FIIs/FPIs have bought Indian equity shares worth Rs. 466 billion in August 2020 and sold shares worth Rs. 6.75 billion in September 2020 (till 6th September 2020). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Futures.

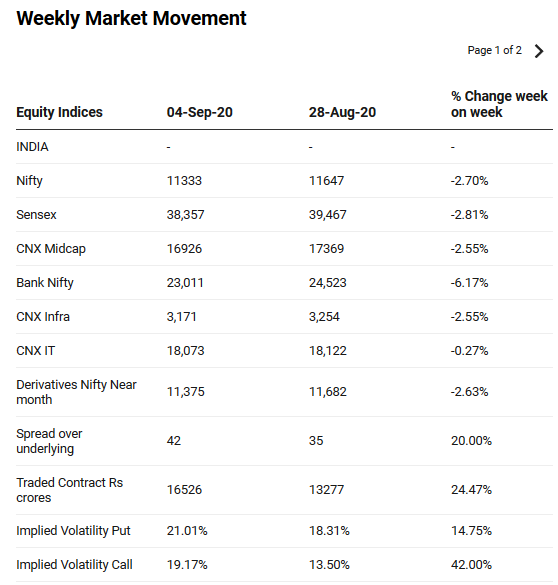

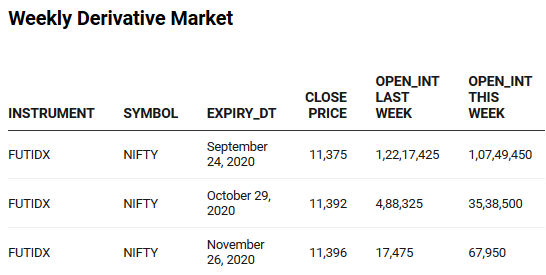

The Nifty Index futures witnessed fall in open interest by 12% for September series and rise of 625% for the October series. Implied volatility (IV) rose for call option and put option in the last week. Rise in IV for call option and put option shows unsteady support for Nifty at present levels.

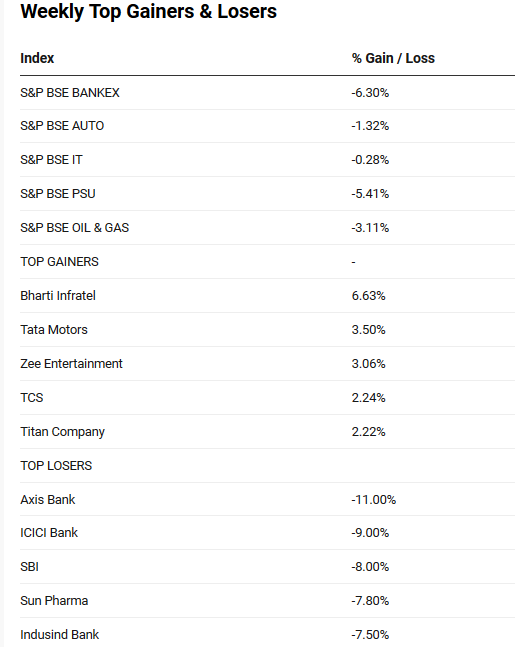

The BSE Sensex index closed on a negative note on Friday tracking global markets sell-off. India - China escalated border tensions spooked investors sentiment during the week. During the week, Sensex & Nifty declined by 2.81% & 2.70% respectively. Meanwhile, active Covid-19 cases in India stood at 8,52,330. On the macro-economic data front, IHS Markit India Services PMI rose to 41.8 levels in August 2020 from 34.2 levels in the previous month, beating market expectations of 39.2 levels. This was the highest reading since March 2020, before the escalation of the coronavirus pandemic. India reported negative GDP growth of 23.9% for Q1Fy21.

On global front, Wall Street closed in red on Friday and witnessed a volatile session to extend Thursday's sharp declines, as the tech stocks continued to fall due to valuation concerns. On the macro side, the US economy added 1.37 million new jobs in August 2020, the jobless rate fell to 8.4% from 10.2%. During the week, Dow Jones declined by 1.8%, Nasdaq slipped by 3.27% and S&P 500 tumbled by 2.37%.

European indices closed on negative note on Friday following the cues from global markets. Also, recent PMI figures showed the construction sector in the Eurozone contracted for the sixth month in August 2020. During the week, FTSE tumbled by 2.75% and DAX declined by 1.47%.

During the week, Gold declined by 1.6% due to strong dollar amid upbeat US employment data.

During the week, Brent Crude Oil declined by 6.88%, after the US jobs report showed the economy added fewer jobs than expected in August 2020 while the unemployment rate fell below expectations. In addition, falling US fuel demand and oversupply concerns weighed on sentiment.

Global Economy

The US unemployment rate fell to 8.4% in August 2020 from 10.2% in the previous month, below market expectations of 9.8%, and marking the 4th straight decline after April's all-time high of 14.7%. The US economy added 1.371 million jobs in August 2020, easing from a downwardly revised 1.734 million in the previous month, and only slightly below market forecasts of 1.4 million.

The ISM Non-Manufacturing PMI for the US fell to 56.9 levels in August 2020 from 58.1 levels in the previous month and in line with market expectations of 57 levels.

The US trade deficit jumped to USD 63.6 billion in July 2020 from a downwardly revised USD 53.5 billion gap in June 2020 and above market forecasts of a USD 58 billion deficit. It is the highest trade gap since July of 2008.

The ISM Manufacturing PMI for the US increased to 56 levels in August 2020 from 54.2 levels in July 2020, beating market forecasts of 54.5 levels.

The IHS Markit Eurozone Manufacturing PMI came in at 51.7 levels in August 2020, little-changed from the previous month's 51.8 levels and in line with preliminary estimates. Manufacturing output growth was recorded for a second successive month during August and accelerated to reach its highest level for over two years, new orders eased slightly, and new export orders rose at a relatively modest pace.

The IHS Markit Eurozone Composite PMI was revised higher to 51.9 levels in August 2020 from a preliminary estimate of 51.6 levels and compared to July's 54.9 levels.

US crude oil stocks fell by 9.362 million barrels in the week ended 28th August 2020, the sixth consecutive period of decrease and compared to market expectations of a 1.887 million drop, according to the EIA Petroleum Status Report.