REIT is an investment trust that owns, manages and operates income-producing real estate assets. It allows individual investors to make investment in this platform and earn income in the form of rental yields and appreciation in capital values of the property.

Under regulations, a REIT has to invest a minimum 80% of the value of its assets in completed and rent and/ or income generating properties. A maximum of 20% of the total value of REITs can be invested in under construction properties with a lock-in period of three years after completion and completed but non-rent generating properties, the listed or unlisted debt of real estate companies, MBS, Government securities, equity of listed companies in India, generating at least 75% of their income from real estate activities, cash or money market instruments.

REITs would be registered as trusts with SEBI. These trusts would not be allowed to launch any scheme. They would be able to raise funds through initial offers and would have to list their units on exchanges for trade. They would be allowed to raise additional funds through follow-on offers as well.

At least 90% value of REITs assets should be in ready properties generating revenue. The remaining 10% can be in other specified assets. It is mandatory for REITs to distribute at least 90% of their net distributable income after tax to investors.

Structure of ReITs

· A REIT operates through a three-tier structure.

· The 3-tier structure of REITs is formed by a sponsor, AMC and Trustee. The sponsor brings in the capital comfort for setting up the REIT.

· The AMC is responsible for selecting and operating the properties.

· The trustee ensures that the money is managed in the interest of unit-holders.

Advantage of REITs

· Steady dividend income and capital appreciation: Investing in REITs is said to provide substantial dividend income and also allows steady capital appreciation over the long term.

· Option to diversify: Since most REITS are traded frequently on the stock exchanges, it provides investors with an opportunity to diversify their real estate.

· Liquidity: REITs are traded on stock exchanges and hence are easy to buy and sell, which adds on to their liquidity aspect.

Tax provision for REITs

· The dividends distributed by REITs are taxable in the investors’ hands. The dividend income is taxable as per the slab rates applicable.

· The tax on Long Term Capital Gains incurred by the investors when they sell the units (REIT units) after 3 years of holding is 10% if the LTCG are in excess of Rs 1 lakh.

· The short -term capital gains on the sale of units held for less than 3 year will be taxed at 15%.

Embassy Park REIT

Embassy REIT is registered as an irrevocable trust under the Indian Trust Act, 1882, and as a REIT with SEBI's Real Estate Investment Trust Regulations, 2014.

Embassy Office Parks REIT has been rated as AAA by both CRISIL and ICRA.

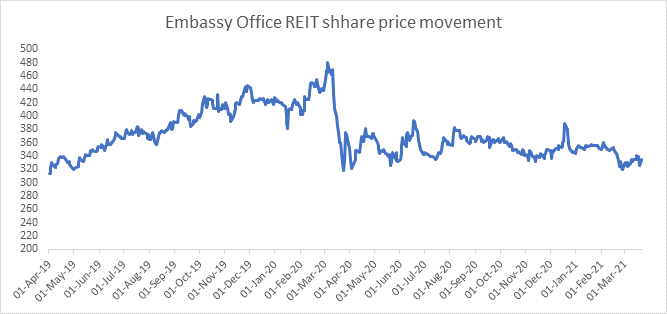

Its shares got listed in April 2019. Its past 1-year return stood at 5.14%

Embassy Office Parks REIT bond yield movement

Date | ISIN | Coupon (%) | Maturity | Price | Yield (%) |

05-Aug-20 | INE041007019 | 0.00 | 03-Jun-22 | 116.23 | 7.20 |

11-Aug-20 | INE041007019 | 0.00 | 03-Jun-22 | 113.85 | 8.50 |

14-Aug-20 | INE041007019 | 0.00 | 03-Jun-22 | 116.08 | 7.19 |

17-Aug-20 | INE041007027 | 0.00 | 03-Jun-22 | 110.03 | 7.10 |

17-Aug-20 | INE041007019 | 0.00 | 03-Jun-22 | 115.35 | 7.02 |

26-Aug-20 | INE041007019 | 0.00 | 03-Jun-22 | 116.51 | 7.30 |

27-Aug-20 | INE041007019 | 0.00 | 03-Jun-22 | 116.57 | 7.28 |

02-Sep-20 | INE041007019 | 0.00 | 03-Jun-22 | 116.98 | 7.00 |

03-Sep-20 | INE041007019 | 0.00 | 03-Jun-22 | 116.86 | 7.19 |

04-Sep-20 | INE041007019 | 0.00 | 03-Jun-22 | 117.76 | 6.75 |

15-Sep-20 | INE041007019 | 0.00 | 03-Jun-22 | 117.05 | 7.25 |

18-Sep-20 | INE041007019 | 0.00 | 03-Jun-22 | 117.71 | 6.93 |

21-Sep-20 | INE041007019 | 0.00 | 03-Jun-22 | 116.26 | 6.97 |

28-Sep-20 | INE041007019 | 0.00 | 03-Jun-22 | 118.27 | 6.75 |

01-Oct-20 | INE041007027 | 0.00 | 03-Jun-22 | 111.11 | 7.10 |

08-Oct-20 | INE041007019 | 0.00 | 03-Jun-22 | 117.30 | 7.40 |

16-Oct-20 | INE041007019 | 0.00 | 03-Jun-22 | 118.17 | 6.90 |

20-Oct-20 | INE041007019 | 0.00 | 03-Jun-22 | 117.40 | 7.50 |

22-Oct-20 | INE041007019 | 0.00 | 03-Jun-22 | 115.70 | 8.50 |

01-Dec-20 | INE041007019 | 0.00 | 03-Jun-22 | 121.02 | 5.71 |

02-Dec-20 | INE041007019 | 0.00 | 03-Jun-22 | 121.02 | 5.71 |

03-Dec-20 | INE041007019 | 0.00 | 03-Jun-22 | 120.58 | 6.00 |

18-Dec-20 | INE041007019 | 0.00 | 03-Jun-22 | 122.29 | 5.37 |

21-Jan-21 | INE041007019 | 0.00 | 03-Jun-22 | 121.89 | 6.00 |

16-Mar-21 | INE041007019 | 0.00 | 03-Jun-22 | 121.18 | 7.10 |

18-Mar-21 | INE041007019 | 0.00 | 03-Jun-22 | 121.22 | 7.10 |

Mindspace REIT

Mindspace Business Park REIT has been rated as AAA by CRISIL.

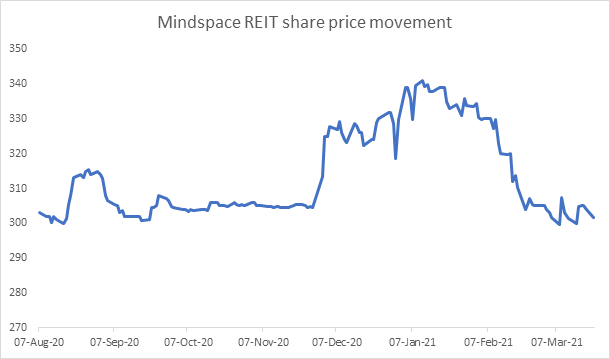

Mindspace REIT share price was listed in August 2020. Its 3 months return stood at -6.91%.

Mindspace REIT bond yield movement

Date | ISIN | Coupon (%) | Maturity | Price | Yield (%) |

01-Oct-20 | INE0CCU07017 | 10-Yr G-sec linked | 28-Apr-22 | 100.09 | 4.78 |

06-Oct-20 | INE0CCU07017 | 10-Yr G-sec linked | 28-Apr-22 | 100.16 | 6.78 |

07-Oct-20 | INE0CCU07017 | 10-Yr G-sec linked | 28-Apr-22 | 100.28 | 6.71 |

22-Oct-20 | INE0CCU07017 | 10-Yr G-sec linked | 28-Apr-22 | 100.49 | 6.76 |

23-Oct-20 | INE0CCU07017 | 10-Yr G-sec linked | 28-Apr-22 | 100.59 | 6.69 |

26-Oct-20 | INE0CCU07017 | 10-Yr G-sec linked | 28-Apr-22 | 100.7 | 6.65 |

27-Oct-20 | INE0CCU07017 | 10-Yr G-sec linked | 28-Apr-22 | 100.7 | 6.67 |

28-Oct-20 | INE0CCU07017 | 10-Yr G-sec linked | 28-Apr-22 | 100.74 | 6.65 |

29-Oct-20 | INE0CCU07017 | 10-Yr G-sec linked | 28-Apr-22 | 100.75 | 6.65 |

02-Nov-20 | INE0CCU07017 | 10-Yr G-sec linked | 28-Apr-22 | 100.61 | 6.80 |

03-Nov-20 | INE0CCU07017 | 10-Yr G-sec linked | 28-Apr-22 | 100.84 | 6.65 |

04-Nov-20 | INE0CCU07017 | 10-Yr G-sec linked | 28-Apr-22 | 101.16 | 6.44 |

18-Dec-20 | INE0CCU07017 | 10-Yr G-sec linked | 28-Apr-22 | 101.84 | 6.50 |

13-Jan-21 | INE0CCU07017 | 10-Yr G-sec linked | 28-Apr-22 | 102.61 | 6.25 |