Equity Markets Snapshot For The Week

- The US jobs report will be in the spotlight next week with non-farm payrolls seen rising by over 1 million in August 2020.

- US will publish trade figures & industrial output growth.

- India will report Q1Fy21 GDP growth.

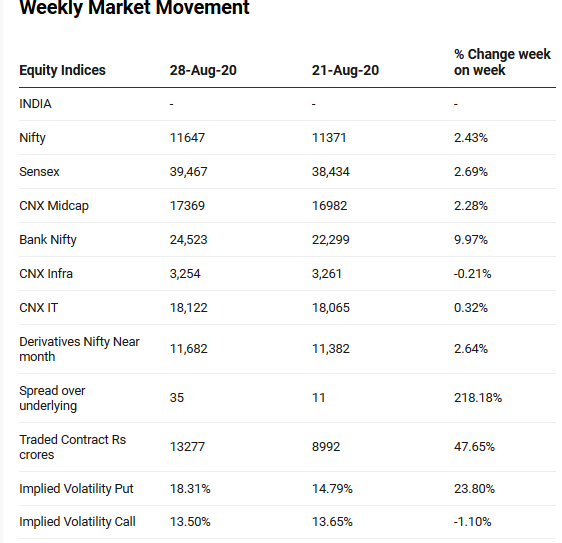

- Implied volatility (IV) for put and call at the money options stood at 18.31 and 13.50 levels respectively.

FIIs/FPIs have bought Indian equity shares worth Rs. 75 billion in July 2020 and bought shares worth Rs. 466 billion in August 2020 (till 30th August 2020). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Futures.

The Nifty Index futures witnessed rise in open interest by 427% for September series and fall of 4% for the October series. Implied volatility (IV) fell for call option and rose for put option in the last week. Fall in IV for call option and rise in IV for put option shows unsteady support for Nifty at present levels.

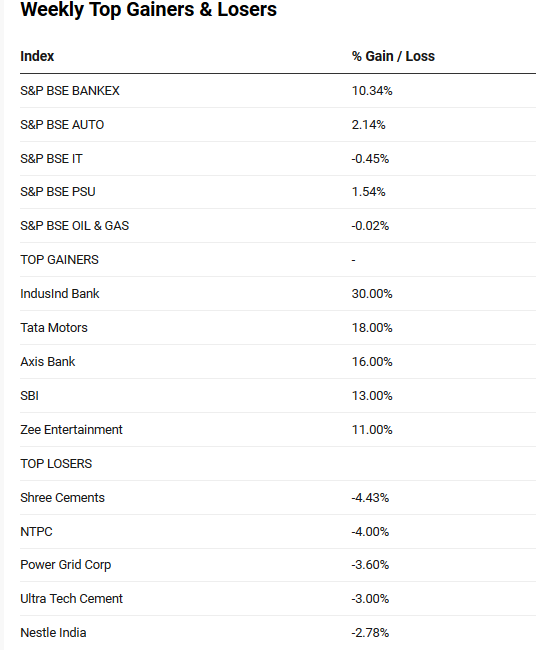

The BSE Sensex index closed on a positive note on Friday lead by financial sector stocks. Investors cheered news about the US Federal Reserve's policy shift to an average inflation targeting, raising expectations of lower interest rates for longer in the world's largest economy. During the week, Sensex & Nifty gained by 2.69% & 2.43%. Meanwhile, India witnessed the highest rainfall in the month of August in the last 44 years, till now, India recorded 25% surplus rainfall this year.

On the global front, Wall Street closed the week on a high note, with the Dow Jones erasing its losses for the year, the S&P 500 and Nasdaq ending at a record high. Walmart and Coca-Cola were the top Dow performers and tech and energy were the leading sectors for the S&P 500. Fed announced new monetary policy framework at Jackson hole which allows a more flexible inflation target, despite higher inflation Fed can leave rates lower for a longer period. During the week, Dow Jones gained by 2.6%, Nasdaq surged by 3.4% and S&P 500 rose by 2.7%.

European indices closed on negative note on Friday as investors feared resurgence of Covid-19 infections could lead to fresh restrictions. During the week, FTSE declined by 0.63% and DAX gained by 2.11%.

The Nikkei declined by 1.41% on Friday after Japanese Prime Minister Shinzo Abe is set to resign, due to worsening of his chronic health condition.

During the week, Brent Crude Oil gained by 3.3%, however, fears about a slow fuel demand recovery mounted after US Federal Reserve Jerome Powell warned about increasing downward risks to employment and inflation due to the pandemic.

Global Economy

Fed Chair Powell announced monetary policy framework during his virtual speech at the Jackson Hole Symposium on 27th August 2020. The Fed's new approach could be viewed as a flexible form of average inflation targeting, allowing inflation to run moderately above or below the Fed's 2% target for some time. This means that interest rates could be left lower for a longer period despite a rise in inflation.

Corporate profits in the United States dropped 11.8 percent to USD 1,569.2 billion in the second half of 2020, following a downwardly revised 11 percent fall in the previous period, a preliminary estimate showed. It was the sharpest decline in corporate profits since the last quarter of 2008, amid the coronavirus crisis.

The US trade deficit on goods widened to USD 79.32 billion in July of 2020 from a revised USD 70.99 billion in the previous month, a preliminary estimate showed.

The US economy shrank by an annualized 31.7% in the second quarter of 2020, lower than a 32.9% plunge in the advance estimate and compared to market forecasts of a 32.5% fall. Still, it is the biggest contraction ever, pushing the economy into a recession.

Japan's all industry activity index rose by 6.1% (M-o-M) in June 2020, after a revised 4.1% fall in May 2020.

Profits earned by China's industrial firms fell by 8.1% (Y-o-Y) to CNY 3.1 trillion in January-July 2020, easing from a 12.8% plunge in the first six months of the year, amid a gradual recovery from the COVID-19 pandemic. Profits at state-owned industrial firms slumped 23.5% and those at private-sector declined 5.3%.

The number of Americans filling for unemployment benefits rose by 1.006 million in the week ended 22nd August 2020, compared to 1.104 million in the previous period and slightly above market expectations of 1 million. The latest number brought the total reported since 21st March 2020 to 58.4 million, suggesting the labor market recovery was stalling amid a resurgence in new COVID-19 cases.

US crude oil stocks fell by 4.689 million barrels in the week ended 21st August 2020, the fifth consecutive period of decrease and compared to market expectations of a 3.694 million drop, according to the EIA Petroleum Status Report.