INRBonds RFQ interface enables users to place request for buy/sell the bonds by specifying the size, anonymity, and public or preferred counterparty list. This enables user:

· One Click easy to use Interface

· Effectively minimize the communication overheads

· Audit trails and event logs for Compliance Requirements

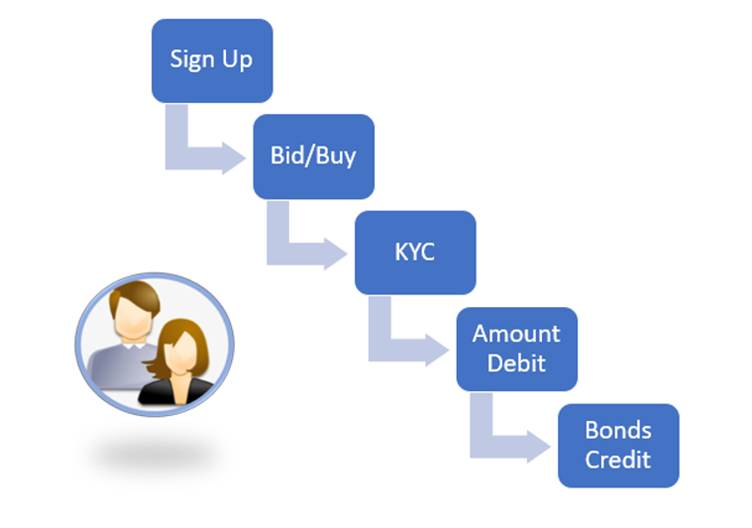

How to Buy Bonds through INRBonds RFQ Platform?

· Complete signing up process on INRBonds.com.

· Log-in to access order book data which is categorised in market watch category.

· As per your financial advisor recommendation search for the desired bond on order book page.

· User can place an order by clicking on BUY/SELL button and enter the details such as quantity and expected YTM.

· Once the order has been initiated by the user a message will be broadcast to all the other market participants notifying them about the new order. Initiated order can be seen in the order book screen.

· Once both the counterparty agrees to close the deal, the initiating user will have to provide the required KYC.

· After successful completion of KYC process, deal slip will be generated.

· Deal slip contains settlement date, bond details, RTGS details and stamp duty fee.

· On the settlement date user must transfer exact amount (including stamp duty) to mentioned bank account of clearing house through only RTGS .

· Bonds will be credited in demat account of user by the end of the day of settlement date.

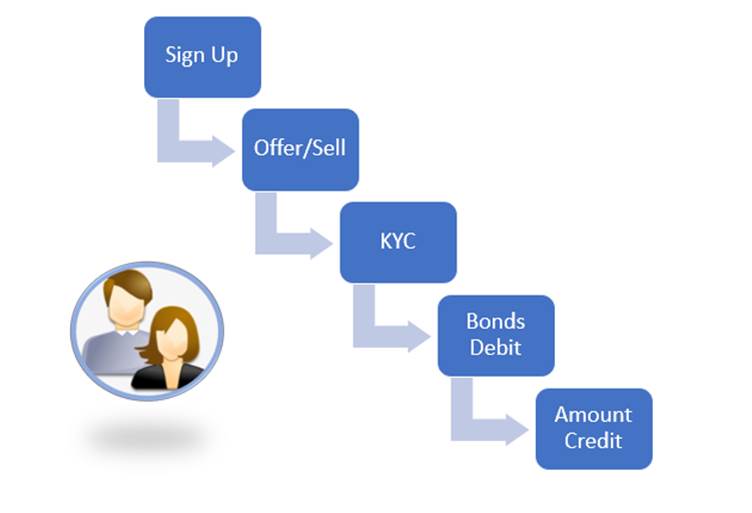

How to Sell Bonds through INRBonds RFQ Platform?

· Complete signing up process on INRBonds.com.

· Log-in to access order book data which is categorised in market watch category.

· Search for the desired bond which you want to sell on order book page.

· User can place an order by clicking on BUY/SELL button and enter the details such as quantity and expected YTM.

· Once the order has been initiated by the user a message will be broadcast to all the other market participants notifying them about the new order. Initiated order can be seen in the order book screen.

· The interested counterparties will then respond to the new order with their intention to close the deal. All counterparties are vetted by INRBonds in terms of their ability and professionalism in transacting.

· Once both the counterparty agrees to close the deal, the initiating user will have to provide the required KYC.

· After successful completion of KYC process, deal slip will be generated.

· Deal slip contains settlement date, bond details, RTGS details and stamp duty fee.

· On the settlement date user must transfer bond to the clearing house.

· Sale amount will be credited in bank account of user by the end of the day of settlement date.