited to either an NRE or NRO account as mentioned and are repatriable. Lastly, for purchases initiated through an NRO account, the payments can be credited only to an NRO account, which is non-repatriable.

NRI Investment in Bonds: Taxation

The gains made from sale of the bonds or the interest earned on it are taxable under the Income Tax Act, 1961 unless the bonds are specified as �tax-free�. The interest is taxed as per the income tax slab of the NRI Investor under the category �Income from other sources�. However, the taxation on sale of bonds is done on the basis of the holding period of the bonds.

Taxation on sale of Bonds on Stock Exchange

Holding Period for Long Term Capital Gains: 12 months

Nature of Gains | Taxation |

Short-Term Capital Gains (bonds sold before 12 months) | As per tax slab |

Long Term Capital Gains (bonds sold after 12 months) | 10.3% |

Taxation on sale of Bonds on Stock Exchange

For NRI investors, the relevant tax applicable is deducted as TDS (Tax Deducted at Source) and the post-tax value is credited to the specified bank account. Also, the gains made from trading of all types of bonds on stock exchanges do not carry any indexation benefit.